- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

High Growth Tech Stocks In South Korea To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.7%, driven by declines in every sector, and is down 3.9% over the past 12 months; however, earnings are forecast to grow by 29% annually. In this fluctuating environment, identifying high-growth tech stocks that can capitalize on future earnings potential becomes crucial for investors looking to navigate these challenging conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea with a market cap of ₩1.91 billion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily from its pharmaceuticals segment, amounting to ₩296.59 billion. The company operates as a biopharmaceutical entity in South Korea, focusing on innovative healthcare solutions.

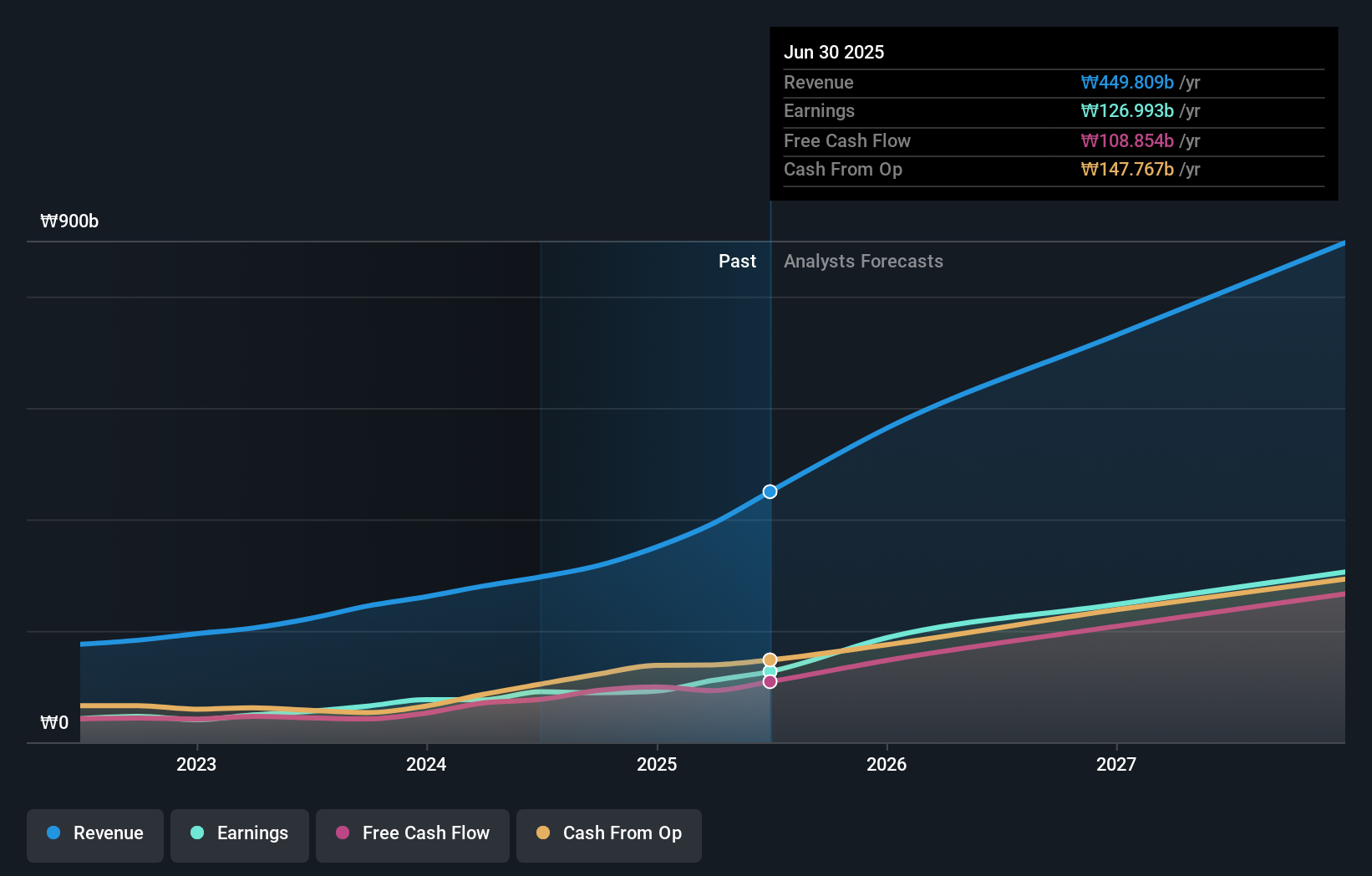

PharmaResearch's earnings grew by 63.2% over the past year, outpacing the Biotechs industry average of 6.1%. The company is expected to see annual revenue growth of 22.1%, significantly higher than South Korea's market average of 10.3%. With R&D expenses contributing to their innovative edge, PharmaResearch is poised for future growth, forecasting a 22.2% annual increase in earnings and a return on equity projected at 21.3% within three years.

- Click here and access our complete health analysis report to understand the dynamics of PharmaResearch.

Assess PharmaResearch's past performance with our detailed historical performance reports.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. develops and provides AI-based software solutions for cancer screening, diagnosis, and treatment, with a market cap of ₩1.21 billion.

Operations: Lunit Inc. generates revenue primarily through its healthcare software segment, which brought in ₩26.03 billion. The company focuses on AI-based solutions for the medical field, particularly in cancer screening and treatment.

Lunit's AI-powered chest X-ray analysis software, Lunit INSIGHT CXR, demonstrated superior performance in tuberculosis detection, achieving the highest AUC of 0.902 in a recent study published in The Lancet Digital Health. Despite being unprofitable currently, Lunit's earnings are forecast to grow by 104.93% annually over the next three years, with revenue expected to increase by 51.8% per year. The company’s significant R&D investment underscores its commitment to innovation and future profitability prospects within the healthcare AI sector.

- Get an in-depth perspective on Lunit's performance by reading our health report here.

Explore historical data to track Lunit's performance over time in our Past section.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.24 billion.

Operations: HYBE Co., Ltd. generates revenue primarily through three segments: Label (₩1.28 billion), Platform (₩361.12 million), and Solution (₩1.24 billion). The company focuses on music production, publishing, and artist management to drive its business operations.

HYBE's earnings growth of 21.6% over the past year outpaced the Entertainment industry's 7.3%. Forecasted revenue growth at 14.1% per year surpasses South Korea’s market average of 10.3%. Despite a significant one-off loss of ₩189.4B, HYBE's earnings are expected to grow by an impressive 42.5% annually over the next three years, highlighting robust future prospects. The company’s recent share repurchase program for up to 150,000 shares underscores its commitment to stock price stabilization and shareholder value enhancement.

- Dive into the specifics of HYBE here with our thorough health report.

Gain insights into HYBE's past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our KRX High Growth Tech and AI Stocks screener has unearthed 46 more companies for you to explore.Click here to unveil our expertly curated list of 49 KRX High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Very undervalued with flawless balance sheet.