- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

Exploring 3 High Growth Tech Stocks In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it has shown a robust increase of 7.8% over the past year, with earnings expected to grow by 29% per annum in the coming years. In this context of promising growth prospects, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain strong revenue streams in an evolving market landscape.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 22.96% | 33.25% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an international entertainment company based in South Korea, with operations extending to Japan and other countries, and it has a market cap of ₩772.48 billion.

Operations: YG Entertainment generates revenue primarily from its entertainment segment, amounting to approximately ₩493.91 billion. The company operates in South Korea, Japan, and other international markets.

YG Entertainment, despite a challenging year with earnings down by 82%, is poised for a rebound with an anticipated earnings growth of 65.4% annually. This contrasts sharply with its recent performance where significant one-off losses of ₩11.9 billion skewed results negatively. On the brighter side, revenue growth projections stand strong at 17.6% per year, outpacing the South Korean market average of 10.3%. While current profit margins are low at 3.1%, down from last year's 13.2%, the firm's aggressive focus on innovation and expanding its digital content offerings could enhance future profitability and market position in the high-growth tech sector of entertainment technology.

- Take a closer look at YG Entertainment's potential here in our health report.

Assess YG Entertainment's past performance with our detailed historical performance reports.

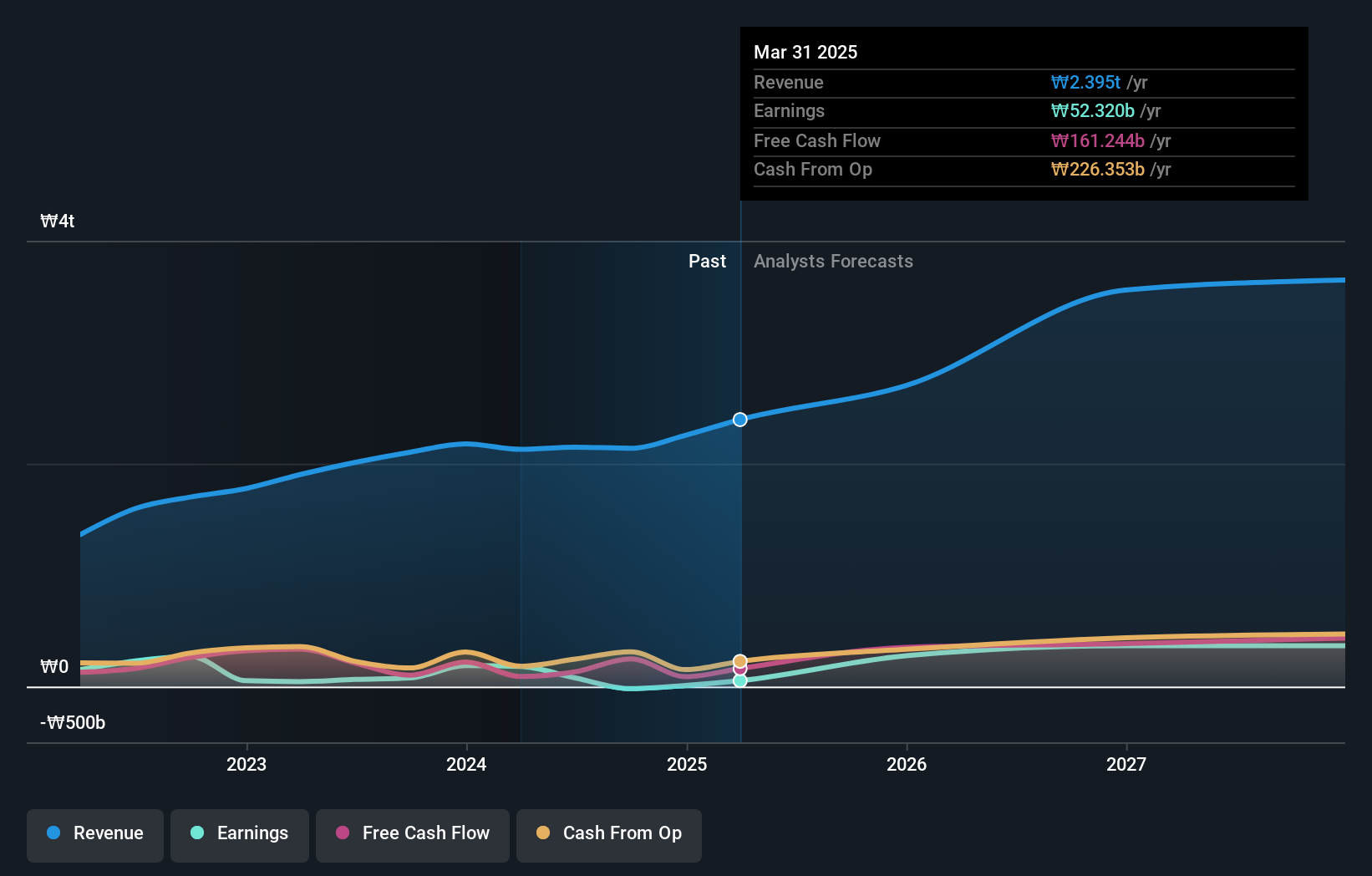

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea, with a market cap of ₩2.38 trillion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling ₩296.59 billion.

PharmaResearch is navigating the high-growth tech landscape in South Korea with notable strategic moves and robust financial forecasts. Recently, the company announced a significant private placement, issuing over 1.17 million shares, which underscores its aggressive capital-raising efforts to fuel further innovation and expansion. This move aligns with their impressive revenue growth rate of 22.3% per year, surpassing the South Korean market average of 10.3%. Additionally, PharmaResearch's earnings are expected to climb by 22.2% annually, albeit slightly below the broader market's growth rate of 29.4%. The firm's commitment to R&D is evident from its substantial investment in this area, positioning it well for sustained technological advancements and competitive edge in biotechnology—a sector where it already outpaces industry growth with a remarkable earnings increase of 63.2% over the past year compared to the industry's 6.1%.

- Click here and access our complete health analysis report to understand the dynamics of PharmaResearch.

Understand PharmaResearch's track record by examining our Past report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩8.08 trillion.

Operations: HYBE generates revenue primarily through its Label and Solution segments, contributing ₩1.28 trillion and ₩1.24 trillion, respectively. The Platform segment adds ₩361.12 billion to the revenue stream.

HYBE's recent strategic maneuvers, including a substantial private placement and aggressive share repurchases, signal robust confidence in its growth trajectory. The company recently announced a private placement of convertible bonds worth KRW 400 billion, aiming to bolster its financial flexibility. Concurrently, HYBE repurchased 150,000 shares to stabilize stock prices, reflecting a proactive capital management approach. These moves coincide with an impressive forecasted annual earnings growth of 42.5% and revenue growth of 13.7%, outpacing the broader South Korean market projections of 29.4% and 10.3%, respectively. This financial dynamism is underpinned by significant R&D investments which are crucial for sustaining HYBE's competitive edge in the fast-evolving entertainment sector.

- Click to explore a detailed breakdown of our findings in HYBE's health report.

Examine HYBE's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Unlock more gems! Our KRX High Growth Tech and AI Stocks screener has unearthed 44 more companies for you to explore.Click here to unveil our expertly curated list of 47 KRX High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet with high growth potential.