- South Korea

- /

- Pharma

- /

- KOSE:A326030

3 KRX Stocks Estimated To Be Trading At Up To 48.6% Below Intrinsic Value

Reviewed by Simply Wall St

The South Korea stock market recently halted a two-day winning streak, shedding 11.68 points to finish at 2,556.73, although it is expected to rebound amid positive global forecasts. In this fluctuating environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIOL (KOSDAQ:A335890) | ₩9840.00 | ₩17899.00 | 45% |

| HANMI Semiconductor (KOSE:A042700) | ₩108500.00 | ₩197025.68 | 44.9% |

| Samyang Foods (KOSE:A003230) | ₩599000.00 | ₩1086674.02 | 44.9% |

| TOVISLtd (KOSDAQ:A051360) | ₩20650.00 | ₩39504.13 | 47.7% |

| Wonik Ips (KOSDAQ:A240810) | ₩34600.00 | ₩67165.82 | 48.5% |

| JNTC (KOSDAQ:A204270) | ₩18830.00 | ₩34350.48 | 45.2% |

| Jeisys Medical (KOSDAQ:A287410) | ₩12940.00 | ₩23779.97 | 45.6% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩92300.00 | ₩179407.08 | 48.6% |

| ABCO Electronics (KOSDAQ:A036010) | ₩6180.00 | ₩11575.42 | 46.6% |

| ADTechnologyLtd (KOSDAQ:A200710) | ₩18020.00 | ₩32803.42 | 45.1% |

Let's review some notable picks from our screened stocks.

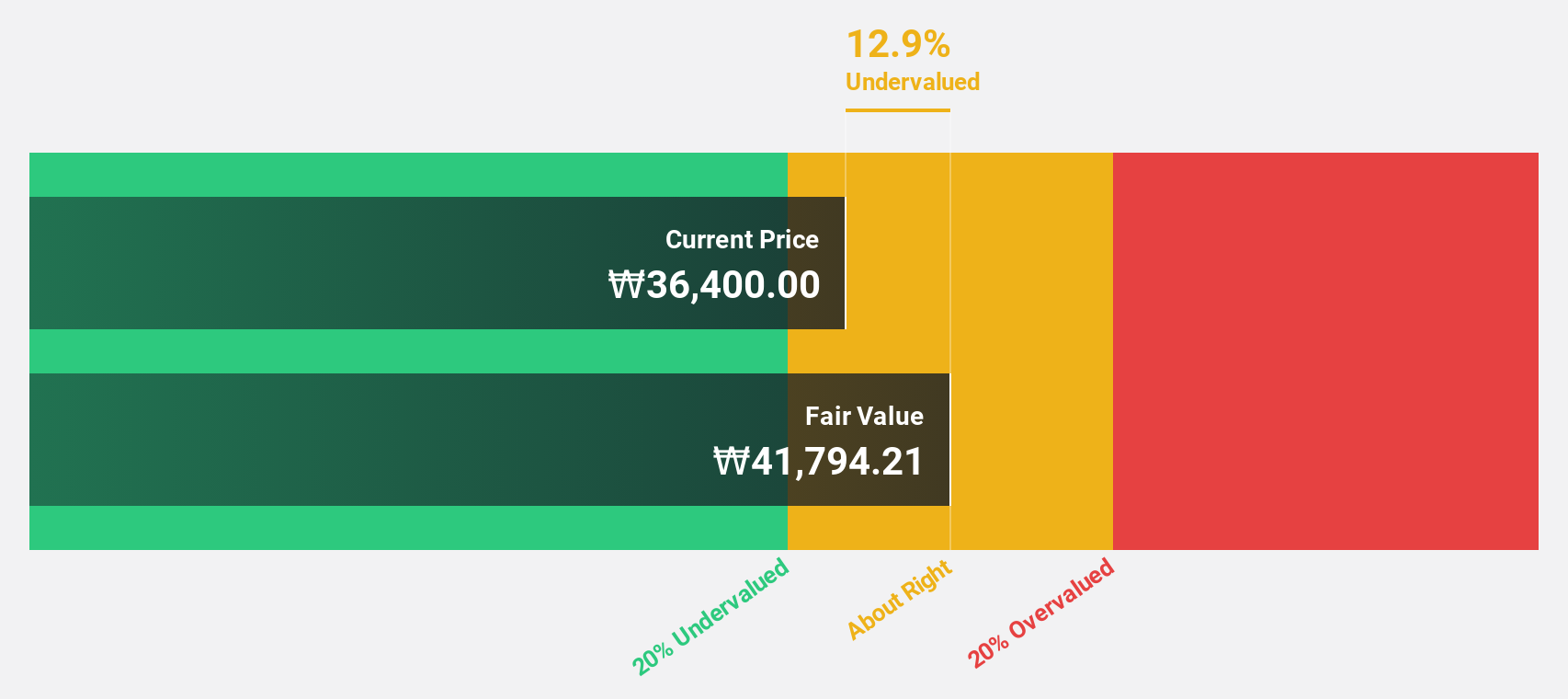

Cafe24 (KOSDAQ:A042000)

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩824.48 billion.

Operations: Cafe24 Corp. generates revenue from its global e-commerce platform, with a market cap of ₩824.48 billion.

Estimated Discount To Fair Value: 33.6%

Cafe24 is trading at ₩34,100, which is 33.6% below its estimated fair value of ₩51,367.46. The company’s revenue is forecast to grow at 10.7% per year, outpacing the South Korean market average of 10%. Despite high share price volatility over the past three months and recent shareholder dilution, Cafe24's earnings are projected to grow by 44% annually and it is expected to become profitable within three years.

- The growth report we've compiled suggests that Cafe24's future prospects could be on the up.

- Get an in-depth perspective on Cafe24's balance sheet by reading our health report here.

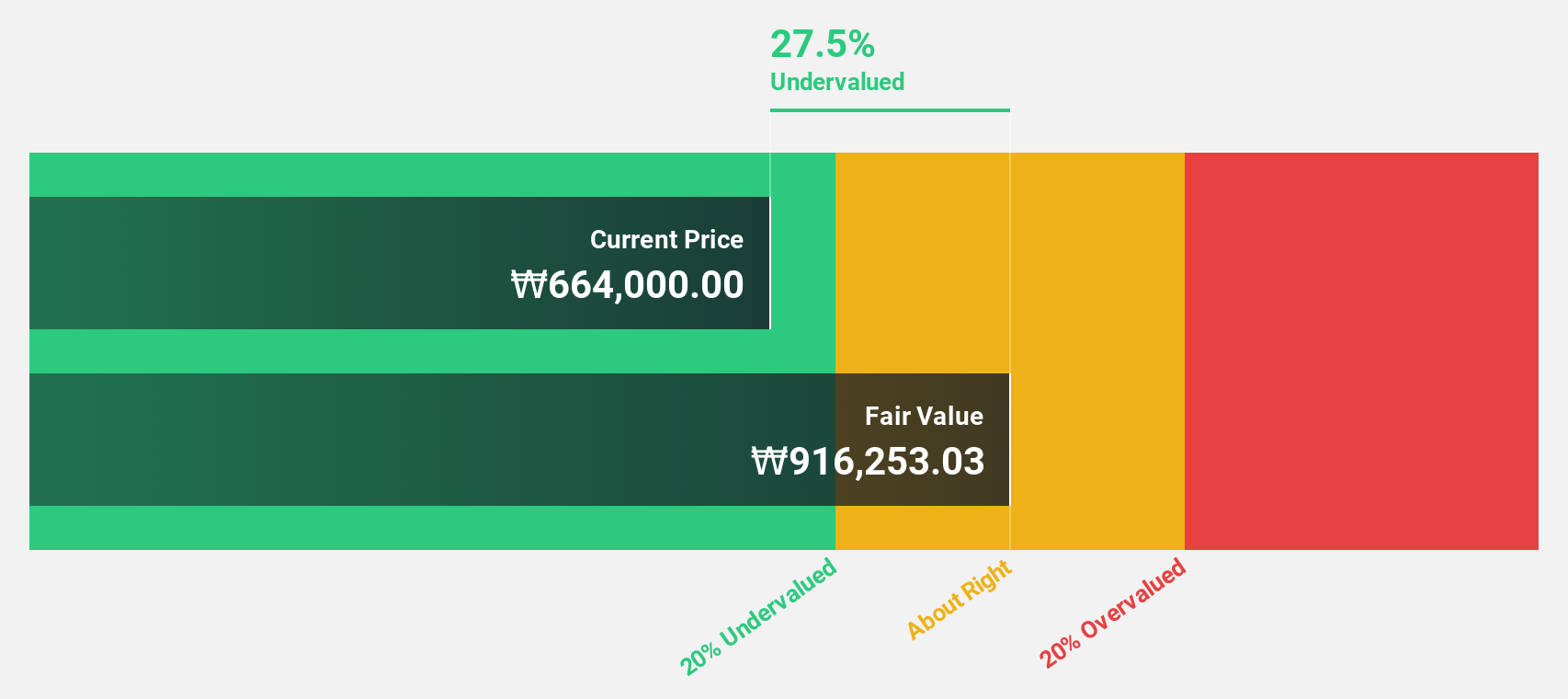

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of ₩1.78 trillion.

Operations: PharmaResearch's revenue from pharmaceuticals amounts to ₩280.29 billion.

Estimated Discount To Fair Value: 44.3%

PharmaResearch is trading at ₩172,000, significantly below its estimated fair value of ₩308,916.70. Earnings grew by 55.4% last year and are forecast to grow 20.74% annually over the next three years, though slower than the South Korean market average of 28%. Revenue is expected to increase by 19.8% per year, outpacing the market's 10%. Despite high share price volatility recently, analysts agree on a potential price rise of 29.1%.

- The analysis detailed in our PharmaResearch growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of PharmaResearch stock in this financial health report.

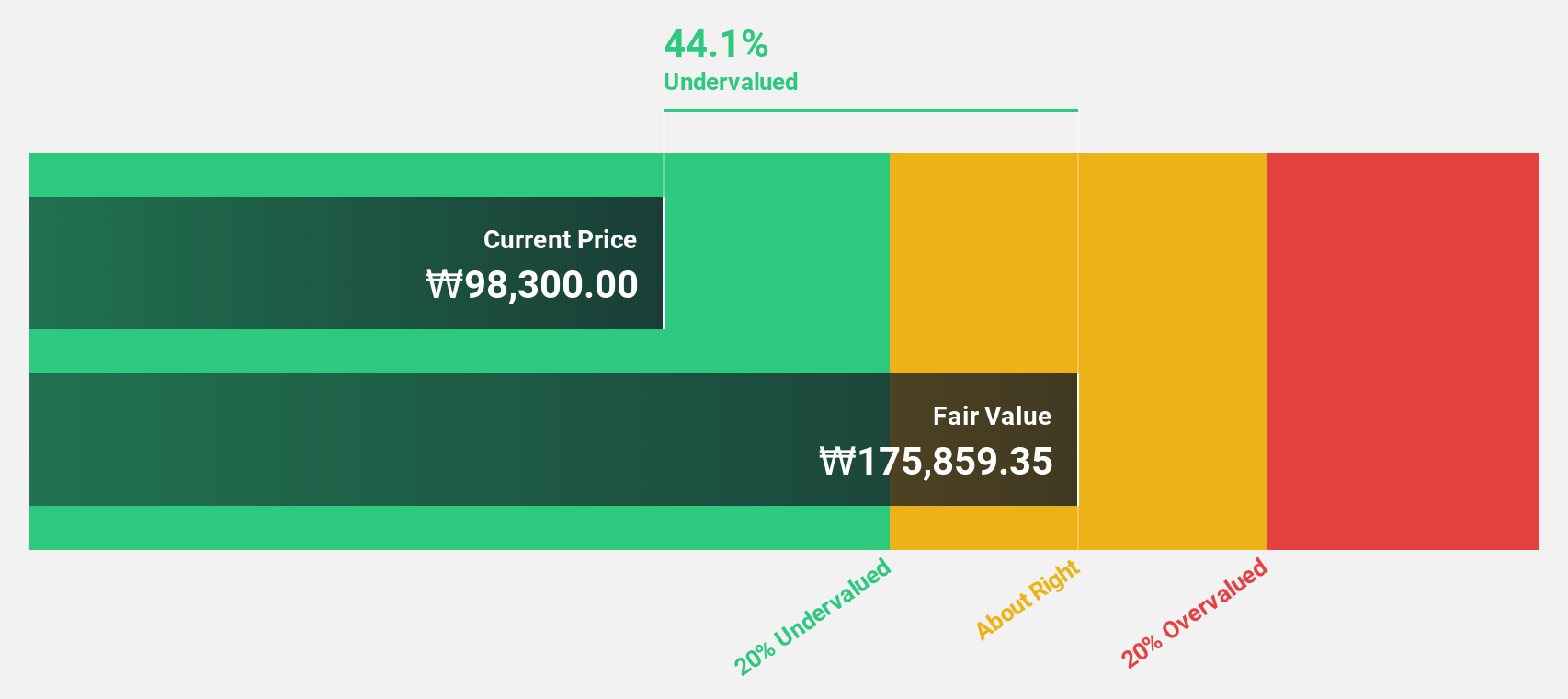

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩7.23 billion.

Operations: SK Biopharmaceuticals generates revenue primarily from the research and development of treatments for central nervous system disorders.

Estimated Discount To Fair Value: 48.6%

SK Biopharmaceuticals is trading at ₩92,300, significantly below its estimated fair value of ₩179,407.08. The company is forecast to become profitable within three years and has shown robust revenue growth of 29.9% annually over the past five years. Future revenue is expected to grow at 21.8% per year, outpacing the market's 10%. Analysts project a high return on equity of 33.8%, reinforcing its undervaluation based on discounted cash flows by more than 20%.

- Our earnings growth report unveils the potential for significant increases in SK Biopharmaceuticals' future results.

- Click to explore a detailed breakdown of our findings in SK Biopharmaceuticals' balance sheet health report.

Seize The Opportunity

- Click here to access our complete index of 40 Undervalued KRX Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A326030

SK Biopharmaceuticals

A pharmaceutical company, engages in the research and development of drugs for the treatment of central nervous system disorders.

Exceptional growth potential with excellent balance sheet.