- South Korea

- /

- Personal Products

- /

- KOSDAQ:A018290

Three Undiscovered Gems in South Korea Backed By Strong Fundamentals

Reviewed by Simply Wall St

The South Korea stock market recently halted a two-day winning streak, shedding 11.68 points or 0.45 percent to finish at 2,556.73 on Thursday, as losses in chemical and tech stocks were partially offset by gains in the financial sector. Despite this dip, the broader market sentiment remains positive with expectations of a rebound driven by easing concerns over the U.S. economy. In this context, identifying stocks backed by strong fundamentals becomes crucial for investors looking to navigate these fluctuating conditions successfully. Here are three undiscovered gems in South Korea that stand out due to their robust financial health and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Miwon Chemicals | 0.16% | 12.04% | 14.03% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyungdong Invest | 8.15% | 3.08% | 15.07% | ★★★★★★ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.31 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩213.71 billion), followed by Entertainment (₩98.08 billion) and Laminating (₩33.15 billion).

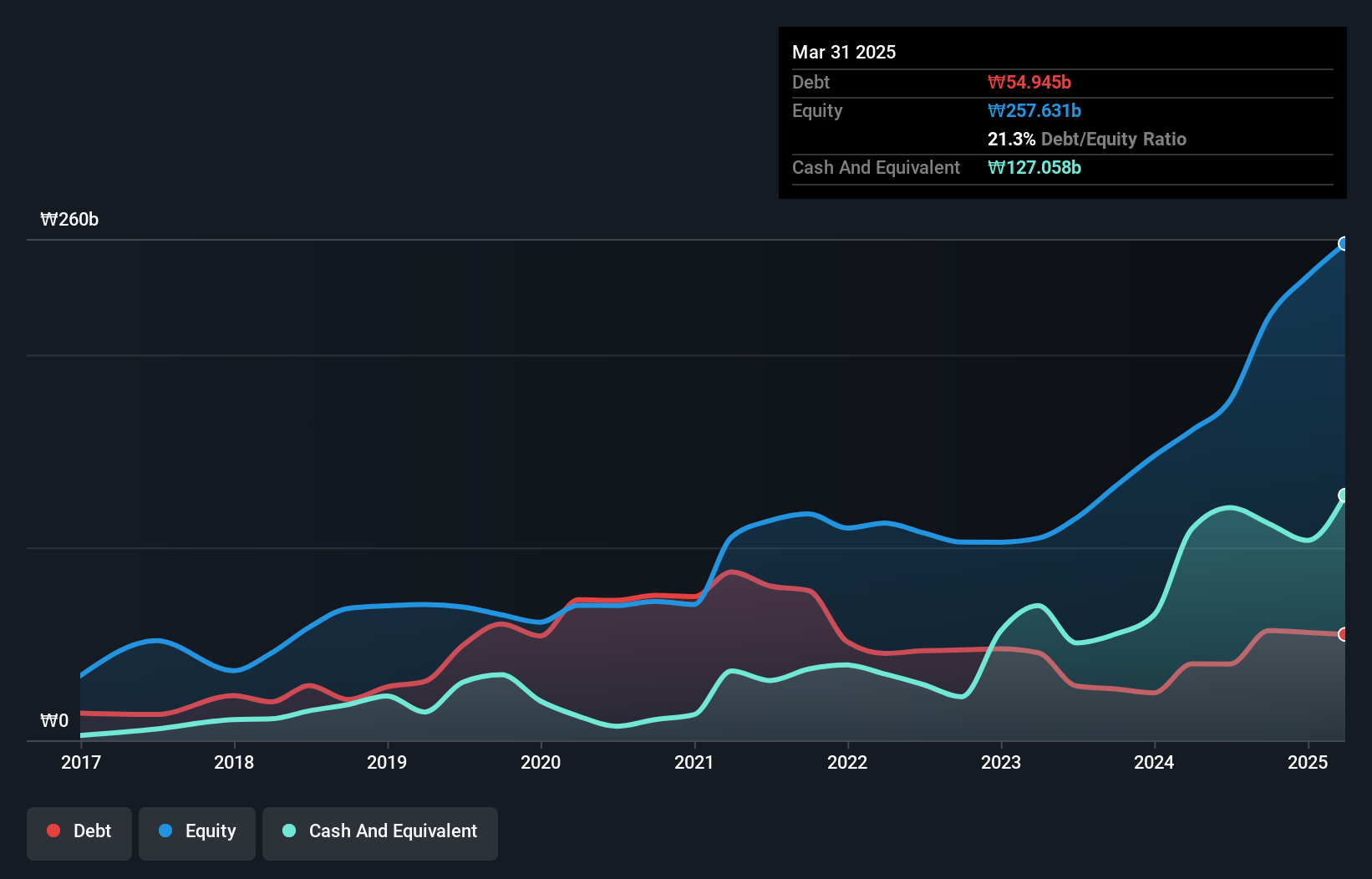

VT has shown impressive earnings growth of 727.4% over the past year, significantly outpacing the Personal Products industry's 36.9%. The company has reduced its debt to equity ratio from 43.3% to 24.6% in five years, highlighting improved financial health. Despite a highly volatile share price recently, VT's interest payments are well covered by EBIT (318x). However, shareholders experienced dilution in the past year, which may concern some investors.

- Click to explore a detailed breakdown of our findings in VT's health report.

Explore historical data to track VT's performance over time in our Past section.

Cheryong ElectricLtd (KOSDAQ:A033100)

Simply Wall St Value Rating: ★★★★★★

Overview: Cheryong Electric Co., Ltd. manufactures and sells power electric equipment in South Korea with a market cap of ₩1.18 billion.

Operations: Cheryong Electric generates revenue primarily from the sale of power electric equipment. The company has a market cap of ₩1.18 billion and operates within South Korea.

Cheryong Electric Ltd., a small cap player in South Korea's electrical industry, has shown impressive growth with earnings surging by 244.4% over the past year, far outpacing the industry average of 16%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 2.8%. Despite recent volatility in its share price, Cheryong’s price-to-earnings ratio stands at an attractive 16.7x compared to the industry average of 22.4x.

Iljin ElectricLtd (KOSE:A103590)

Simply Wall St Value Rating: ★★★★★★

Overview: Iljin Electric Co., Ltd operates as a heavy electric machinery company in South Korea and internationally, with a market cap of ₩1.12 trillion.

Operations: Iljin Electric Co., Ltd generates revenue primarily from its Wire segment (₩1.03 billion) and Power System segment (₩321.97 million).

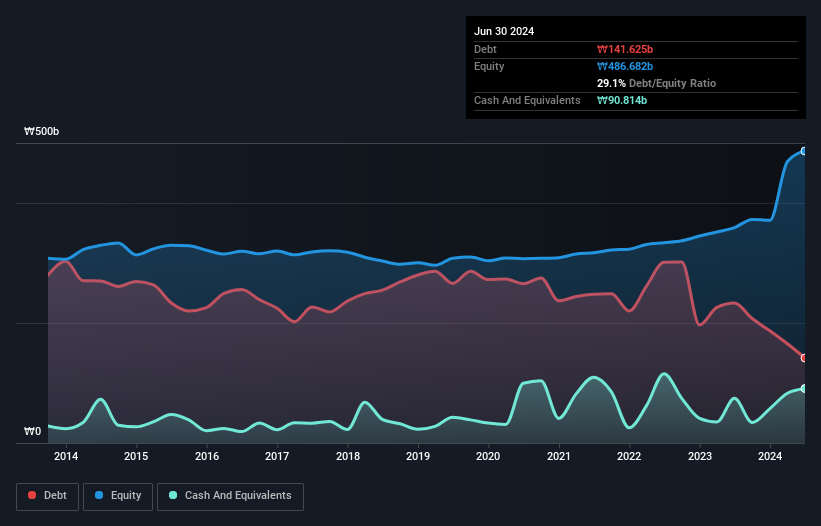

Iljin Electric Ltd, a relatively small player in South Korea's electrical industry, has shown impressive growth with earnings increasing by 50.8% over the past year, outpacing the industry's 16%. The company’s net debt to equity ratio stands at a satisfactory 17.6%, and its EBIT covers interest payments 6.3 times over. Despite recent volatility in share price, Iljin is forecasted to grow earnings by 37.12% annually, suggesting strong future potential for investors looking into emerging market opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Iljin ElectricLtd.

Evaluate Iljin ElectricLtd's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 198 KRX Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A018290

Outstanding track record with flawless balance sheet.