Stock Analysis

As global markets navigate the uncertainty surrounding the incoming Trump administration's policies, key indices like the S&P 500 and Nasdaq have experienced notable declines, reflecting broader market sentiment. In such a dynamic environment, identifying high growth tech stocks requires a focus on companies with innovative solutions and strong adaptability to evolving regulatory landscapes and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.66% | 31.69% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and globally, and it has a market cap of ₩517.50 billion.

Operations: Bioneer Corporation generates revenue through its biotechnology operations across various regions, including South Korea, the Americas, Europe, Asia, and Africa. The company focuses on providing innovative solutions in the biotechnology sector.

Bioneer, currently unprofitable, is poised for significant growth with revenue expected to increase by 23.5% annually, outpacing the South Korean market's average of 9.8%. This biotech firm is investing heavily in R&D, allocating funds that underscore its commitment to innovation—critical as it aims to transition into profitability within three years. With earnings projected to surge by 97.6% per year, Bioneer is strategically positioning itself in a competitive landscape where technological advancement and market responsiveness are key. The anticipated release of Q3 results could provide further insights into the company’s trajectory and operational adjustments post-analysis.

- Dive into the specifics of Bioneer here with our thorough health report.

Assess Bioneer's past performance with our detailed historical performance reports.

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EuBiologics Co., Ltd. is a South Korean biopharmaceutical company specializing in providing vaccines for epidemics, with a market cap of ₩537.05 billion.

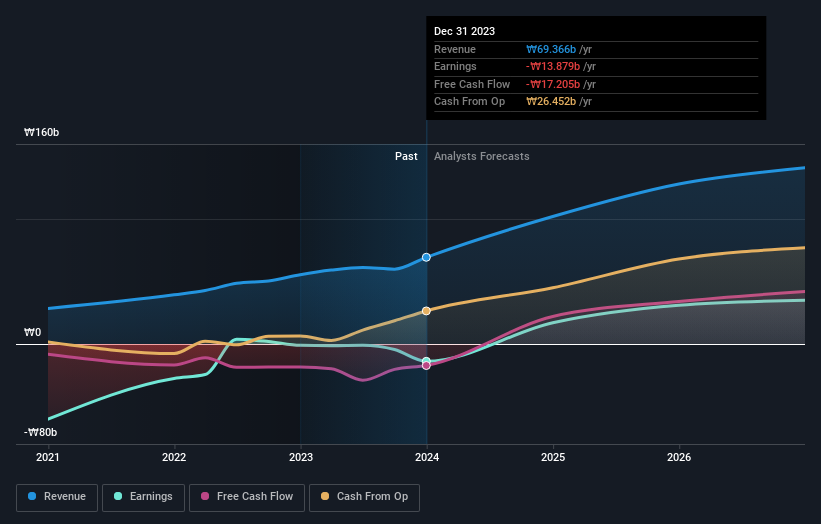

Operations: EuBiologics focuses on the production and distribution of epidemic vaccines in South Korea, generating revenue primarily from its pharmaceuticals segment, which brought in ₩69.37 billion.

EuBiologics, despite its unprofitability, is on a robust growth trajectory with revenue expected to surge by 21.9% annually, significantly outpacing the average market growth of 9.8%. This biotech firm's commitment to innovation is evident from its substantial investment in R&D, which has been strategically increased to support future profitability. With earnings forecasted to grow at an impressive rate of 66.3% per year, the company is well-positioned for a competitive edge in the biotech industry. The anticipated Q3 results could provide deeper insights into EuBiologics' operational strategies and market positioning as it navigates through its critical growth phase.

China Resources Boya Bio-pharmaceutical GroupLtd (SZSE:300294)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Resources Boya Bio-pharmaceutical Group Co., Ltd operates in the blood product industry within China, with a market capitalization of CN¥15.71 billion.

Operations: The company focuses on the blood product sector in China, generating revenue primarily from the sale of plasma-derived products. It operates with a market capitalization of CN¥15.71 billion, reflecting its significant presence in this niche industry.

Despite recent fluctuations in earnings and sales, China Resources Boya Bio-pharmaceutical GroupLtd remains a compelling entity within the biopharmaceutical sector. The company's commitment to growth is underscored by its R&D expenditure trends, which are crucial for fostering innovation and maintaining competitive advantage. With revenue projected to increase by 13.9% annually, outpacing the Chinese market average, and earnings expected to surge by 44.4% per year, the strategic focus appears well-placed. However, it's important to note that past financial results have been impacted by significant one-off losses totaling CN¥325.5M as of September 2024, affecting the overall quality of earnings. As it navigates these challenges, the firm recently affirmed its commitment to shareholder returns with consistent dividend payments highlighted in October 2024 announcements.

Where To Now?

- Gain an insight into the universe of 1301 High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300294

China Resources Boya Bio-pharmaceutical GroupLtd

Engages in the blood product businesses in China.