Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A064550

Exploring Three High Growth Tech Stocks in South Korea

Reviewed by Simply Wall St

The South Korean market has seen a 1.9% increase in the last 7 days and a 5.0% climb over the past year, with earnings forecasted to grow by 29% annually. In this dynamic environment, identifying high growth tech stocks that leverage innovation and robust financial performance can be particularly rewarding for investors.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ALTEOGEN | 48.67% | 72.95% | ★★★★★★ |

| IMLtd | 20.76% | 106.30% | ★★★★★★ |

| Bioneer | 22.49% | 89.69% | ★★★★★★ |

| NEXON Games | 31.70% | 66.31% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 62.10% | ★★★★★★ |

| FLITTO | 32.07% | 100.38% | ★★★★★★ |

| Devsisters | 26.11% | 65.92% | ★★★★★★ |

| AmosenseLtd | 24.29% | 55.45% | ★★★★★★ |

| Park Systems | 22.50% | 37.52% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and internationally, and it has a market cap of approximately ₩842.71 billion.

Operations: Bioneer Corporation operates as a biotechnology company across multiple continents, including South Korea, the Americas, Europe, Asia, and Africa. The company's revenue streams are diversified across various regions globally.

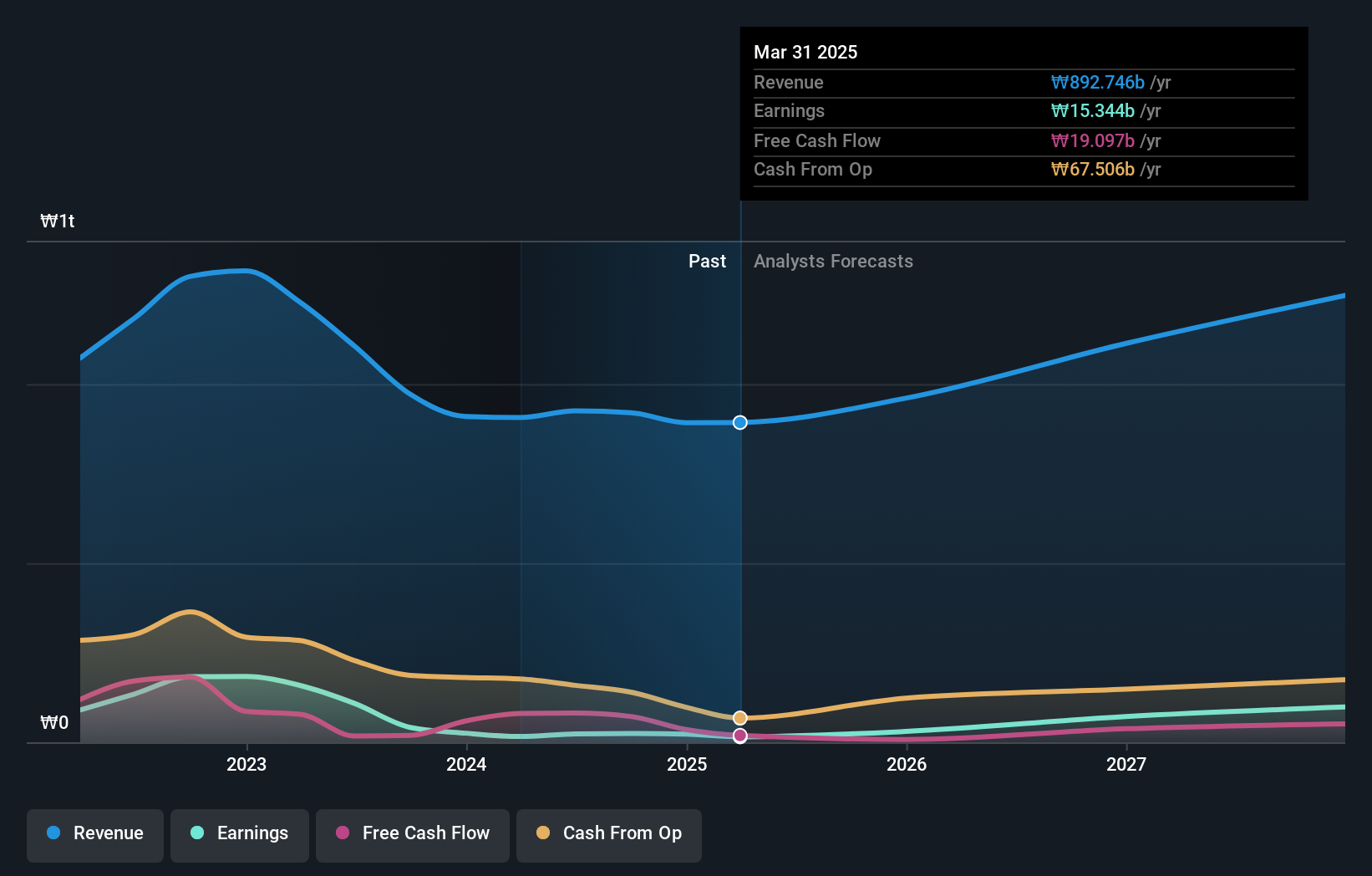

Bioneer, a prominent player in South Korea's tech landscape, is forecasted to achieve annual revenue growth of 22.5%, significantly outpacing the market average of 10.5%. Despite current unprofitability, earnings are expected to surge by an impressive 89.7% annually over the next three years. The company has invested heavily in R&D, with expenditures amounting to ₩45 billion last year, underscoring its commitment to innovation and long-term growth prospects.

- Navigate through the intricacies of Bioneer with our comprehensive health report here.

Assess Bioneer's past performance with our detailed historical performance reports.

EuBiologics (KOSDAQ:A206650)

Simply Wall St Growth Rating: ★★★★★★

Overview: EuBiologics Co., Ltd. is a biopharmaceutical company that provides vaccines for epidemics in South Korea and has a market cap of ₩426.50 billion.

Operations: EuBiologics Co., Ltd. generates revenue primarily from its pharmaceutical segment, which reported ₩69.37 billion. The company's focus is on developing and providing vaccines for epidemic diseases in South Korea.

EuBiologics is on track to achieve significant revenue growth, projected at 28.1% annually, outpacing the South Korean market average of 10.5%. Although currently unprofitable, earnings are expected to grow by an impressive 93.4% per year over the next three years. The company has heavily invested in R&D with expenditures reaching ₩45 billion last year, highlighting its commitment to innovation and future profitability. Recent quarterly results are anticipated soon, potentially shedding more light on their financial trajectory and operational efficiency.

- Unlock comprehensive insights into our analysis of EuBiologics stock in this health report.

Explore historical data to track EuBiologics' performance over time in our Past section.

DAEDUCK ELECTRONICS (KOSE:A353200)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daeduck Electronics Co., Ltd. manufactures and sells various printed circuit boards (PCB) in South Korea and internationally, with a market cap of ₩1.07 billion.

Operations: Daeduck Electronics Co., Ltd. generates revenue primarily from the manufacture and sale of printed circuit boards (PCB), amounting to ₩925.14 billion. The company operates both domestically in South Korea and internationally.

Daeduck Electronics, known for its innovative FCBGA substrates for AI servers and data centers, reported a net income of ₩12.23 billion in Q2 2024, up from ₩4.30 billion the previous year. Despite a net profit margin drop to 2.5% from 9.8%, the company's earnings are forecasted to grow at an impressive 57.2% annually, outpacing the South Korean market average of 28.5%. With R&D expenses reaching ₩45 billion last year, Daeduck's commitment to technological advancements is evident in their recent product developments and market expansion efforts.

Seize The Opportunity

- Unlock more gems! Our KRX High Growth Tech and AI Stocks screener has unearthed 47 more companies for you to explore.Click here to unveil our expertly curated list of 50 KRX High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bioneer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A064550

Bioneer

Operates as a biotechnology company in South Korea, the Americas, Europe, Asia, Africa, and internationally.