- South Korea

- /

- Building

- /

- KOSE:A009450

Gaonchips And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.9% and is up 5.0% over the last 12 months, with earnings forecast to grow by 29% annually. In this favorable environment, identifying promising stocks like Gaonchips and two other undiscovered gems can present valuable opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| SELVAS Healthcare | 13.58% | 10.16% | 77.14% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

We'll examine a selection from our screener results.

Gaonchips (KOSDAQ:A399720)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gaonchips Co., Ltd. manufactures semiconductors and has a market cap of ₩628.41 billion.

Operations: Gaonchips generates revenue primarily from its semiconductor segment, totaling ₩68.88 billion.

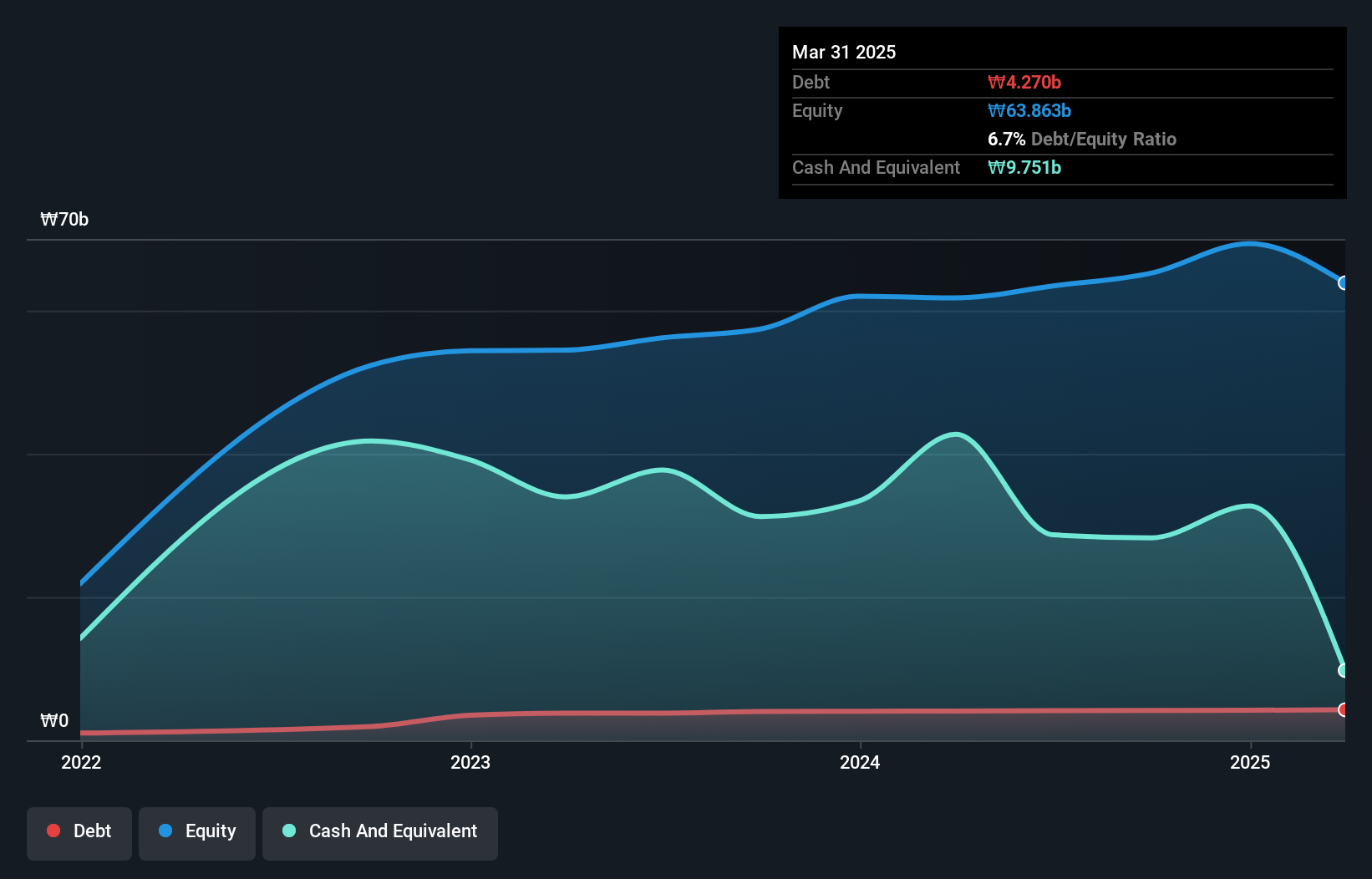

Gaonchips, a small cap semiconductor player in South Korea, has shown remarkable earnings growth of 111.2% over the past year, outpacing the industry average of -20.1%. The company repurchased shares in 2024, indicating confidence in its future prospects. With more cash than total debt and high-quality earnings, Gaonchips is positioned for continued growth with forecasted annual earnings increase of 69.72%. However, its share price has been highly volatile over the past three months.

- Click here to discover the nuances of Gaonchips with our detailed analytical health report.

Explore historical data to track Gaonchips' performance over time in our Past section.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd., along with its subsidiaries, manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.37 trillion.

Operations: Sebang Global Battery generates revenue primarily from the sale of lead acid batteries in South Korea and international markets. The company's cost structure includes manufacturing and distribution expenses, impacting its overall profitability. Gross profit margin has shown variability, reflecting changes in production costs and pricing strategies.

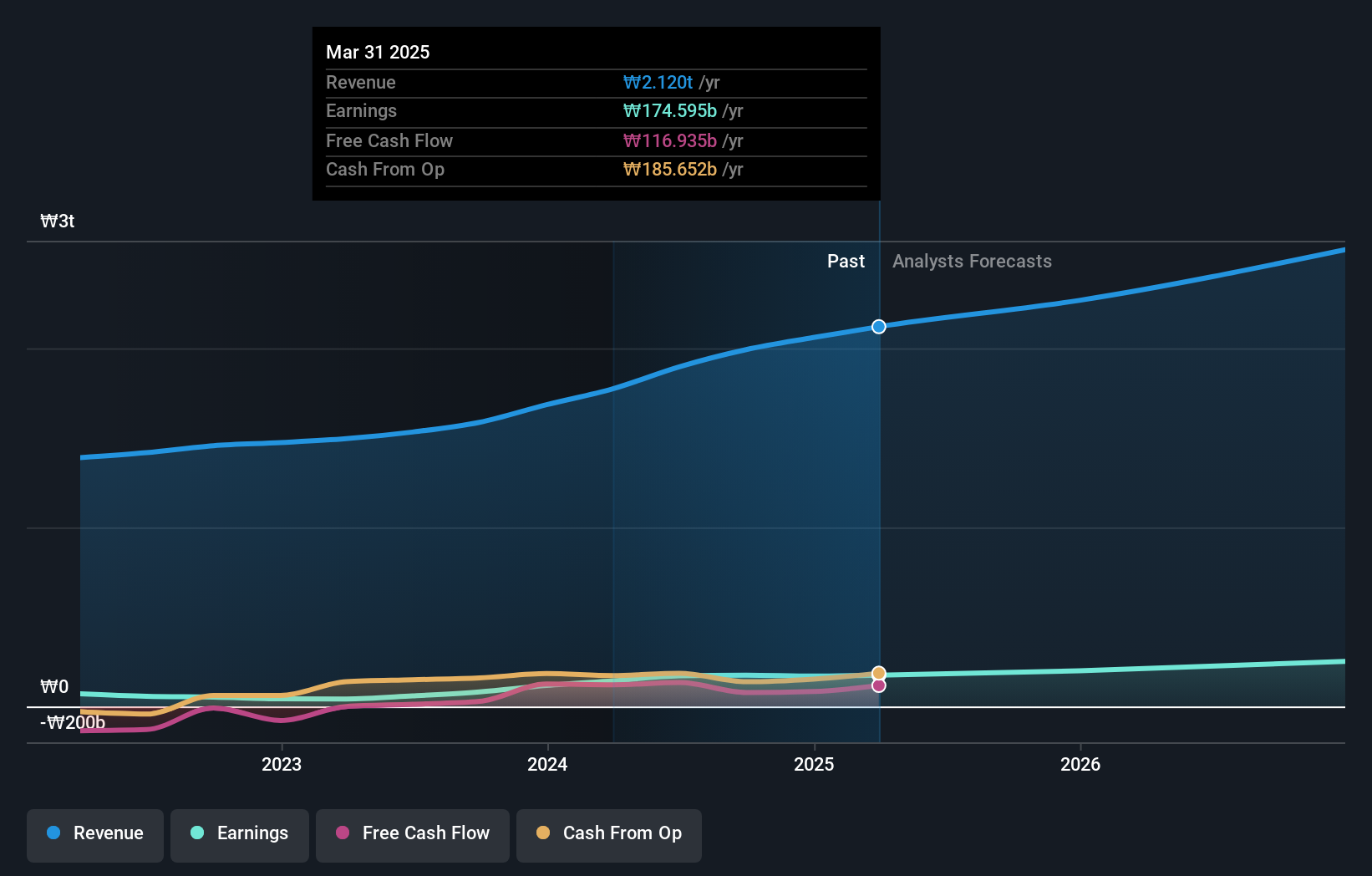

Sebang Global Battery, a promising player in South Korea's battery industry, has shown impressive growth with earnings surging 190.8% over the past year. Trading at 30.6% below its estimated fair value, it offers significant upside potential. The company's debt to equity ratio rose from 12.5% to 17.1% over five years, indicating increased leverage but manageable risk given its high-quality earnings and positive free cash flow of US$133M as of June 2024.

- Get an in-depth perspective on Sebang Global Battery's performance by reading our health report here.

Evaluate Sebang Global Battery's historical performance by accessing our past performance report.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. manufactures and sells machinery and heat combustion equipment in South Korea, with a market cap of ₩1.06 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the sale of machinery and heat combustion equipment in South Korea. The company has a market cap of ₩1.06 trillion.

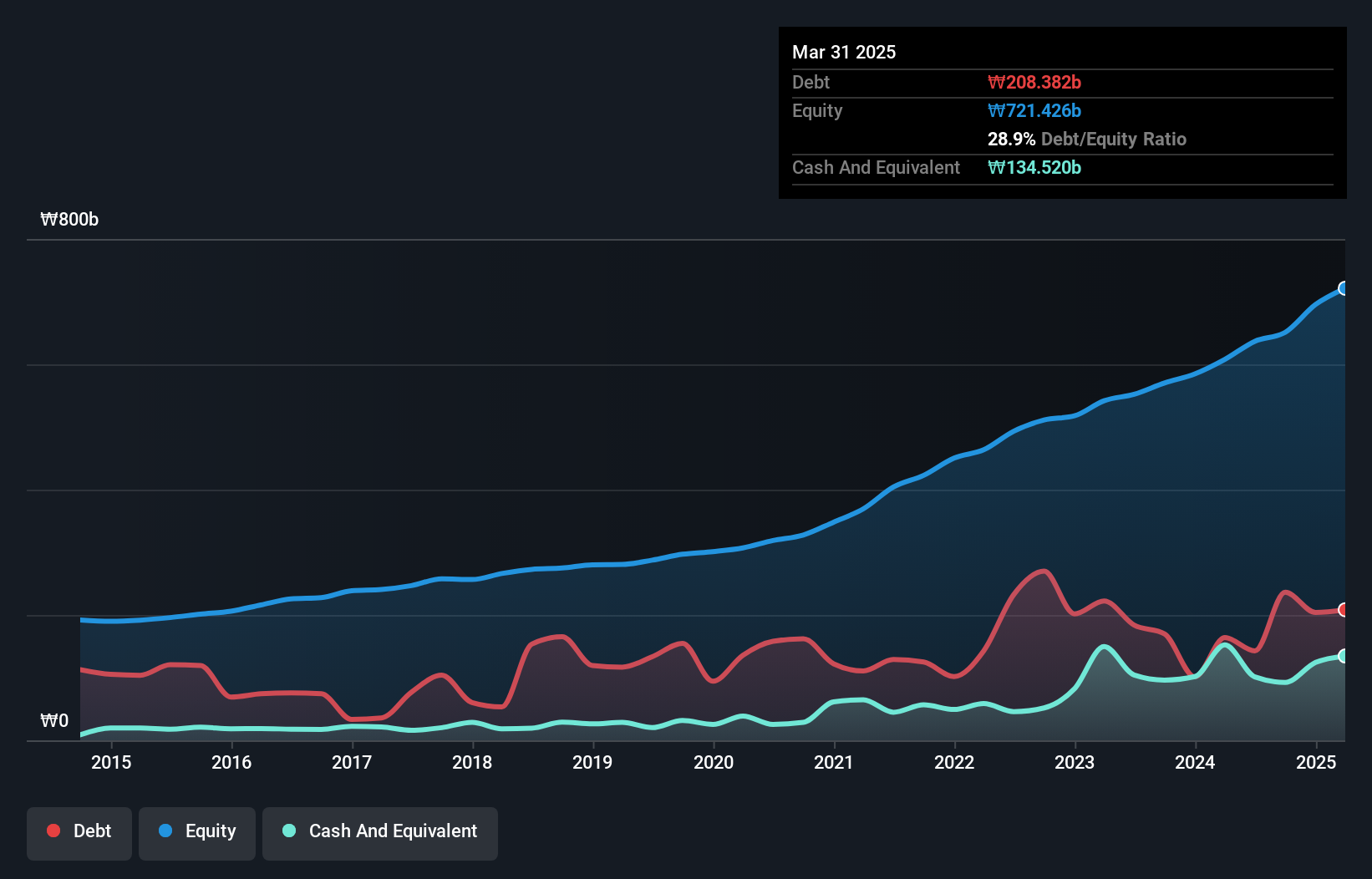

Kyung Dong Navien, a notable player in the South Korean market, has shown impressive financial health. The company's earnings surged by 85.5% over the past year, significantly outpacing the building industry's 4.6% growth rate. With a price-to-earnings ratio of 10.5x, it is attractively valued compared to the KR market's 12.1x average. Over five years, its debt-to-equity ratio decreased from 46.4% to 22.4%, highlighting prudent financial management and ensuring interest payments are well covered by EBIT at a robust 27.4x coverage.

Summing It All Up

- Explore the 198 names from our KRX Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyung Dong Navien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009450

Kyung Dong Navien

Manufactures and sells machinery and heat combustion equipment in South Korea.

Flawless balance sheet with solid track record.