Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A086900

KRX Growth Leaders With High Insider Stakes Including HANA Micron And Two Others

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index declining over three consecutive sessions. Amidst this broader market turbulence, certain growth companies with high insider ownership may offer investors unique stability and potential for robust performance. In current market conditions, companies with substantial insider stakes are often perceived as having aligned interests between their management and shareholders, which can be particularly appealing during times of uncertainty.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.8% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 36.3% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| HANA Micron (KOSDAQ:A067310) | 20% | 99.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Underneath we present a selection of stocks filtered out by our screen.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. specializes in semiconductor back-end process packaging solutions based in South Korea, with a market capitalization of approximately ₩967.48 billion.

Operations: The company generates revenue primarily from semiconductor manufacturing, contributing approximately ₩1.27 billion, and semiconductor materials, adding about ₩221.85 million.

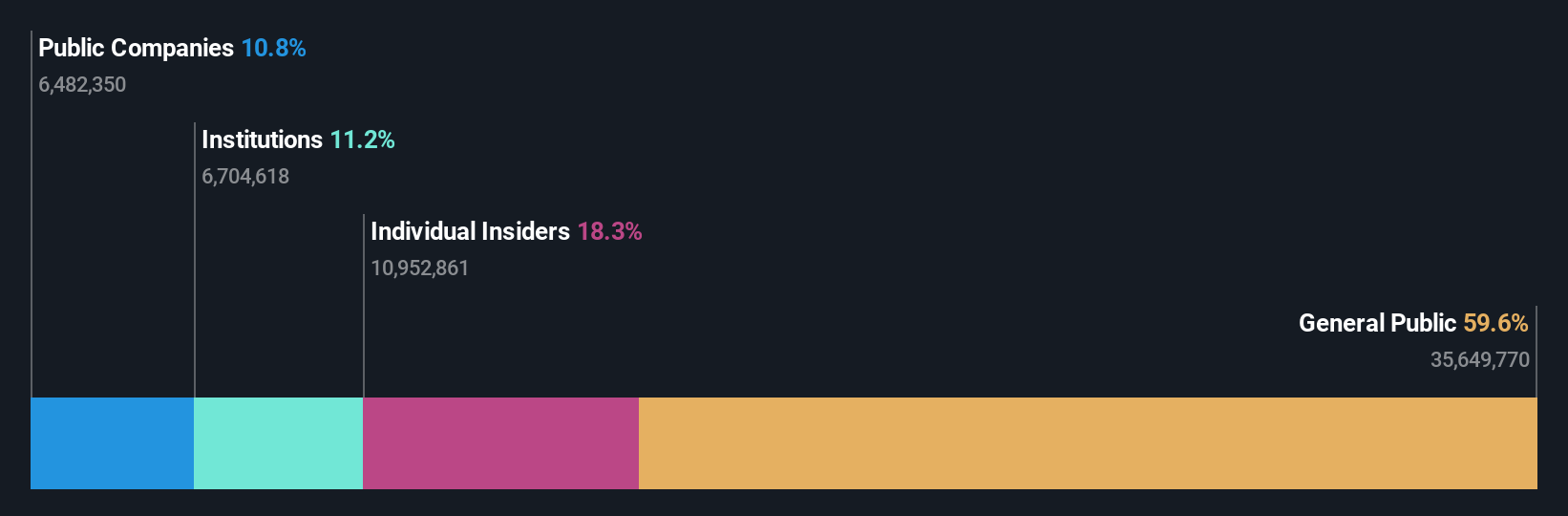

Insider Ownership: 20%

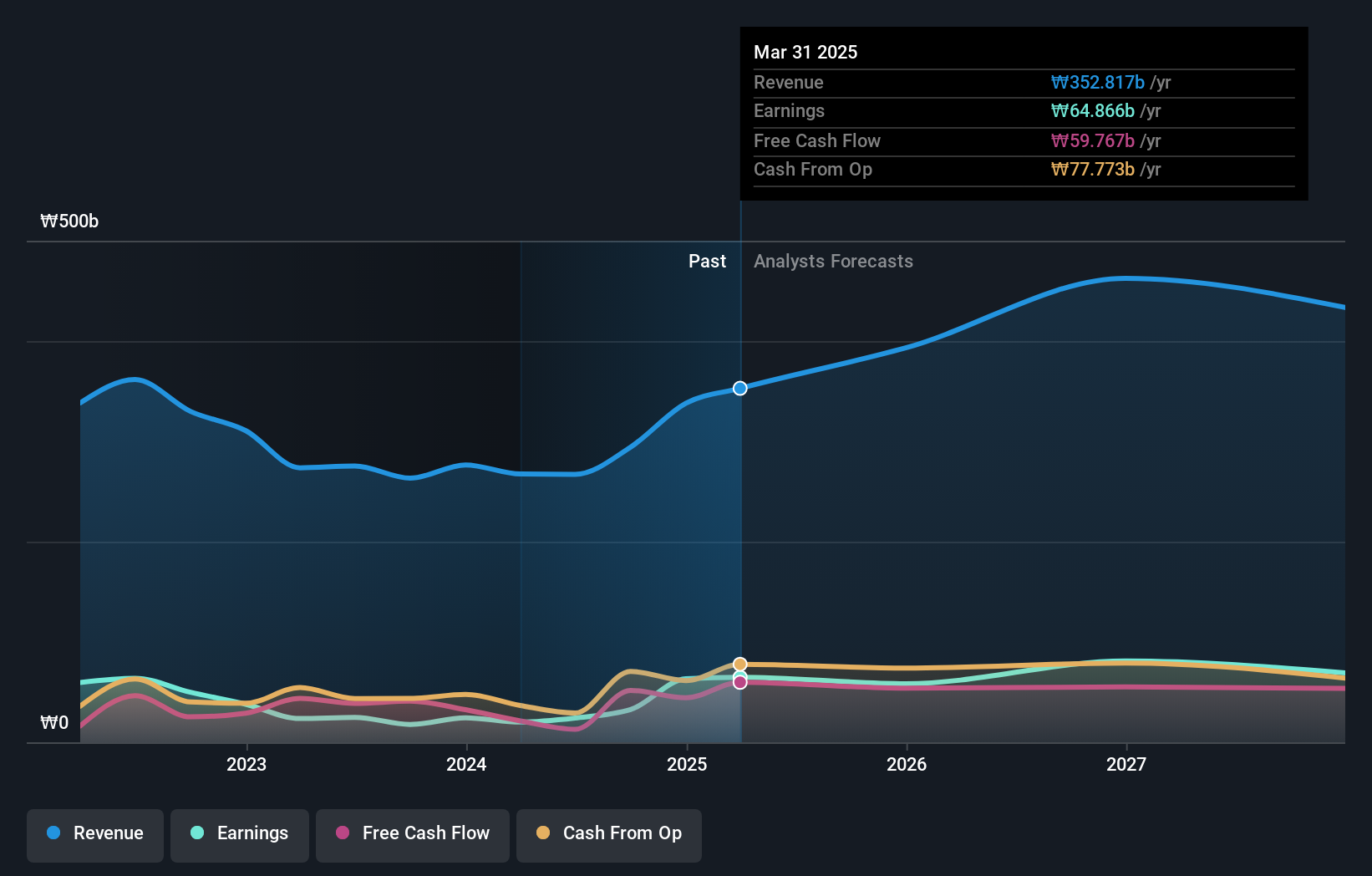

HANA Micron, a South Korean company with significant insider ownership, is navigating a challenging financial landscape. Despite recent substantial losses and shareholder dilution, including a KRW 112.5 billion follow-on equity offering, the firm is poised for recovery. Analysts predict robust revenue growth (27% annually) and profitability within three years, outpacing average market projections. The company's anticipated high return on equity (23.2%) underscores its potential for strong future performance despite current setbacks.

- Click to explore a detailed breakdown of our findings in HANA Micron's earnings growth report.

- Our valuation report unveils the possibility HANA Micron's shares may be trading at a discount.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eugene Technology Co., Ltd. specializes in manufacturing and selling semiconductor equipment and parts, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.04 trillion.

Operations: The company generates revenue primarily through two segments: semiconductor equipment, which brings in ₩257.39 billion, and industrial gas for semiconductors, contributing ₩10.01 billion.

Insider Ownership: 37.5%

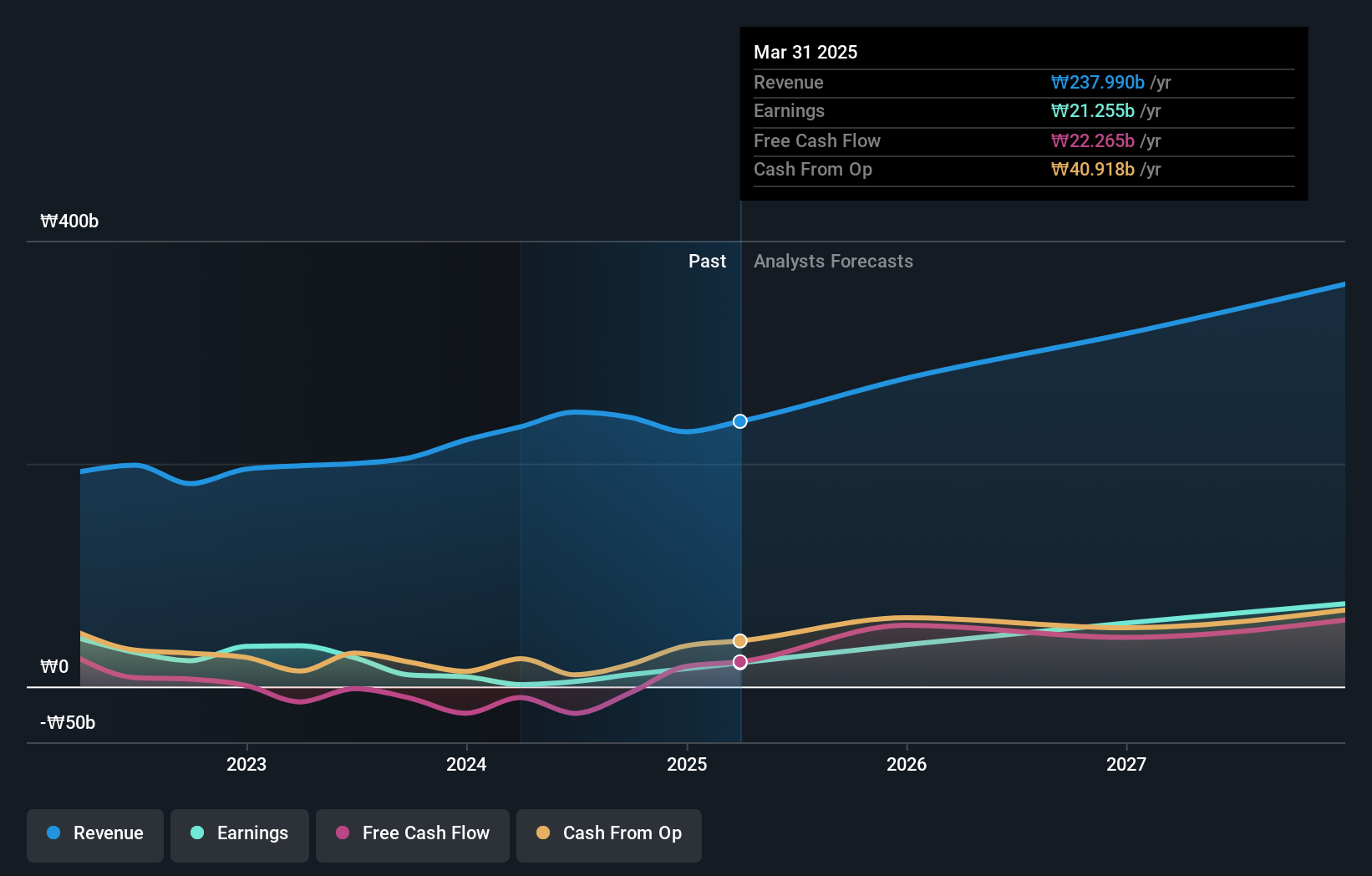

Eugene TechnologyLtd, despite a recent dip in net income and earnings per share as reported in its latest quarterly results, remains a compelling case within the high insider ownership landscape of South Korea. The company is trading just below its estimated fair value and analysts expect significant revenue growth (20.5% annually) and even higher profit growth (46.2% annually), outperforming broader market expectations. However, its projected return on equity is relatively low at 16.6%, suggesting potential challenges in capital efficiency ahead.

- Navigate through the intricacies of Eugene TechnologyLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Eugene TechnologyLtd may be overvalued.

Medy-Tox (KOSDAQ:A086900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea, with a market capitalization of approximately ₩1.18 billion.

Operations: The company generates its revenues primarily from its biopharmaceutical operations in South Korea.

Insider Ownership: 19.8%

Medy-Tox, despite a sharp downturn in its latest quarterly earnings with significant losses and a drop in sales, still holds potential under the high insider ownership umbrella in South Korea. The company is currently undervalued by 42%, with expectations of substantial earnings growth at 68.3% annually over the next three years, outpacing the broader Korean market's forecast of 29.7%. However, it faces challenges with low profit margins and a volatile share price.

- Get an in-depth perspective on Medy-Tox's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Medy-Tox's share price might be on the cheaper side.

Taking Advantage

- Navigate through the entire inventory of 79 Fast Growing KRX Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Medy-Tox is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A086900

Flawless balance sheet and good value.