- South Korea

- /

- Biotech

- /

- KOSDAQ:A065660

Does Anterogen.Co.Ltd's (KOSDAQ:065660) Share Price Gain of 25% Match Its Business Performance?

It hasn't been the best quarter for Anterogen.Co.,Ltd. (KOSDAQ:065660) shareholders, since the share price has fallen 17% in that time. Looking on the brighter side, the stock is actually up over twelve months. In that time, it is up 25%, which isn't bad, but is below the market return of 34%.

Check out our latest analysis for Anterogen.Co.Ltd

Anterogen.Co.Ltd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

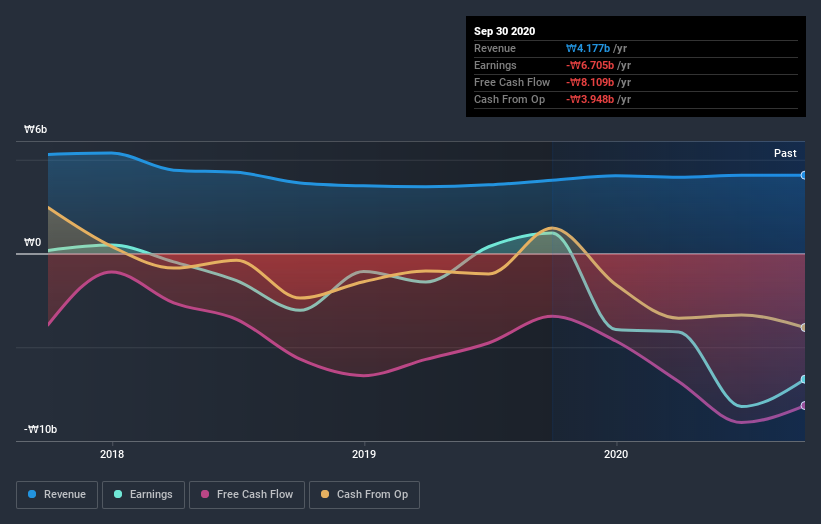

In the last year Anterogen.Co.Ltd saw its revenue grow by 6.8%. That's not a very high growth rate considering it doesn't make profits. Over that time the share price gained a very modest 25%. It might be worth thinking about how long it will take the company to turn a profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Anterogen.Co.Ltd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year Anterogen.Co.Ltd shareholders have received a TSR of 25%. It's always nice to make money but this return falls short of the market return which was about 34% for the year. On the other hand, the TSR over three years was worse, at just 7% per year. This suggests the company's position is improving. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Anterogen.Co.Ltd (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Anterogen.Co.Ltd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A065660

Anterogen.Co.Ltd

A bio-venture company, engages in the research, development, and commercialization of cell therapy products using adipose-derived stem cells in South Korea and internationally.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives