- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A039860

NanoEntek (KOSDAQ:039860) adds ₩38b to market cap in the past 7 days, though investors from three years ago are still down 50%

NanoEntek, Inc. (KOSDAQ:039860) shareholders should be happy to see the share price up 19% in the last month. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 50%. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

The recent uptick of 19% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for NanoEntek

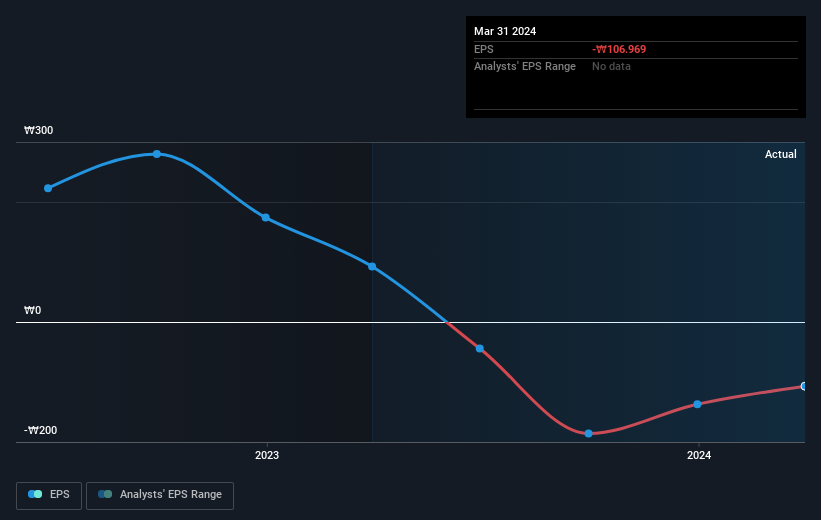

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the three years that the share price declined, NanoEntek's earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on NanoEntek's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in NanoEntek had a tough year, with a total loss of 21%, against a market gain of about 3.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for NanoEntek (1 is a bit unpleasant) that you should be aware of.

We will like NanoEntek better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NanoEntek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039860

NanoEntek

Engages in the research and development, production, and sale of life-science lab equipment, in vitro diagnostic medical devices, point of care diagnostic devices, and related consumables and solutions in Korea and internationally.

Flawless balance sheet slight.