- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A039860

If You Had Bought NanoEnTek (KOSDAQ:039860) Shares A Year Ago You'd Have Earned 48% Returns

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. Of course, the aim of the game is to pick stocks that do better than an index fund. NanoEnTek, Inc. (KOSDAQ:039860) has done well over the last year, with the stock price up 48% beating the market return of 46% (not including dividends). However, the stock hasn't done so well in the longer term, with the stock only up 27% in three years.

See our latest analysis for NanoEnTek

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, NanoEnTek actually saw its earnings per share drop 13%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We think that the revenue growth of 3.6% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

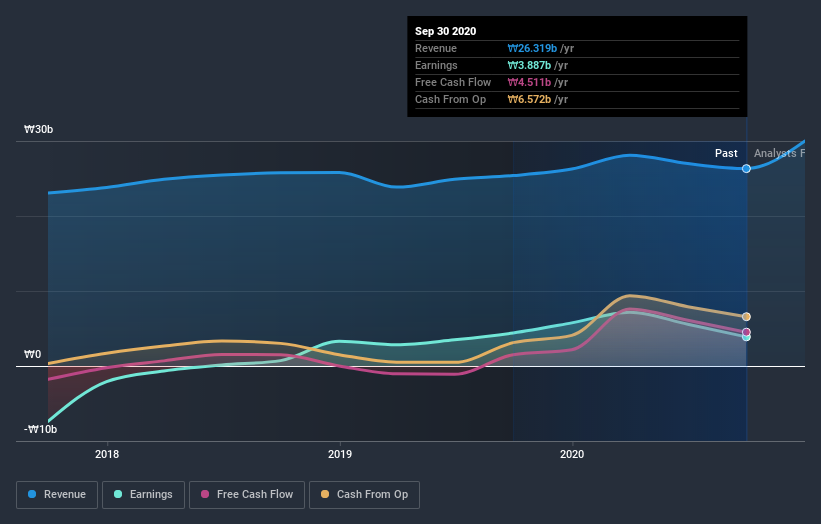

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on NanoEnTek's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

NanoEnTek shareholders have received returns of 48% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 4%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand NanoEnTek better, we need to consider many other factors. For example, we've discovered 1 warning sign for NanoEnTek that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade NanoEnTek, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NanoEntek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A039860

NanoEntek

Engages in the research and development, production, and sale of life-science lab equipment, in vitro diagnostic medical devices, point of care diagnostic devices, and related consumables and solutions in Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives