- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A036180

GW Vitek CO.,LTD.'s (KOSDAQ:036180) Shares Bounce 27% But Its Business Still Trails The Industry

GW Vitek CO.,LTD. (KOSDAQ:036180) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

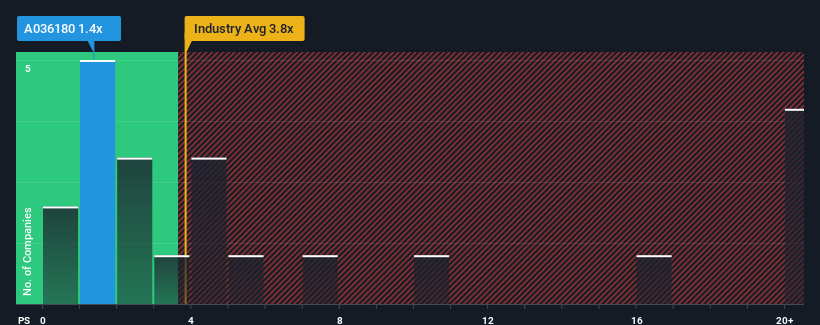

In spite of the firm bounce in price, GW VitekLTD's price-to-sales (or "P/S") ratio of 1.4x might still make it look like a strong buy right now compared to the wider Life Sciences industry in Korea, where around half of the companies have P/S ratios above 3.8x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for GW VitekLTD

How Has GW VitekLTD Performed Recently?

For example, consider that GW VitekLTD's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GW VitekLTD will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, GW VitekLTD would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that GW VitekLTD is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Shares in GW VitekLTD have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of GW VitekLTD revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for GW VitekLTD you should be aware of, and 1 of them doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A036180

GW VitekLTD

Engages in the development, manufacturing, and sale of bio-related antibodies and biotechnology solutions in Korea, the United States, Asia, Europe, and internationally.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success