Stock Analysis

- South Korea

- /

- Pharma

- /

- KOSDAQ:A000250

Recent 6.6% pullback isn't enough to hurt long-term Sam Chun Dang Pharm (KOSDAQ:000250) shareholders, they're still up 446% over 5 years

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Sam Chun Dang Pharm. Co., Ltd (KOSDAQ:000250) share price. It's 444% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 105% in about a quarter.

While the stock has fallen 6.6% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Sam Chun Dang Pharm

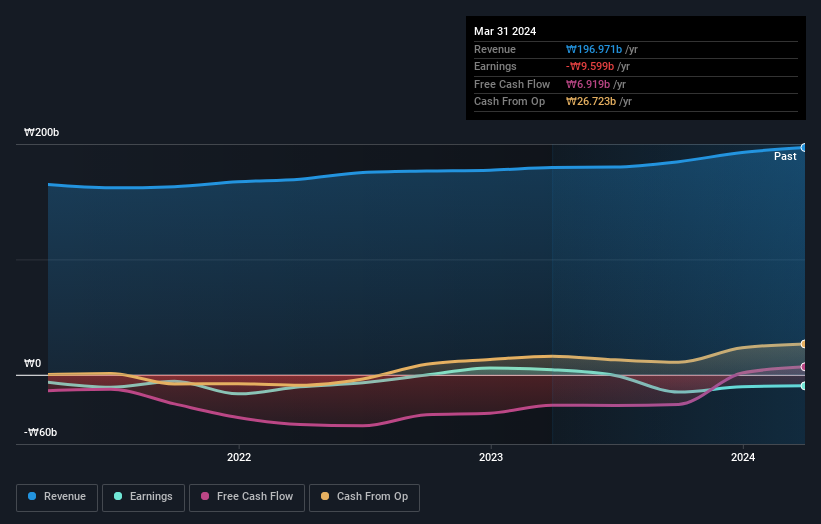

Given that Sam Chun Dang Pharm didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Sam Chun Dang Pharm can boast revenue growth at a rate of 1.6% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 40% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Sam Chun Dang Pharm's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Sam Chun Dang Pharm shareholders have received a total shareholder return of 252% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 40% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Sam Chun Dang Pharm .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sam Chun Dang Pharm is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sam Chun Dang Pharm is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A000250

Sam Chun Dang Pharm

Engages in the manufacturing and sale of pharmaceutical products in South Korea.

Excellent balance sheet low.