- South Korea

- /

- Biotech

- /

- KOSE:A068270

High Growth Tech Stocks In South Korea October 2024

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, but it is up 3.8% over the past year with earnings forecasted to grow by 30% annually. In this environment, identifying high growth tech stocks involves focusing on companies that are well-positioned to capitalize on technological advancements and robust earnings potential.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

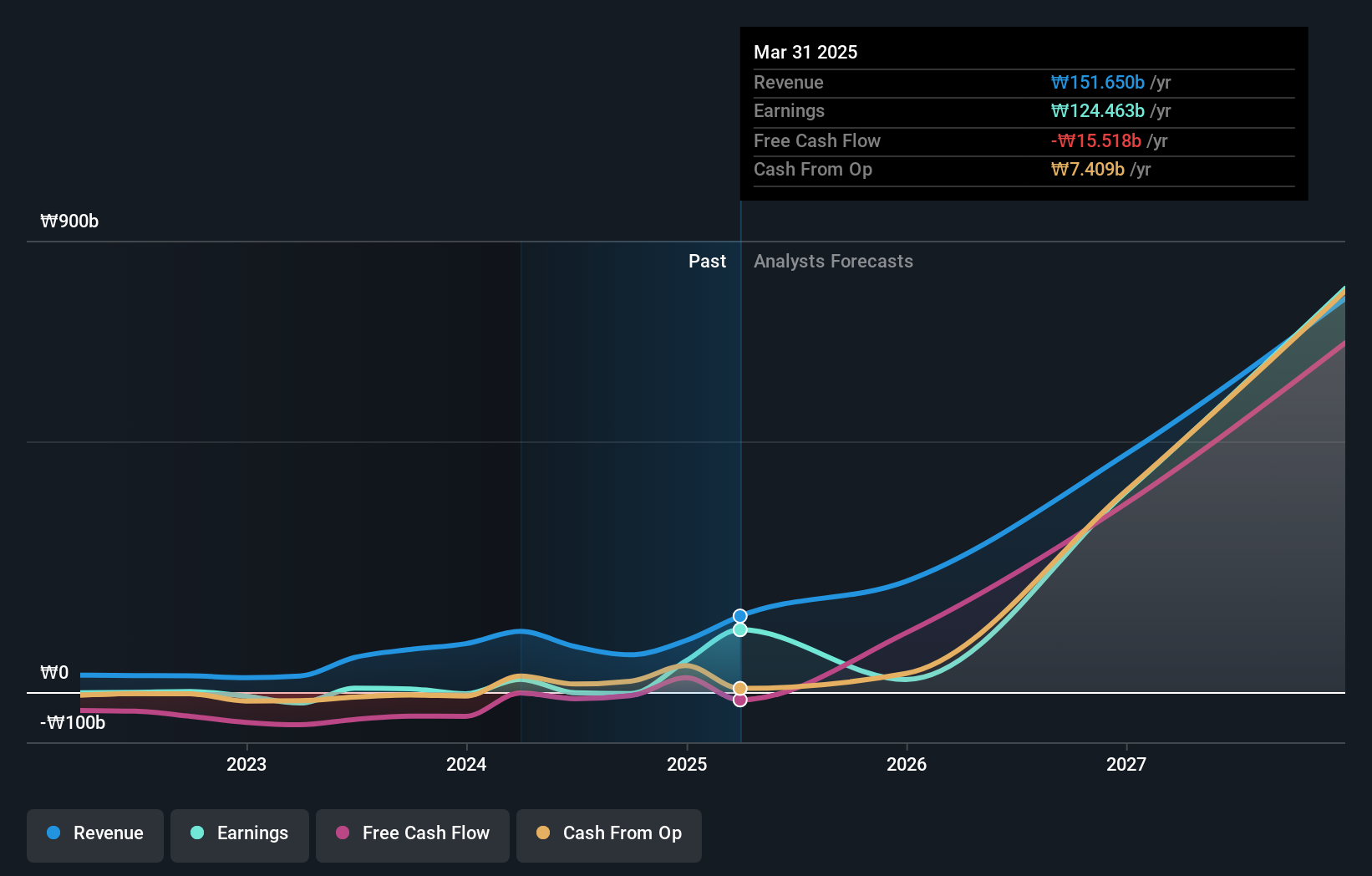

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.11 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. It focuses on developing innovative products such as long-acting biobetters and proprietary antibody-drug conjugates.

ALTEOGEN is navigating the competitive landscape of South Korea's biotech sector with a strategic focus on innovation and market adaptation. With a remarkable expected revenue growth rate of 64.2% per year, the company outpaces the average Korean market growth of 10.4%, positioning itself as a formidable contender in high-growth tech arenas. Despite current unprofitability, ALTEOGEN is anticipated to shift towards profitability within three years, supported by an aggressive R&D strategy that has significantly shaped its pipeline and technological advancements. This investment in R&D not only underscores its commitment to growth but also aligns with an impressive projected annual earnings increase of 99.5%. As it moves towards a robust financial standing, the forecasted Return on Equity at an exceptional 66.3% highlights potential for substantial economic value creation, making ALTEOGEN's journey one to watch closely in the evolving biotech landscape.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Gain insights into ALTEOGEN's past trends and performance with our Past report.

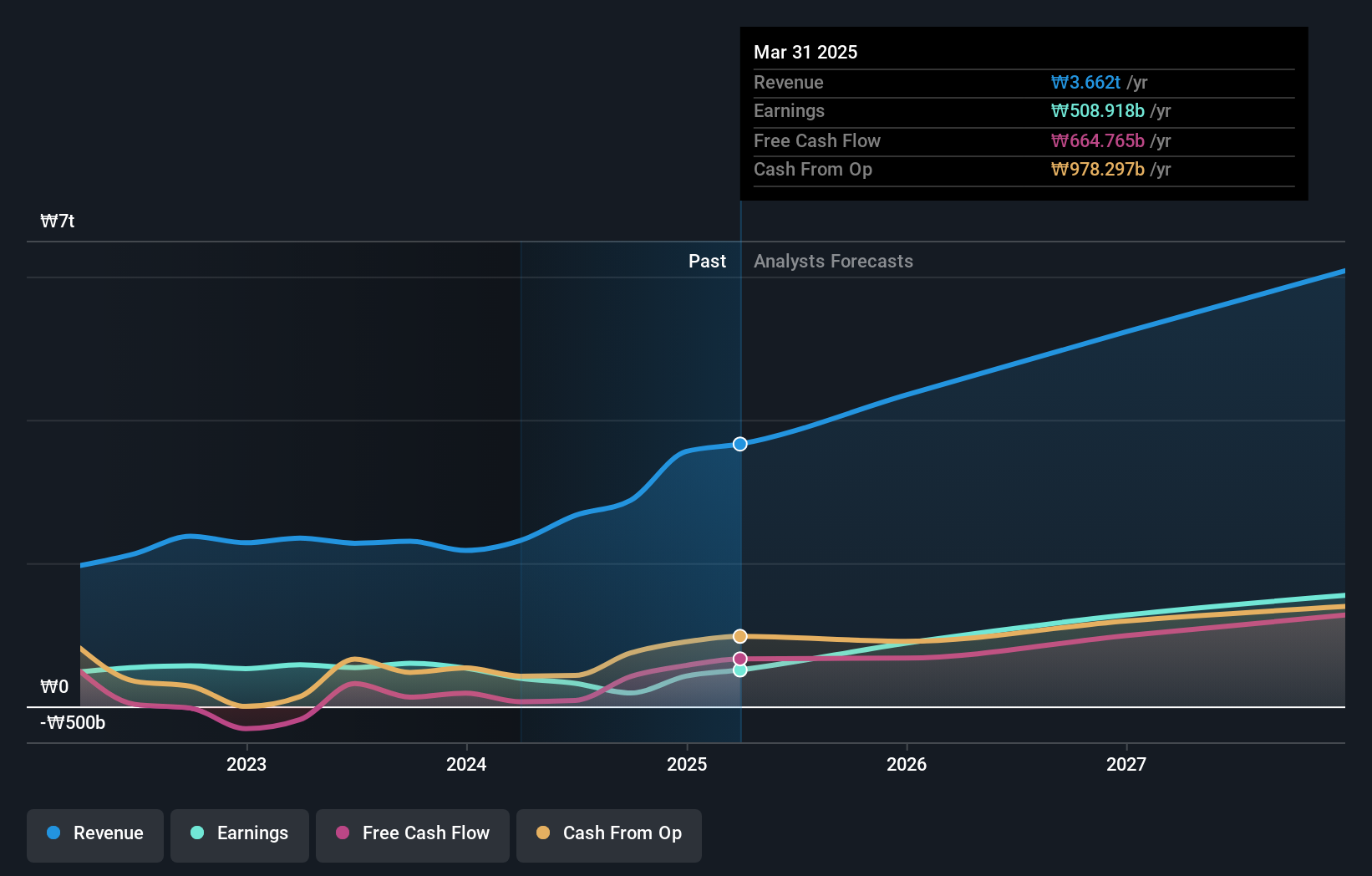

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and producing protein-based drugs for oncology treatment in South Korea, with a market capitalization of ₩40.40 trillion.

Operations: The company generates revenue primarily from its Bio Medical Supply segment, contributing ₩3.54 trillion, and Chemical Drugs segment, adding ₩507 billion. The business focuses on the development and production of protein-based oncology drugs in South Korea.

Celltrion, a South Korean biotech firm, is making significant strides in the high-growth tech sector with its focus on developing biosimilars. The company's revenue is expected to grow by 25.6% annually, outpacing the domestic market growth of 10.4%. This aggressive expansion is supported by substantial R&D investments, which have recently amounted to significant figures in relation to total revenue, underscoring a commitment to innovation and market leadership in biotechnology. Additionally, Celltrion has enhanced its market position through strategic client partnerships and recent product approvals like ZYMFENTRA® in the U.S., which is set to increase accessibility for millions of patients. Despite facing challenges such as a dip in net income from KRW 147 billion last year to KRW 78 billion this quarter, the company's proactive management of its portfolio and strategic buybacks—repurchasing shares worth over KRW 75 billion—demonstrates a robust approach to sustaining growth and shareholder value.

- Navigate through the intricacies of Celltrion with our comprehensive health report here.

Examine Celltrion's past performance report to understand how it has performed in the past.

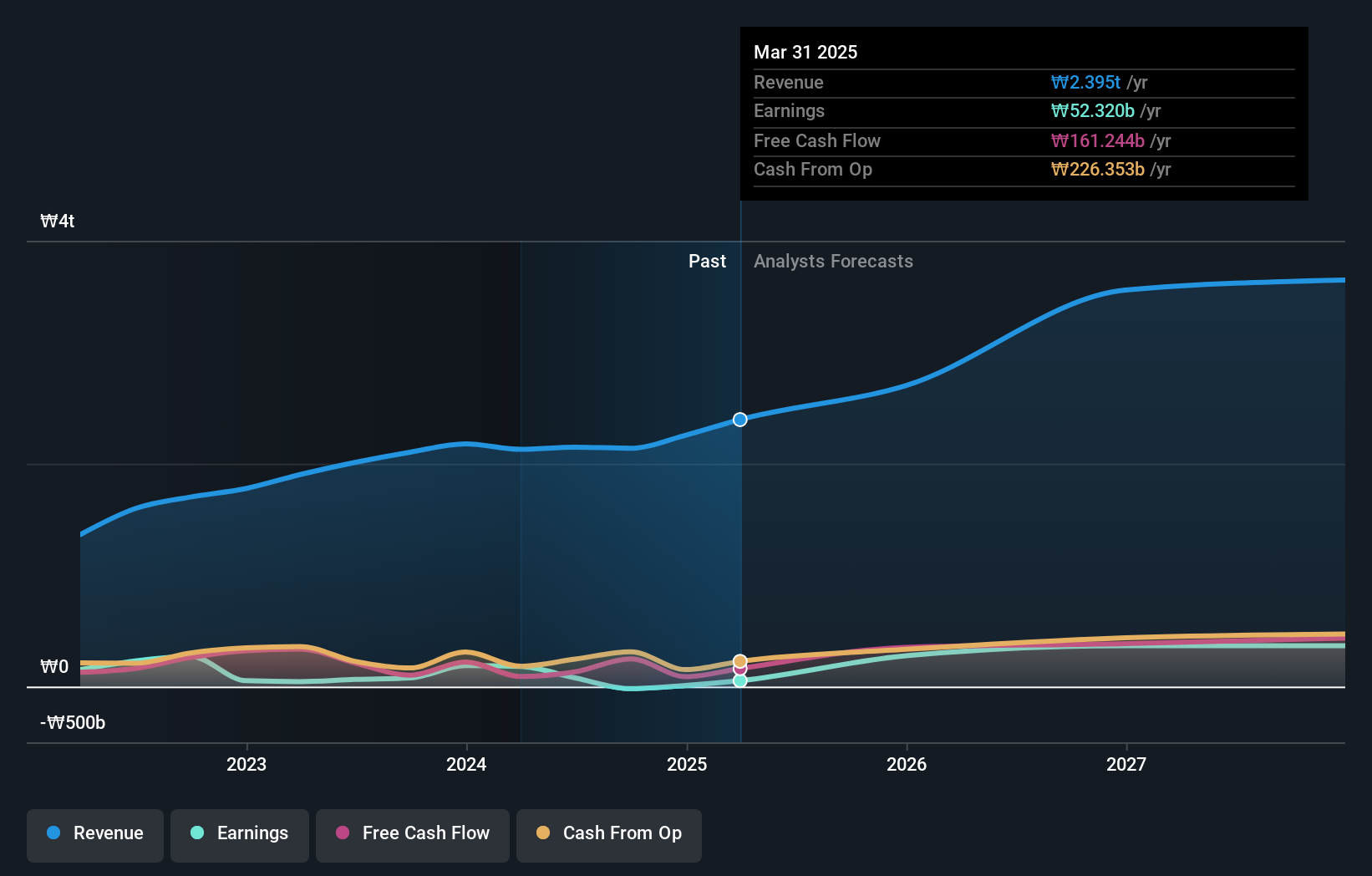

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market capitalization of ₩7.68 trillion.

Operations: HYBE Co., Ltd.'s revenue is primarily driven by its Label segment, contributing ₩1.28 trillion, and the Solution segment, which adds ₩1.24 trillion. The Platform segment also plays a significant role with revenues of ₩361.12 billion.

HYBE, a South Korean entertainment company, is navigating the high-growth tech landscape with notable strategic maneuvers. Despite a significant dip in net income from KRW 117.34 billion to KRW 14.59 billion year-over-year as of June 2024, HYBE's commitment to growth is evident in its aggressive R&D spending and revenue forecasts. The firm's R&D expenses are crucial for its innovation trajectory, particularly as it plans to expand its digital and platform services which are integral to competing globally. Moreover, with an expected annual revenue growth rate of 14% and profit surge forecast at 42.6%, HYBE is actively working to outpace market averages significantly. This growth strategy is complemented by recent share buybacks totaling KRW 26.09 billion, underscoring efforts to enhance shareholder value amid market fluctuations.

- Click to explore a detailed breakdown of our findings in HYBE's health report.

Gain insights into HYBE's historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 48 KRX High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

Develops and produces drugs based on proteins for the treatment of oncology in South Korea.

Flawless balance sheet with high growth potential.