- South Korea

- /

- Entertainment

- /

- KOSE:A251270

Netmarble (KRX:251270) shareholders are up 6.2% this past week, but still in the red over the last three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Netmarble Corporation (KRX:251270) have had an unfortunate run in the last three years. Unfortunately, they have held through a 59% decline in the share price in that time. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days. Of course, this share price action may well have been influenced by the 9.3% decline in the broader market, throughout the period.

While the last three years has been tough for Netmarble shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Netmarble

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Netmarble has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

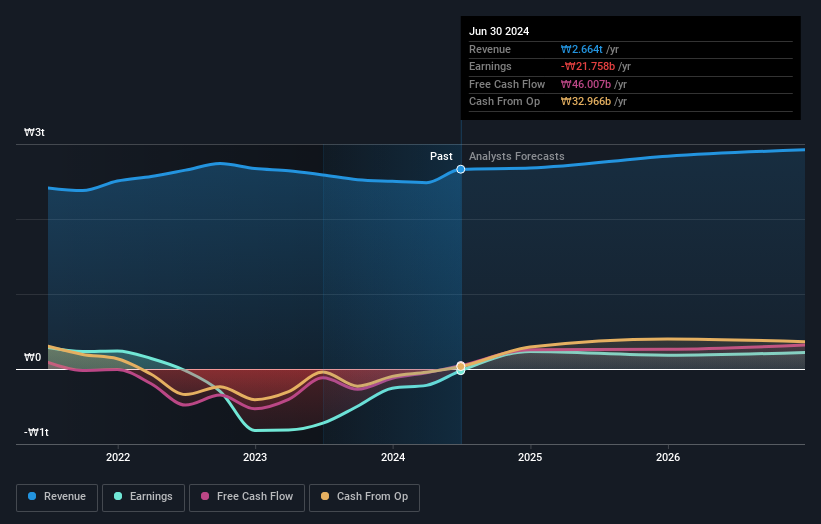

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Netmarble is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 2.2% in the twelve months, Netmarble shareholders did even worse, losing 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Netmarble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A251270

Netmarble

Develops and publishes PC, mobile, and console games in South Korea and internationally.

Good value with moderate growth potential.