- Thailand

- /

- Electronic Equipment and Components

- /

- SET:DELTA

High Growth Tech Stocks To Watch In Asia July 2025

Reviewed by Simply Wall St

As global markets continue to experience varied performances, with small-cap indices like the S&P MidCap 400 and Russell 2000 showing notable gains, Asian tech stocks are drawing attention amidst evolving trade dynamics and economic indicators. In such a climate, identifying high-growth tech stocks involves looking at companies that can leverage technological advancements and navigate geopolitical shifts effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 28.67% | 35.10% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 25.04% | 26.89% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation is a global developer and publisher of online games, with a market capitalization of ₩4.01 trillion.

Operations: The company generates revenue primarily through online games and game services, totaling ₩1.54 trillion.

NCSOFT, despite a challenging year with a 51.9% dip in earnings, is set for a rebound with projected annual earnings growth of 31.2%. This growth trajectory outpaces the broader Korean market's forecast of 21% and is supported by robust revenue predictions at an annual increase of 10.7%, surpassing the market average of 6.6%. The firm's commitment to innovation is evident from its R&D expenses, which are crucial for staying competitive in the fast-evolving tech landscape. Recent presentations at global investor conferences underscore NCSOFT’s strategic focus on expanding its influence and adapting to shifting market dynamics, although it grapples with profit margins that have narrowed from last year’s 9.2% to this year’s 4.9%.

- Click here and access our complete health analysis report to understand the dynamics of NCSOFT.

Explore historical data to track NCSOFT's performance over time in our Past section.

Delta Electronics (Thailand) (SET:DELTA)

Simply Wall St Growth Rating: ★★★☆☆☆

Overview: Delta Electronics (Thailand) Public Company Limited, along with its subsidiaries, engages in the research, development, manufacturing, and distribution of electronic products and has a market capitalization of approximately THB1.37 trillion.

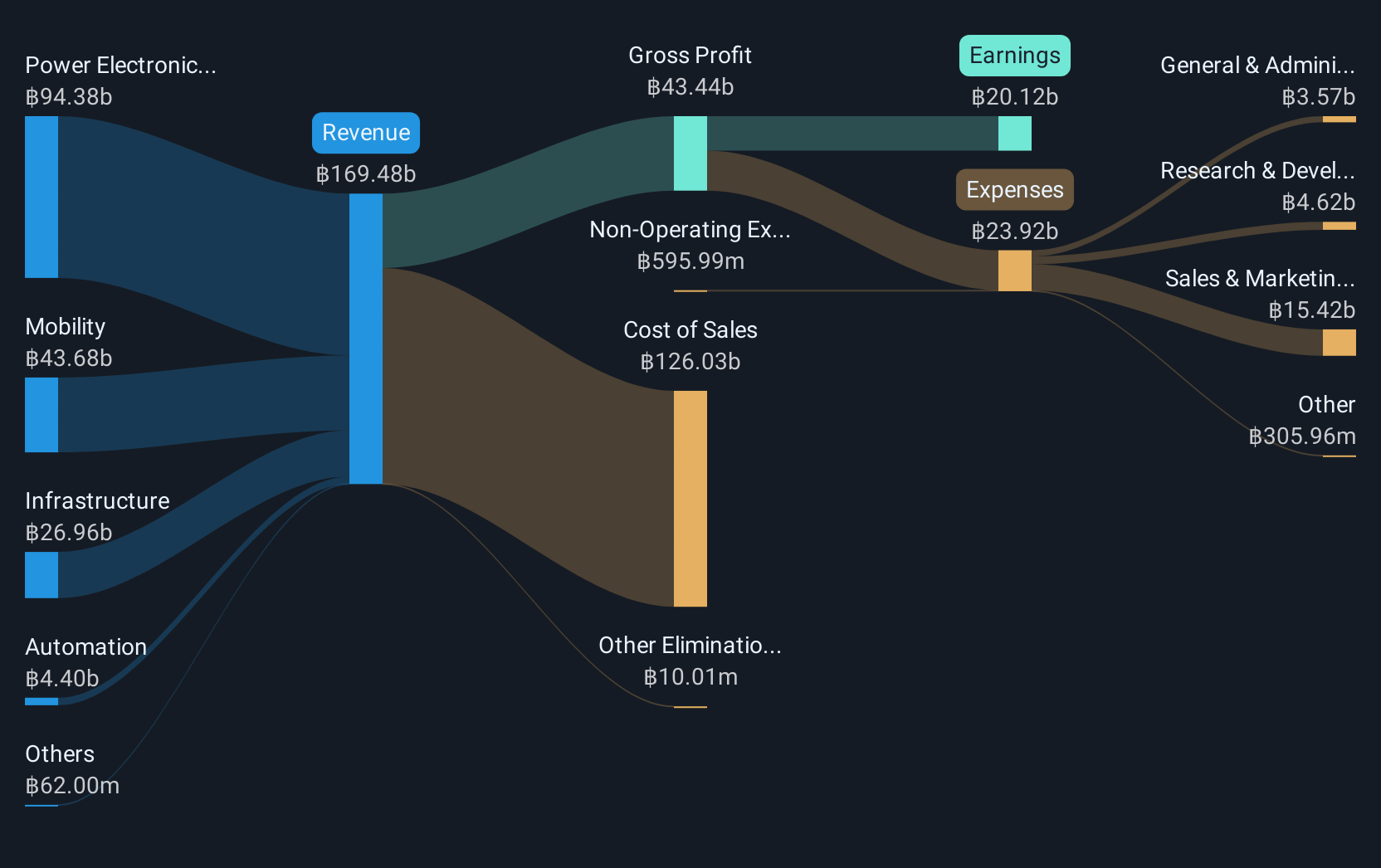

Operations: Delta Electronics (Thailand) generates revenue primarily through Power Electronics, contributing THB94.38 billion, followed by Mobility at THB43.68 billion and Infrastructure at THB26.96 billion. The company's operations encompass research, development, manufacturing, and distribution of these electronic products across various segments.

Delta Electronics (Thailand) demonstrates a robust trajectory in the high-growth tech sector in Asia, with its earnings and revenue growth outpacing local market averages. The company's annualized revenue growth stands at 10.8%, surpassing Thailand's average of 5%. Additionally, Delta maintains a significant focus on research and development, essential for sustaining innovation and competitive edge in the technology industry. Recent financial results highlighted a notable increase in sales to THB 41.89 billion from THB 37.68 billion year-over-year, alongside an improvement in net income to THB 5.49 billion from THB 4.31 billion, reflecting strong operational performance and market responsiveness.

- Click here to discover the nuances of Delta Electronics (Thailand) with our detailed analytical health report.

Gain insights into Delta Electronics (Thailand)'s past trends and performance with our Past report.

Vcanbio Cell & Gene Engineering (SHSE:600645)

Simply Wall St Growth Rating: ★★★★☆☆

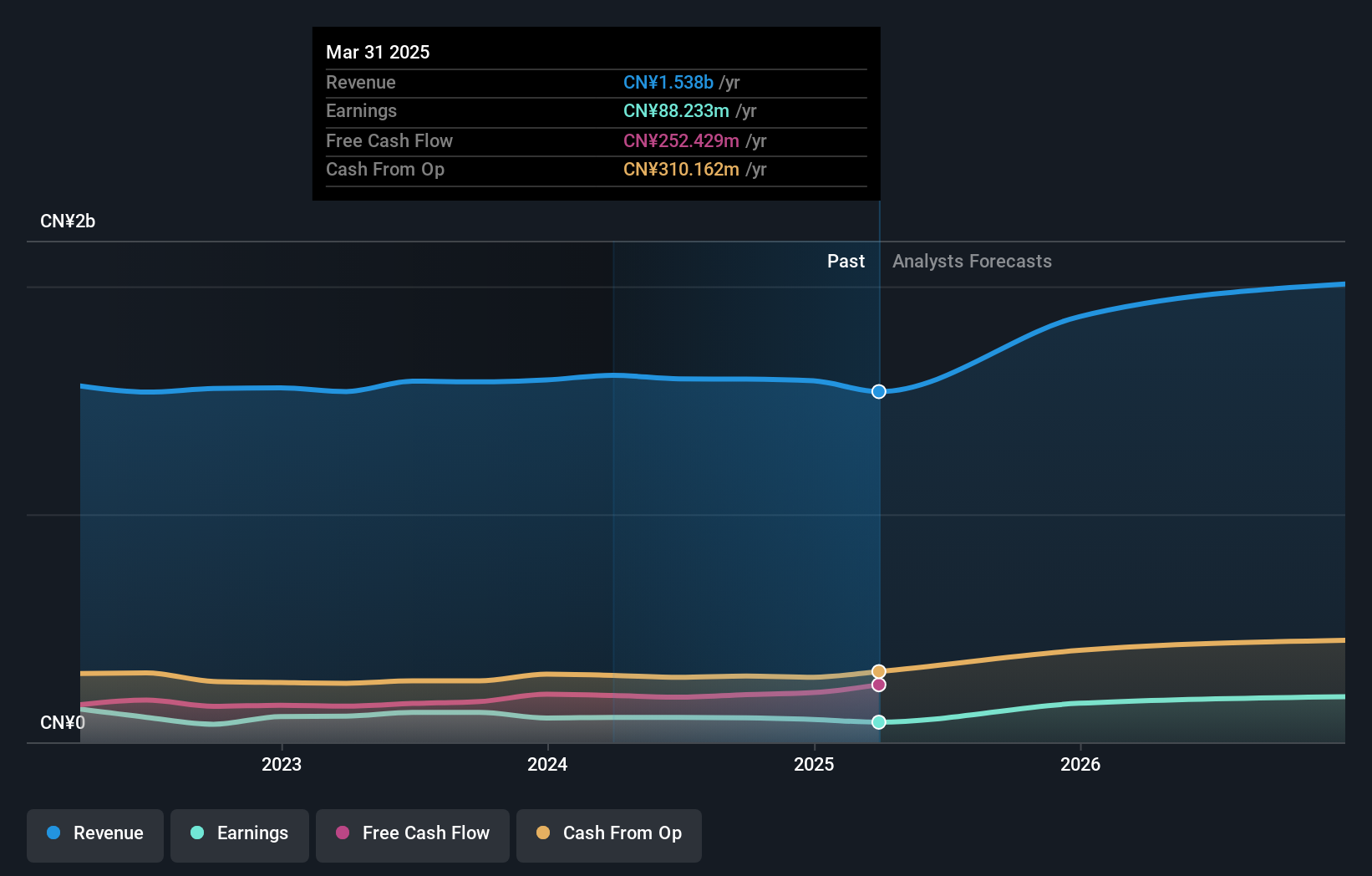

Overview: Vcanbio Cell & Gene Engineering Corp., Ltd, along with its subsidiaries, focuses on the preparation and storage of cell detection tests in China and has a market cap of approximately CN¥11.79 billion.

Operations: The company generates revenue by specializing in cell detection test preparation and storage within China. It operates with a market capitalization of approximately CN¥11.79 billion, reflecting its significant presence in the biotechnology sector.

Vcanbio Cell & Gene Engineering, navigating through a challenging landscape, reported a decrease in Q1 sales and net income year-over-year, with revenues dropping to CNY 350.79 million from CNY 397.98 million. Despite this downturn, the company's future looks promising with an expected annual earnings growth of 40.5%, significantly outpacing the Chinese market average of 23.3%. This growth is underpinned by robust R&D investments that are crucial for maintaining its competitive edge in the biotech industry. With recent corporate activities including an Annual General Meeting and earnings calls signaling active management engagement, Vcanbio is poised to leverage its scientific research capabilities to potentially enhance future financial performance and market position.

- Click to explore a detailed breakdown of our findings in Vcanbio Cell & Gene Engineering's health report.

Learn about Vcanbio Cell & Gene Engineering's historical performance.

Turning Ideas Into Actions

- Discover the full array of 494 Asian High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:DELTA

Delta Electronics (Thailand)

Researches and develops, manufactures, and distributes electronic products.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives