In recent weeks, global markets have experienced a mix of volatility and cautious optimism, with U.S. stocks snapping a winning streak amid concerns over elevated valuations and AI spending scrutiny. As investors navigate these uncertain conditions, growth companies with high insider ownership can present intriguing opportunities, as they often signal strong confidence from those closest to the business and may offer resilience in fluctuating market environments.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Let's review some notable picks from our screened stocks.

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation, along with its subsidiaries, develops and publishes online games across Korea, Japan, Taiwan, the United States of America, Europe, and Canada with a market cap of ₩4.45 trillion.

Operations: The company's revenue primarily comes from its online games and game services segment, which generated approximately ₩1.55 trillion.

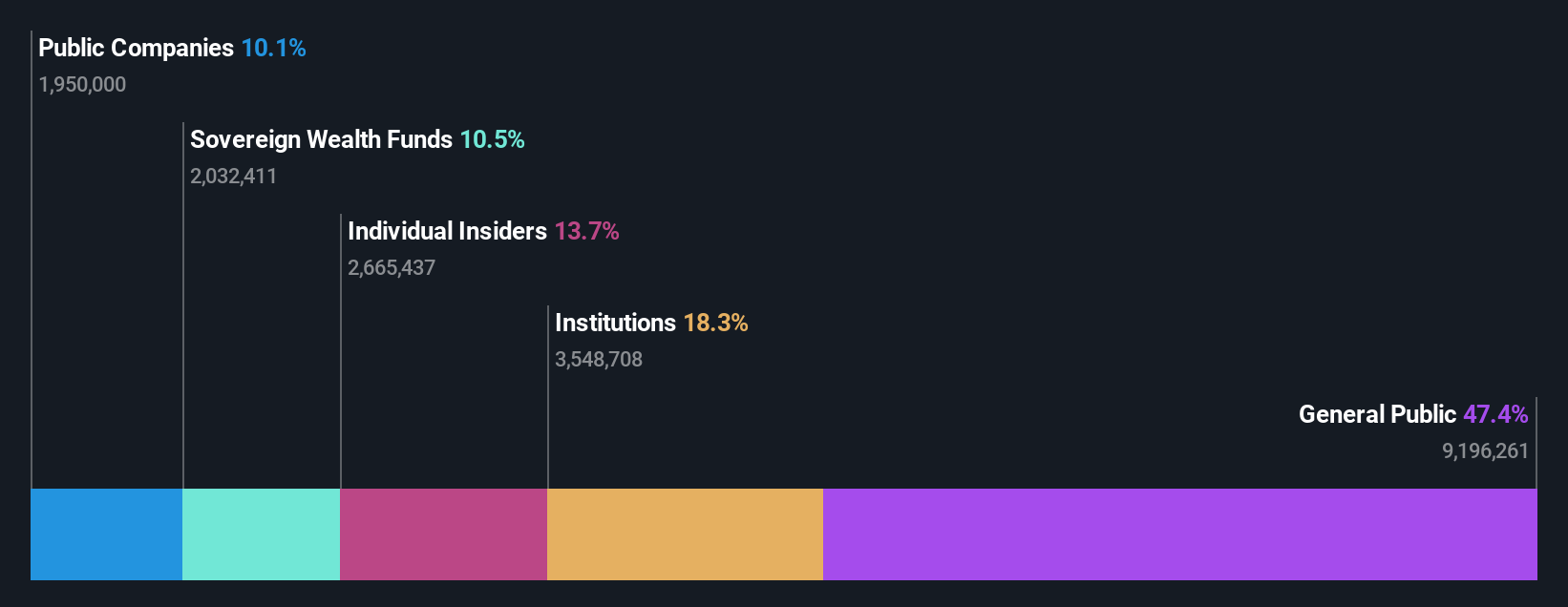

Insider Ownership: 13.7%

NCSOFT's growth prospects are underscored by its forecasted earnings increase of 78.59% per year, despite a slower revenue growth rate of 12.6% annually, which still surpasses the KR market average. The company is trading at a discount to its estimated fair value and is expected to achieve profitability within three years, outpacing average market growth expectations. Recent financials reveal challenges with a net loss in Q2 2025 but highlight potential for recovery and expansion.

- Click here to discover the nuances of NCSOFT with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of NCSOFT shares in the market.

Fujian Wanchen Biotechnology GroupLtd (SZSE:300972)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Wanchen Biotechnology Co., Ltd operates in China, focusing on the research, development, cultivation, production, and sale of edible fungi with a market cap of CN¥35.13 billion.

Operations: The company generates revenue through its activities in research, development, cultivation, production, and sales of edible fungi within the Chinese market.

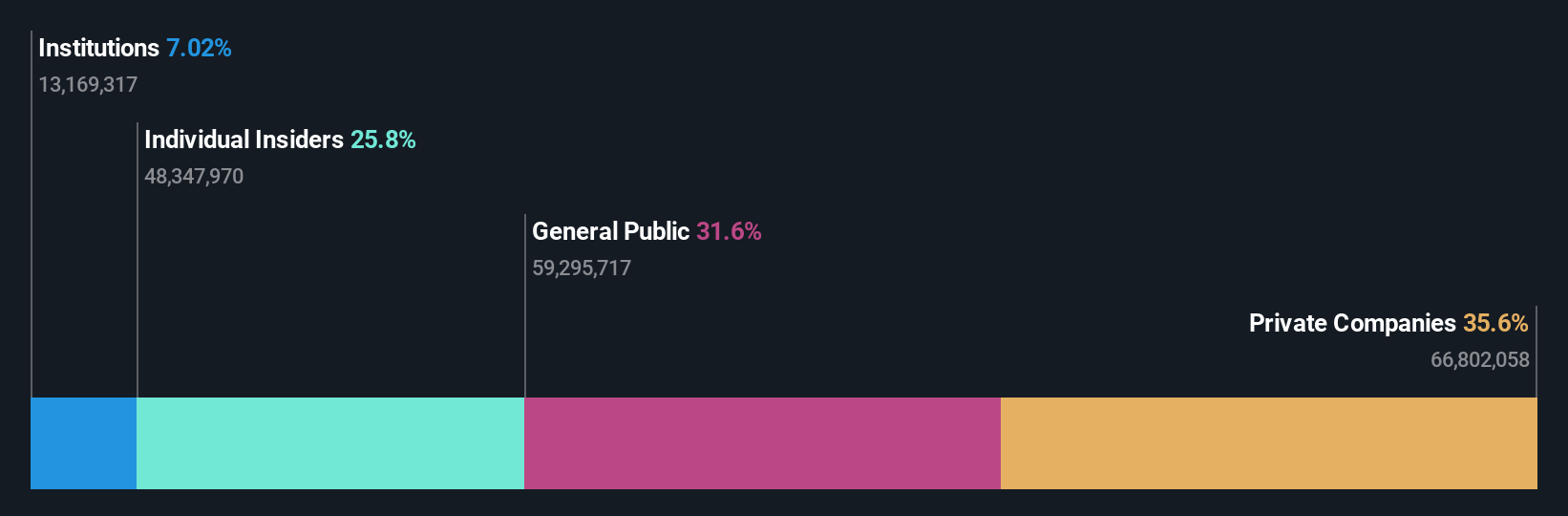

Insider Ownership: 25.6%

Fujian Wanchen Biotechnology Group Ltd. demonstrates strong growth potential with a significant earnings increase of 1745% over the past year and projected annual revenue growth of 16%, outpacing the broader CN market. However, it faces challenges with an unstable dividend track record and high share price volatility. Recent amendments to its articles of association could signal strategic shifts, while trading at a substantial discount to fair value presents opportunities for investors focused on long-term growth.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Wanchen Biotechnology GroupLtd.

- The analysis detailed in our Fujian Wanchen Biotechnology GroupLtd valuation report hints at an deflated share price compared to its estimated value.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Growth Rating: ★★★★☆☆

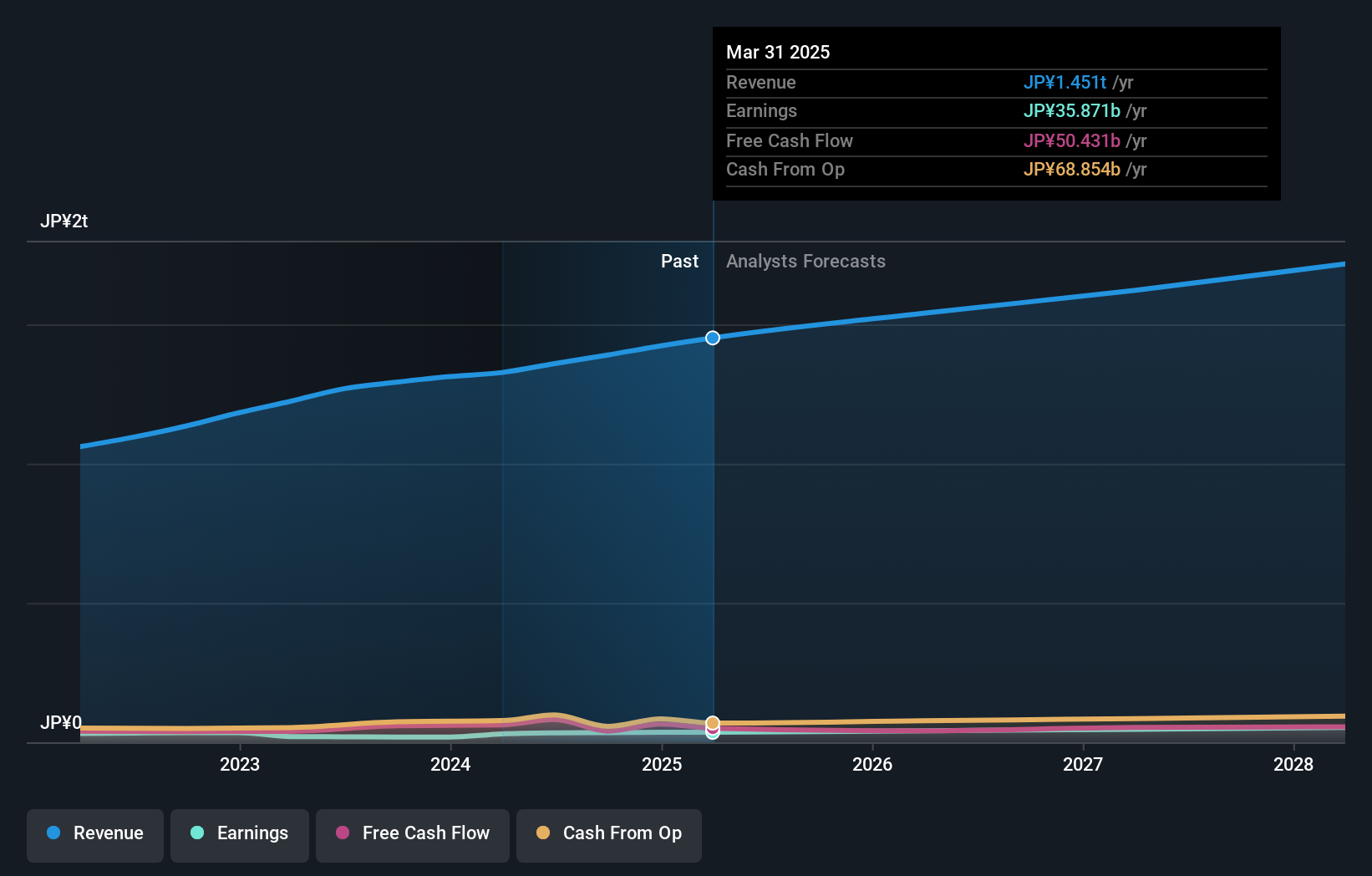

Overview: Persol Holdings Co., Ltd. is a global provider of human resource services operating under the PERSOL brand, with a market cap of ¥578.15 billion.

Operations: The company's revenue segments include Staffing (Excluding BPO) at ¥607.90 billion, Asia Pacific at ¥471.31 billion, Career services at ¥147.01 billion, Technology services at ¥117.76 billion, and BPO services at ¥123.97 billion.

Insider Ownership: 12.2%

Persol Holdings Ltd. is strategically expanding by acquiring Gojob SAS, enhancing its AI-driven staffing capabilities. The company trades at a significant discount to estimated fair value, presenting potential growth opportunities despite an unstable dividend history. Earnings have grown 13% annually over five years and are projected to outpace the JP market with a 12.8% annual increase, though revenue growth remains modest at 5%. No recent insider trading activity has been reported.

- Click to explore a detailed breakdown of our findings in Persol HoldingsLtd's earnings growth report.

- The valuation report we've compiled suggests that Persol HoldingsLtd's current price could be quite moderate.

Summing It All Up

- Navigate through the entire inventory of 799 Fast Growing Global Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300972

Fujian Wanchen Biotechnology GroupLtd

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives