- China

- /

- Auto Components

- /

- SZSE:300432

3 Growth Companies With High Insider Ownership And 30% Revenue Growth

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are navigating a landscape marked by geopolitical tensions and economic uncertainties. In this environment, companies that exhibit strong revenue growth and high insider ownership can stand out as potentially robust investments, reflecting confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's explore several standout options from the results in the screener.

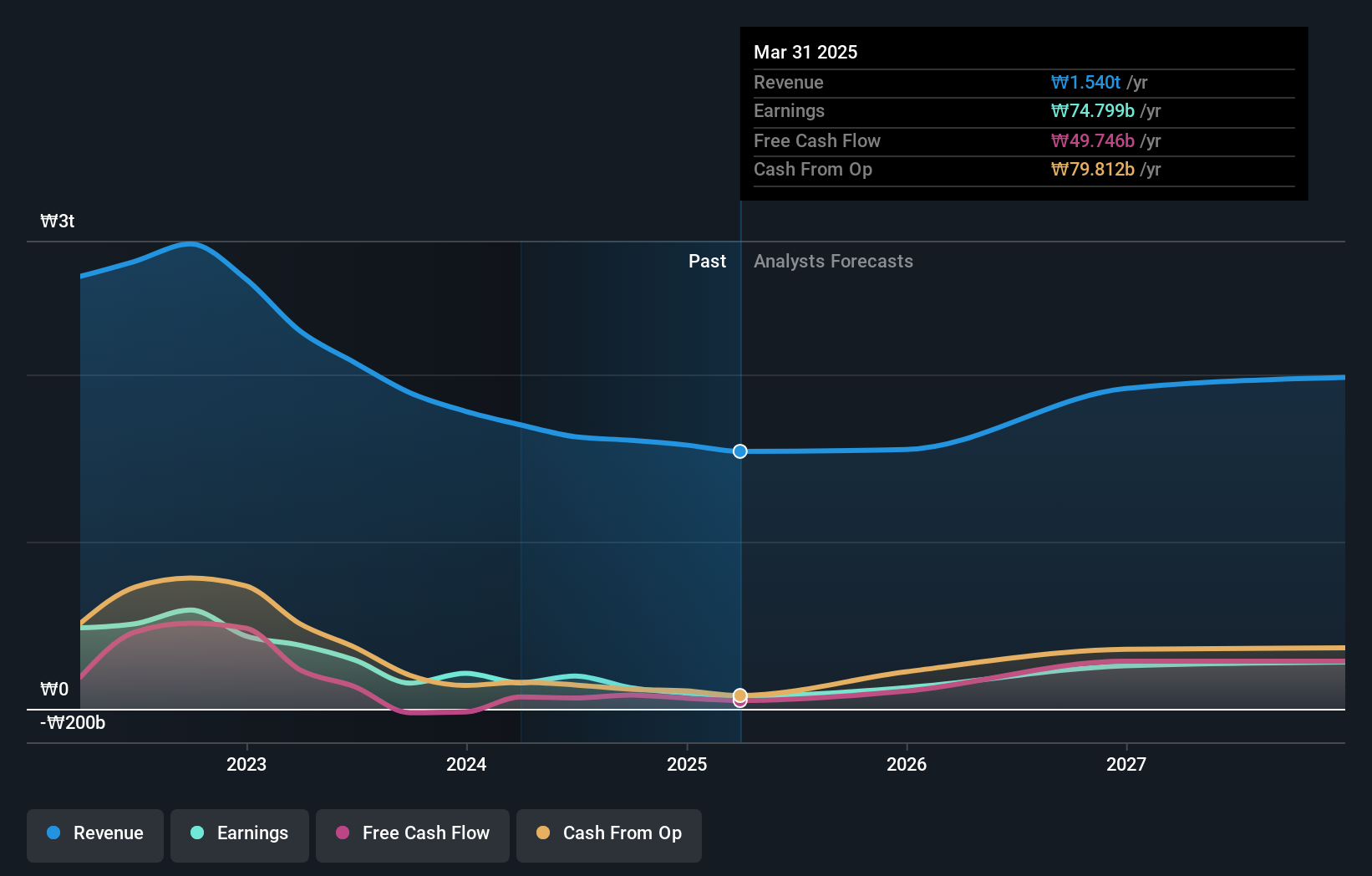

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩4.28 trillion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 13.2%

Revenue Growth Forecast: 11.1% p.a.

NCSOFT's recent earnings report shows a decline, with a net loss of KRW 26.50 billion in Q3 2024 compared to a profit the previous year. Despite this setback, its revenue is forecasted to grow at 11.1% annually, outpacing the Korean market's average growth rate. The company trades at approximately 14% below its estimated fair value and boasts significant projected earnings growth of about 39.6% annually over the next three years, indicating potential for future recovery and expansion.

- Delve into the full analysis future growth report here for a deeper understanding of NCSOFT.

- Our expertly prepared valuation report NCSOFT implies its share price may be too high.

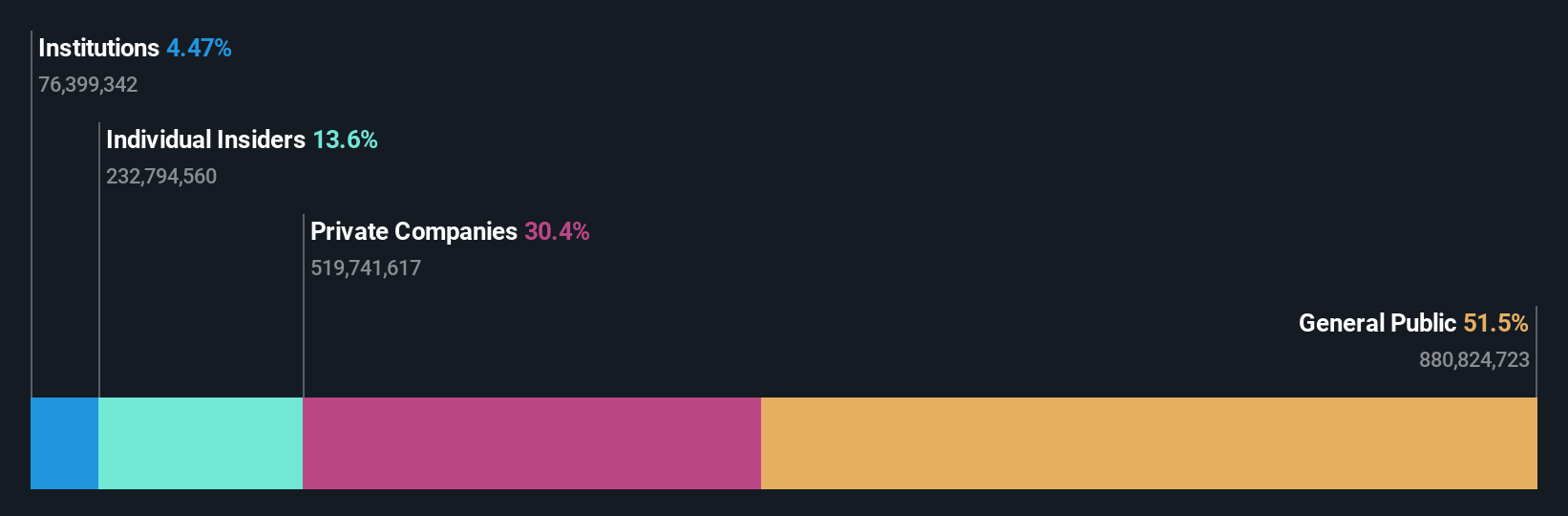

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing sector in China and has a market capitalization of CN¥20.31 billion.

Operations: The company generates revenue from its digital publishing operations in China.

Insider Ownership: 12.4%

Revenue Growth Forecast: 20% p.a.

COL Group Ltd. has faced financial challenges, reporting a net loss of CNY 188.12 million for the nine months ending September 30, 2024, compared to a profit last year. Despite this, its revenue is projected to grow at 20% annually, surpassing the Chinese market average. The company completed a share buyback worth CNY 20.05 million recently but maintains high share price volatility and low forecasted return on equity (13.2%) in three years.

- Navigate through the intricacies of COL GroupLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our COL GroupLtd valuation report hints at an inflated share price compared to its estimated value.

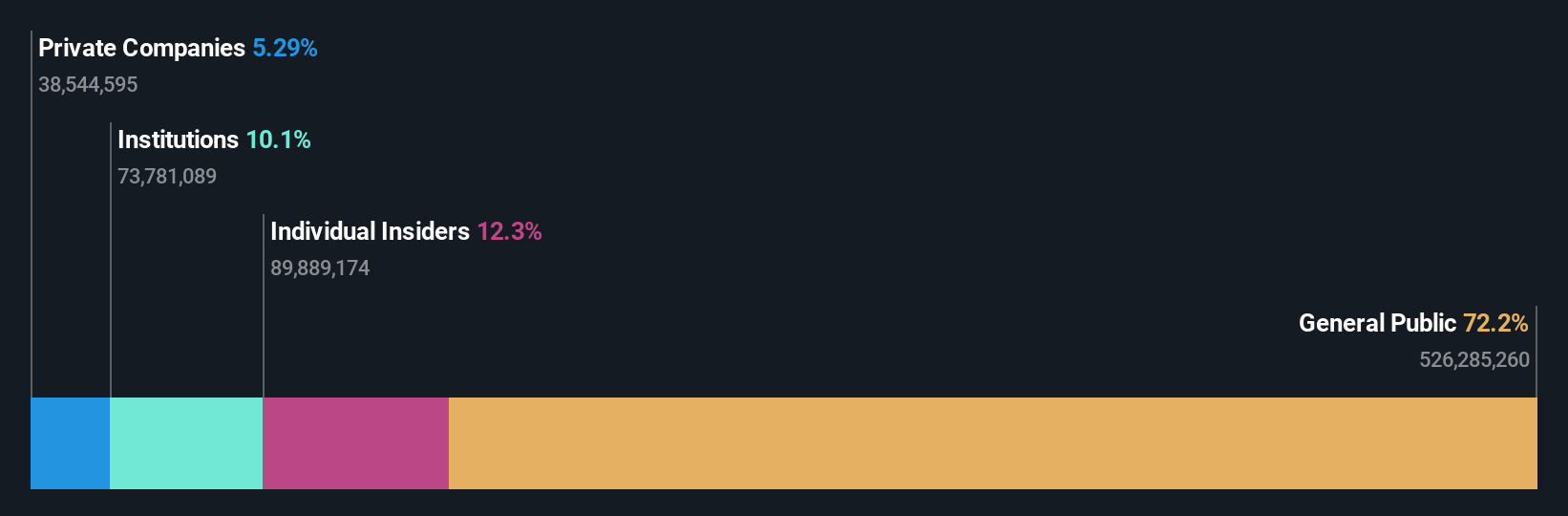

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. focuses on the research, development, manufacture, and sale of automotive engine parts in China, with a market cap of approximately CN¥17.96 billion.

Operations: Fulin Precision's revenue is primarily derived from its activities in the research, development, manufacture, and sale of automotive engine parts within China.

Insider Ownership: 13.6%

Revenue Growth Forecast: 30.7% p.a.

Mianyang Fulin Precision Co., Ltd. has shown strong financial performance, reporting CNY 5.88 billion in revenue for the first nine months of 2024 and transitioning to a net income of CNY 310.67 million from a loss last year. With expected annual earnings growth of over 66% and revenue growth forecasted at 30.7%, it surpasses market averages significantly, despite share price volatility and limited recent insider trading activity.

- Click here to discover the nuances of Fulin Precision with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Fulin Precision shares in the market.

Key Takeaways

- Delve into our full catalog of 1527 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

Exceptional growth potential with mediocre balance sheet.