- South Korea

- /

- Entertainment

- /

- KOSDAQ:A419530

SAMG Entertainment Co., Ltd. (KOSDAQ:419530) Shares May Have Slumped 33% But Getting In Cheap Is Still Unlikely

SAMG Entertainment Co., Ltd. (KOSDAQ:419530) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. The good news is that in the last year, the stock has shone bright like a diamond, gaining 215%.

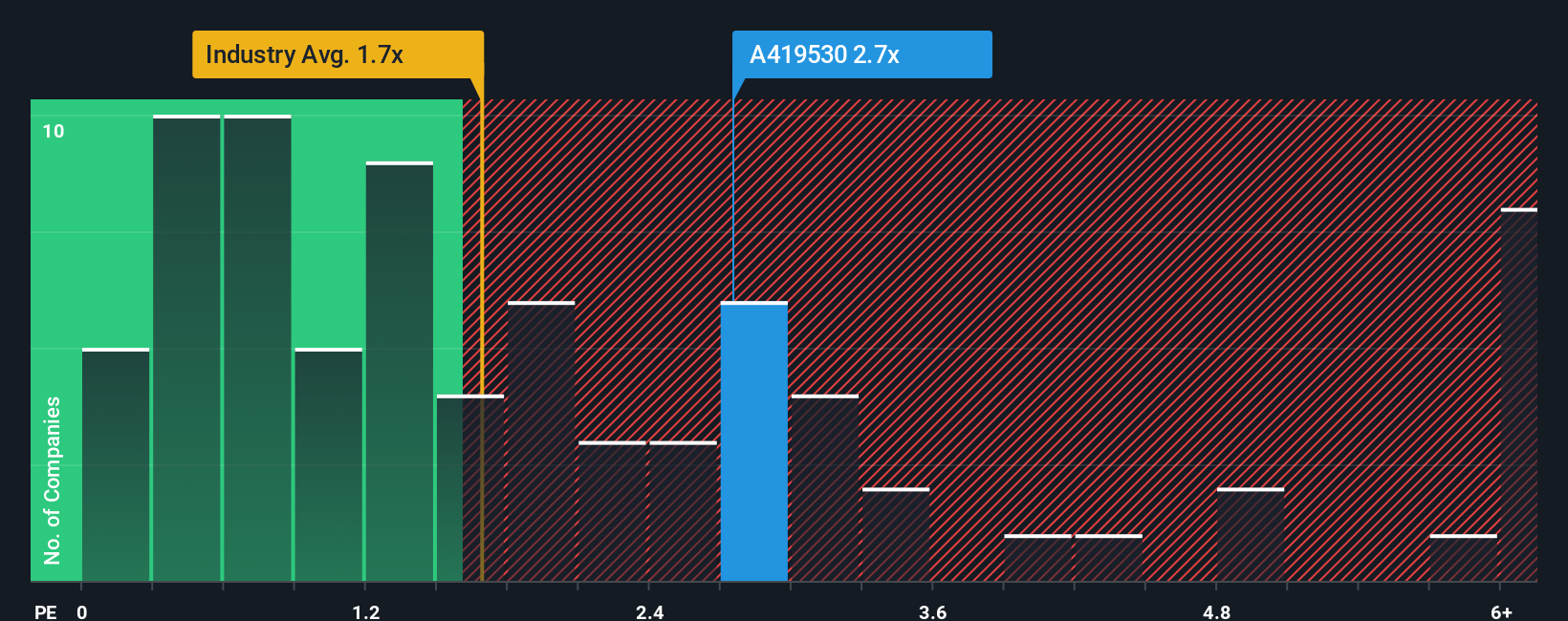

Although its price has dipped substantially, you could still be forgiven for thinking SAMG Entertainment is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in Korea's Entertainment industry have P/S ratios below 1.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SAMG Entertainment

How SAMG Entertainment Has Been Performing

Recent times have been advantageous for SAMG Entertainment as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SAMG Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.How Is SAMG Entertainment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as SAMG Entertainment's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. The latest three year period has also seen an excellent 140% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. Meanwhile, the rest of the industry is forecast to expand by 22%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that SAMG Entertainment's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

SAMG Entertainment's P/S remain high even after its stock plunged. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for SAMG Entertainment, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for SAMG Entertainment (2 are a bit unpleasant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A419530

SAMG Entertainment

Produces TV series and animated feature films, and AD and games worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives