- China

- /

- Electronic Equipment and Components

- /

- SHSE:688582

High Growth Tech Stocks in Asia for November 2025

Reviewed by Simply Wall St

As global markets experience mixed performances, with large-cap tech companies driving gains and smaller-cap indexes facing declines, the recent U.S.-China trade truce has offered some relief to investors concerned about geopolitical tensions. In this environment, identifying high-growth tech stocks in Asia requires a focus on companies that can leverage technological advancements and navigate economic shifts effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Accton Technology | 25.20% | 28.91% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.70% | 35.09% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Fositek | 37.45% | 48.50% | ★★★★★★ |

| Eoptolink Technology | 40.70% | 37.57% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

DEAR U (KOSDAQ:A376300)

Simply Wall St Growth Rating: ★★★★★★

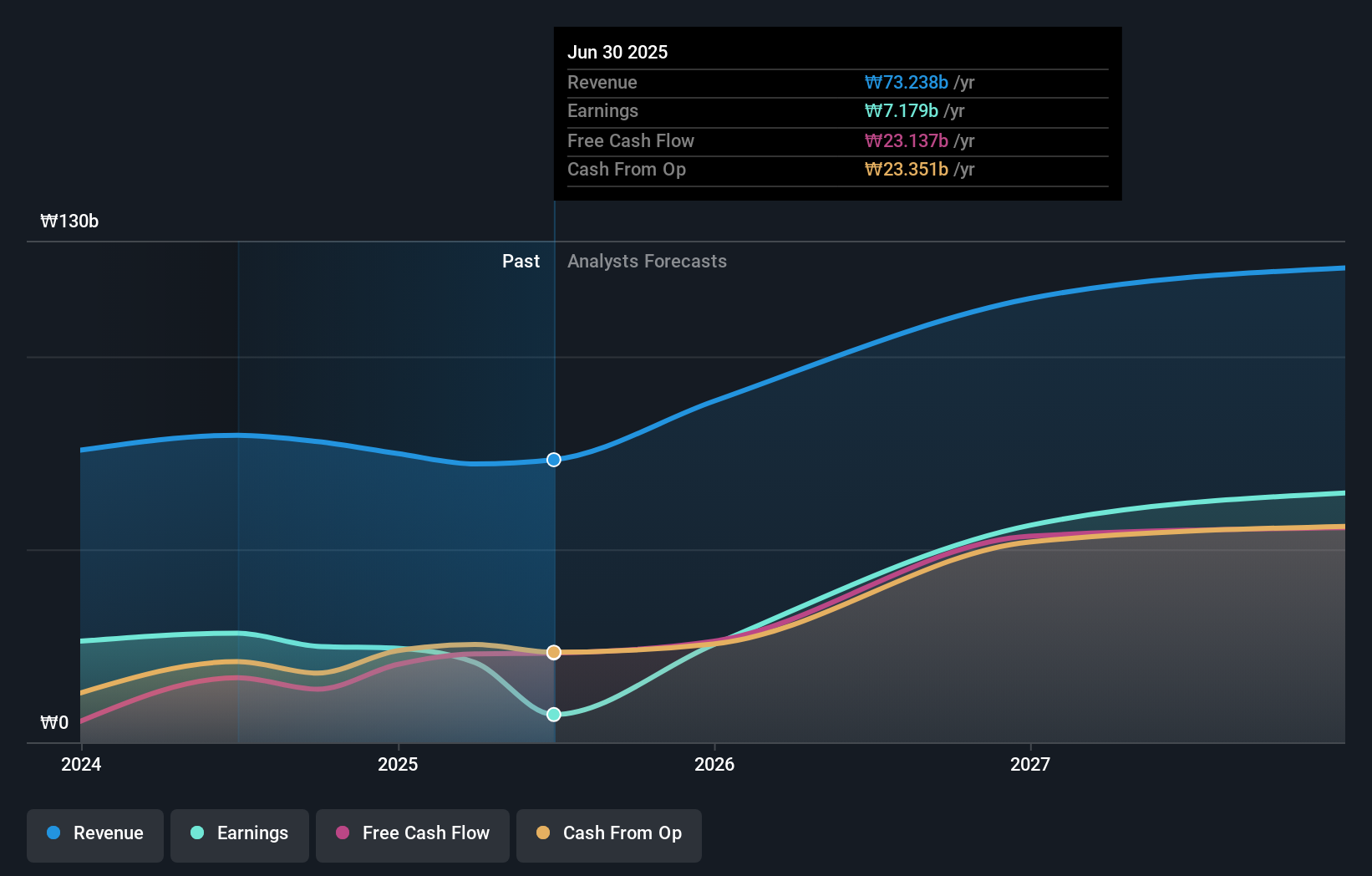

Overview: DEAR U Co., LTD. is a communication platform company with operations in South Korea and internationally, and it has a market capitalization of approximately ₩851.02 billion.

Operations: The company generates revenue primarily from its Bubble segment, which brought in ₩73.24 billion.

DEAR U, a player in the Interactive Media and Services sector, is navigating a challenging landscape with a 74.6% dip in earnings last year. Despite this, the company's revenue growth remains robust at 20.2% annually, outpacing the Korean market average of 10.4%. Looking ahead, DEAR U is poised for significant recovery with projected annual earnings growth of 60.5%, well above the market forecast of 28.3%. This turnaround is underpinned by its strategic focus on innovative content and services tailored to dynamic consumer demands in Asia's tech landscape.

- Take a closer look at DEAR U's potential here in our health report.

Gain insights into DEAR U's historical performance by reviewing our past performance report.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

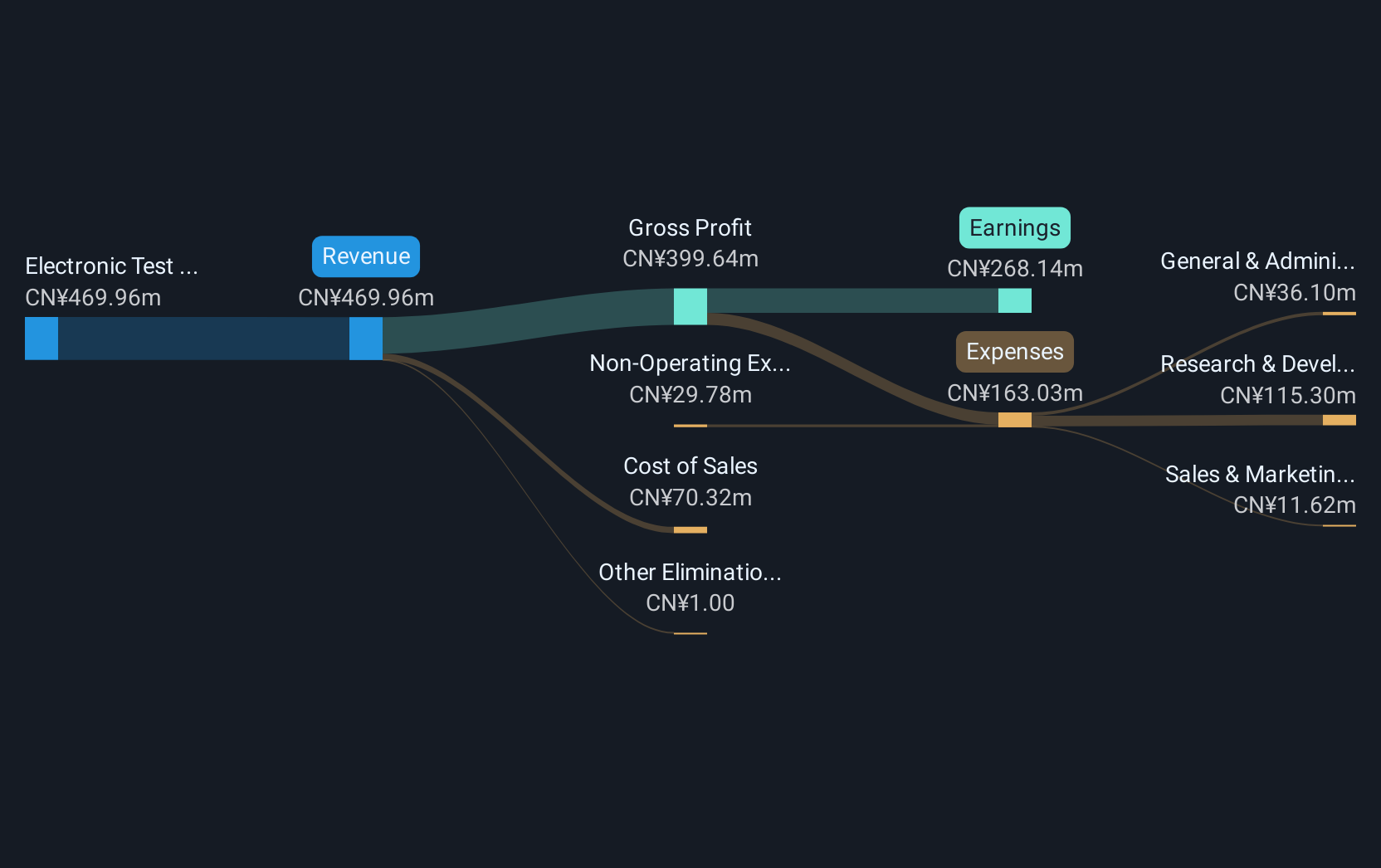

Overview: Anhui XDLK Microsystem Corporation Limited focuses on the research, development, production, and sale of sensors in China with a market capitalization of approximately CN¥24.97 billion.

Operations: XDLK Microsystem generates revenue primarily from its Electronic Test & Measurement Instruments segment, which contributed CN¥534.08 million. The company's cost structure and profit margins are not detailed in the available data.

Anhui XDLK Microsystem has demonstrated a robust financial performance, with revenue soaring to CNY 401.03 million from CNY 271.46 million year-over-year, marking a significant growth trajectory in the tech sector. This increase is complemented by a net income rise to CNY 238.76 million, up from CNY 138.08 million, reflecting efficient operational execution and market adaptation. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in Asia's dynamic tech landscape. With earnings per share also increasing from CNY 0.35 to CNY 0.6, Anhui XDLK is positioning itself as a formidable player amidst shifting technological demands.

- Unlock comprehensive insights into our analysis of Anhui XDLK Microsystem stock in this health report.

Explore historical data to track Anhui XDLK Microsystem's performance over time in our Past section.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★☆☆

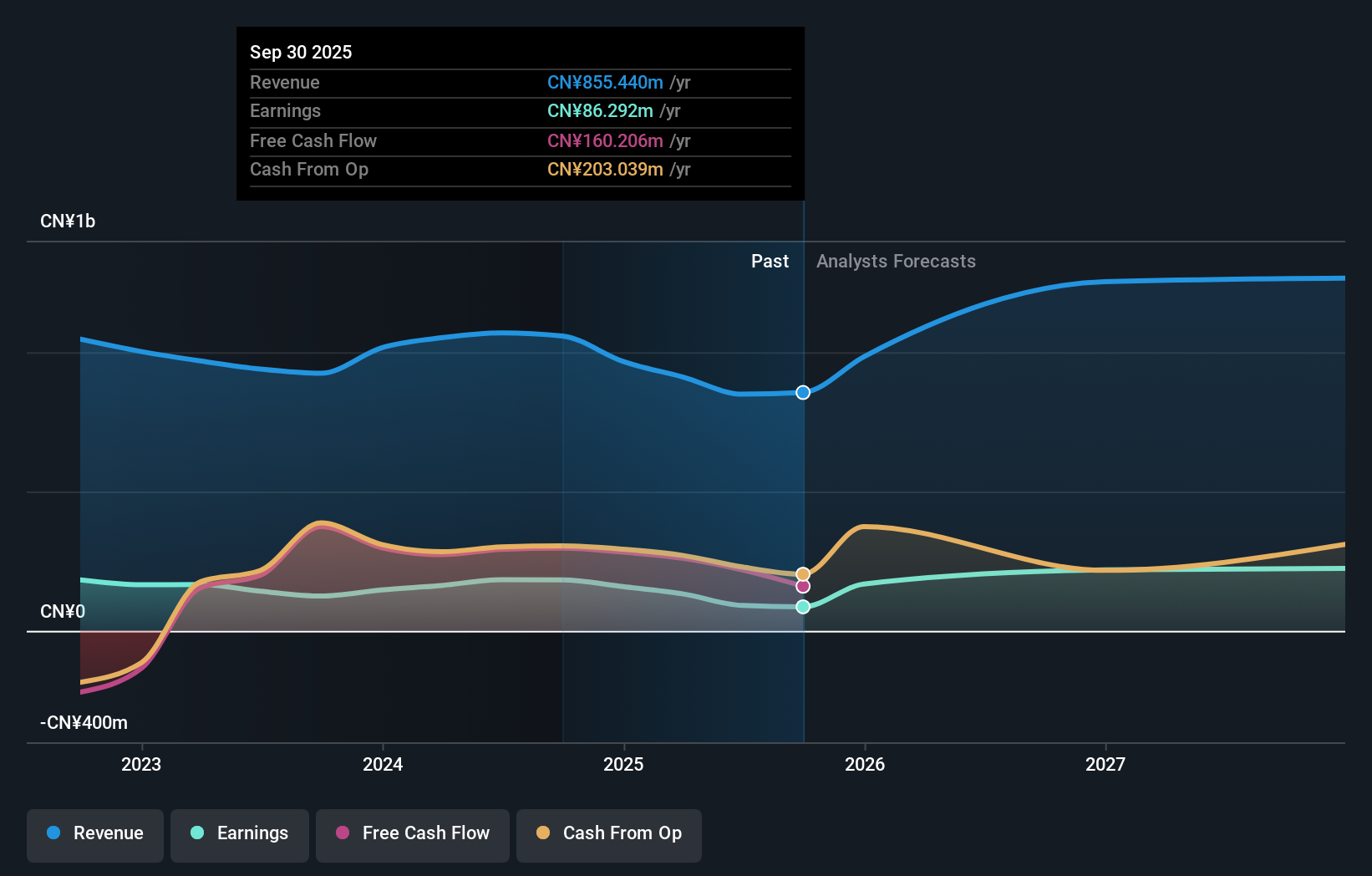

Overview: Queclink Wireless Solutions Co., Ltd. is engaged in the research, development, manufacturing, and sale of wireless IoT equipment and solutions both domestically in China and internationally, with a market capitalization of CN¥5.53 billion.

Operations: Queclink Wireless Solutions focuses on the development and sale of wireless IoT equipment and solutions, catering to both domestic and international markets. The company operates through various revenue streams related to its core business in IoT technology.

Despite a challenging year with revenue and net income declines to CNY 582.31 million and CNY 61.63 million respectively, Queclink Wireless Solutions remains a compelling narrative in the tech landscape of Asia due to its strategic amendments in corporate governance aimed at enhancing operational efficiency. These changes include the abolishment of the supervisory committee and introduction of employee directors, signaling agility in adapting to dynamic market demands. The company's robust R&D focus, essential for sustaining innovation and competitiveness, is evident from its consistent investment in this area, aligning with an expected earnings growth forecast of 32.5% annually. This positions Queclink not just as a survivor but as a potential leader in navigating through tech industry fluctuations.

- Dive into the specifics of Queclink Wireless Solutions here with our thorough health report.

Learn about Queclink Wireless Solutions' historical performance.

Taking Advantage

- Navigate through the entire inventory of 178 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688582

Anhui XDLK Microsystem

Engages in the research and development, production, and sale of sensors in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives