- South Korea

- /

- Entertainment

- /

- KOSDAQ:A289220

GIANTSTEP Inc.'s (KOSDAQ:289220) 25% Cheaper Price Remains In Tune With Revenues

GIANTSTEP Inc. (KOSDAQ:289220) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

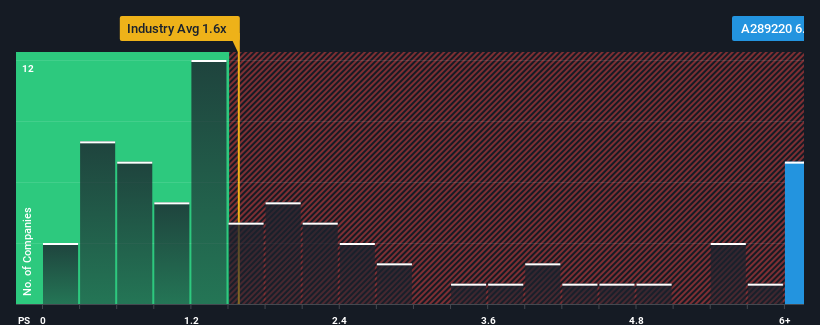

Even after such a large drop in price, given around half the companies in Korea's Entertainment industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider GIANTSTEP as a stock to avoid entirely with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GIANTSTEP

How Has GIANTSTEP Performed Recently?

We'd have to say that with no tangible growth over the last year, GIANTSTEP's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GIANTSTEP will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GIANTSTEP's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why GIANTSTEP's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does GIANTSTEP's P/S Mean For Investors?

GIANTSTEP's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that GIANTSTEP maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for GIANTSTEP that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A289220

GIANTSTEP

Produces digital media for various clients related to visual image production in feature films, commercials, music video, and television industries.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives