Spotlight On 3 Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, growth stocks have demonstrated resilience, with the tech-heavy Nasdaq Composite Index showing slight gains amidst broader market fluctuations. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best, highlighting potential opportunities for investors seeking growth in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

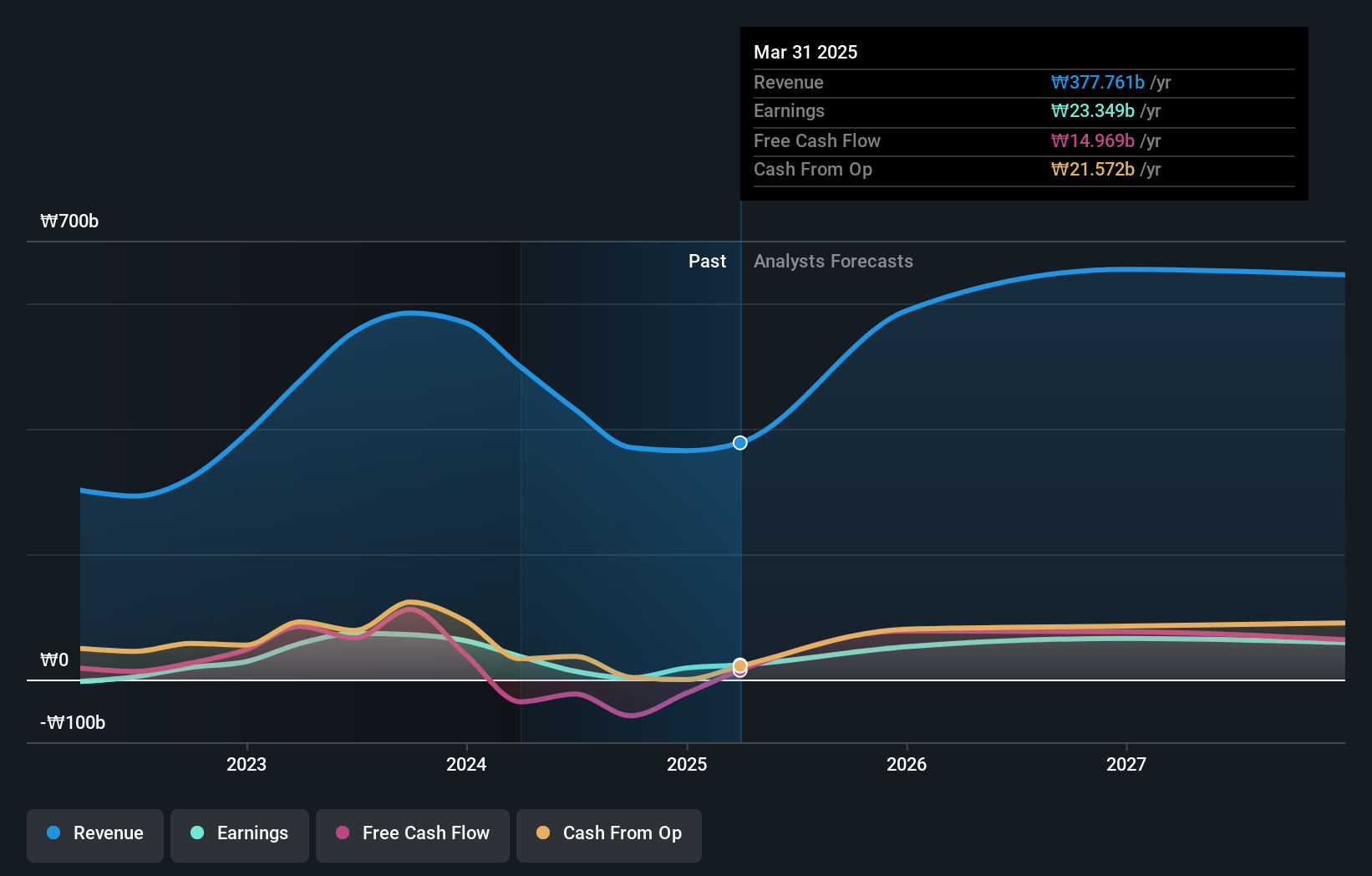

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YG Entertainment Inc. is an entertainment company operating in South Korea, Japan, and internationally with a market cap of ₩713.13 billion.

Operations: The company generates revenue of ₩493.91 million from its entertainment segment.

Insider Ownership: 23.2%

Revenue Growth Forecast: 17.6% p.a.

YG Entertainment is poised for significant earnings growth, forecast at 65.4% annually, outpacing Korea's market average of 30.3%. Despite this, recent financial results reveal challenges with a net loss of KRW 1,924.89 million in Q2 compared to a substantial profit the previous year. Revenue growth is expected at 17.6%, slightly below the high-growth benchmark but above market averages. Analysts anticipate a stock price rise of 24.5%, although return on equity remains modest at 10.4%.

- Navigate through the intricacies of YG Entertainment with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility YG Entertainment's shares may be trading at a premium.

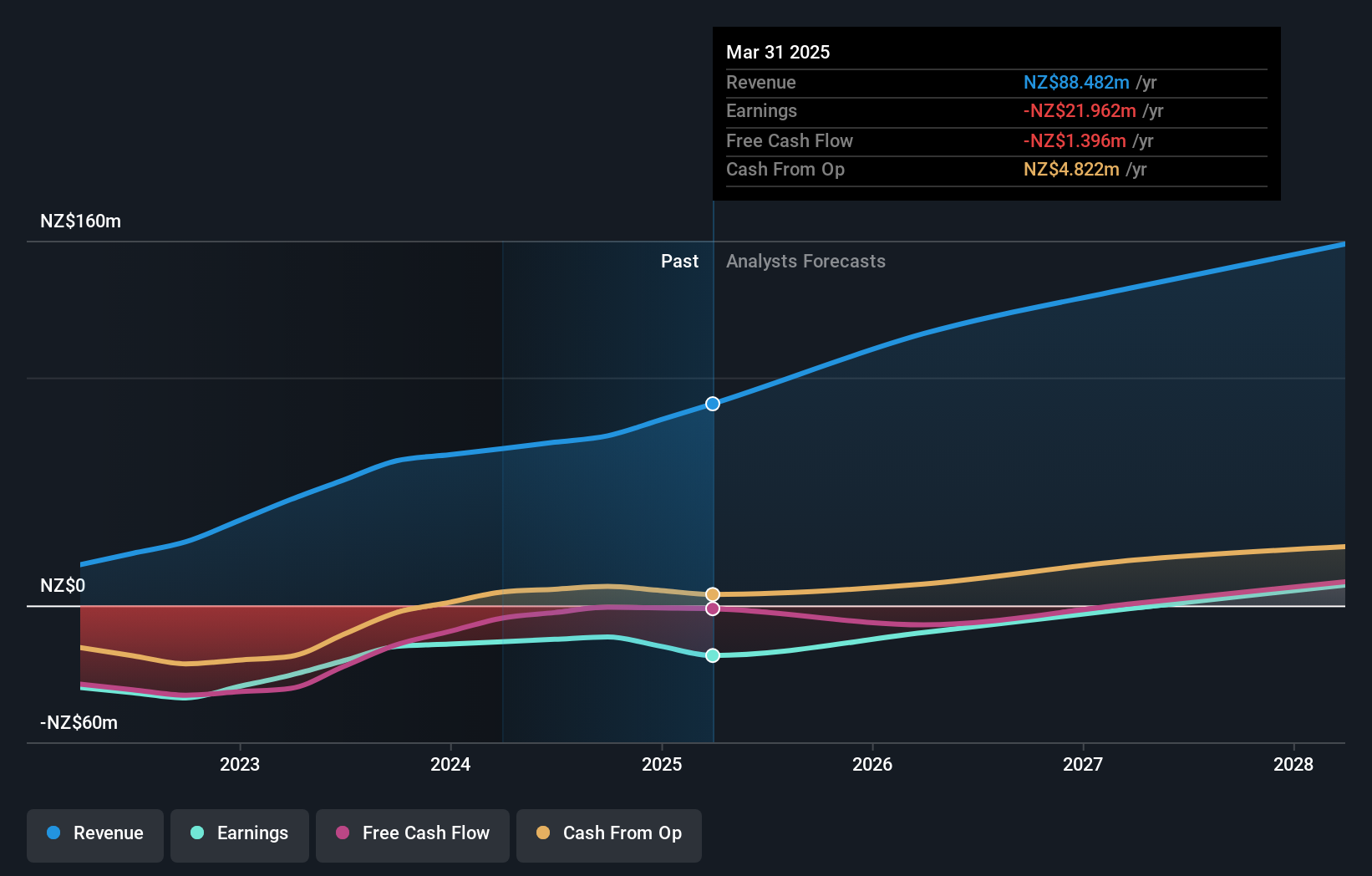

Serko (NZSE:SKO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Serko Limited is a Software-as-a-Service company offering online travel booking software and expense management services across New Zealand, Australia, North America, Europe, and other international markets with a market cap of NZ$424.40 million.

Operations: The company's revenue primarily comes from the provision of software solutions, totaling NZ$74.45 million.

Insider Ownership: 31.6%

Revenue Growth Forecast: 22.4% p.a.

Serko Limited shows promising growth prospects with revenue expected to increase by 22.4% annually, surpassing the New Zealand market average of 4.4%. Recent earnings reported sales of NZ$41.46 million, up from NZ$35.78 million, and a reduced net loss of NZ$5.11 million compared to NZ$7.17 million previously. Despite high share price volatility and low forecasted return on equity at 14%, Serko aims for profitability within three years, indicating robust growth potential amidst insider ownership stability.

- Unlock comprehensive insights into our analysis of Serko stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Serko shares in the market.

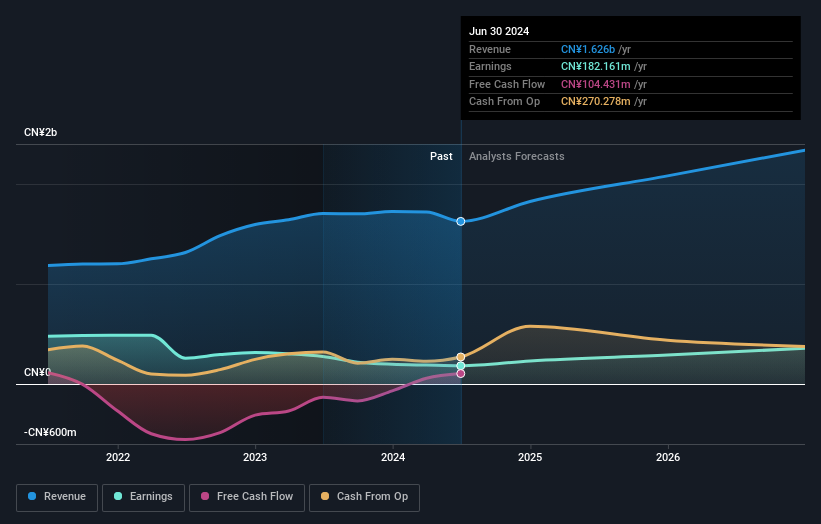

PharmaBlock Sciences (Nanjing) (SZSE:300725)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PharmaBlock Sciences (Nanjing), Inc. offers chemistry products and services for pharmaceutical research, development, and commercial production, with a market cap of CN¥7.17 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 25%

Revenue Growth Forecast: 16.4% p.a.

PharmaBlock Sciences (Nanjing) is poised for significant earnings growth at 28.55% annually, outpacing the Chinese market's 25%, despite a recent decline in sales to CNY 1.13 billion and net income to CNY 131.79 million for the nine months ended September 2024. The company faces challenges with volatile share prices and low projected return on equity of 9.1%. However, its earnings growth potential remains strong amid stable insider ownership trends over the past three months.

- Get an in-depth perspective on PharmaBlock Sciences (Nanjing)'s performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, PharmaBlock Sciences (Nanjing)'s share price might be too optimistic.

Seize The Opportunity

- Gain an insight into the universe of 1527 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300725

PharmaBlock Sciences (Nanjing)

Provides chemistry products and services throughout the pharmaceutical research and development, and commercial production.

Reasonable growth potential with adequate balance sheet.