- China

- /

- Commercial Services

- /

- SHSE:603661

Purmo Group Oyj And 2 Other Companies That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets respond to recent political shifts and economic policy changes, investors are witnessing significant movements in major indices, with U.S. stocks reaching record highs amid expectations of favorable fiscal policies. In this environment, identifying undervalued stocks becomes crucial for investors aiming to capitalize on potential market inefficiencies; companies like Purmo Group Oyj and others may present opportunities where their current market prices do not fully reflect their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| IMAGICA GROUP (TSE:6879) | ¥473.00 | ¥944.72 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| SISB (SET:SISB) | THB31.75 | THB63.07 | 49.7% |

| Appier Group (TSE:4180) | ¥1697.00 | ¥3377.51 | 49.8% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

Let's explore several standout options from the results in the screener.

Purmo Group Oyj (HLSE:PURMO)

Overview: Purmo Group Oyj is a company that offers indoor climate comfort solutions globally, with a market capitalization of €482.26 million.

Operations: The company's revenue is primarily derived from two segments: Climate Solutions, which contributes €139.20 million, and Climate Products & Systems, accounting for €569.60 million.

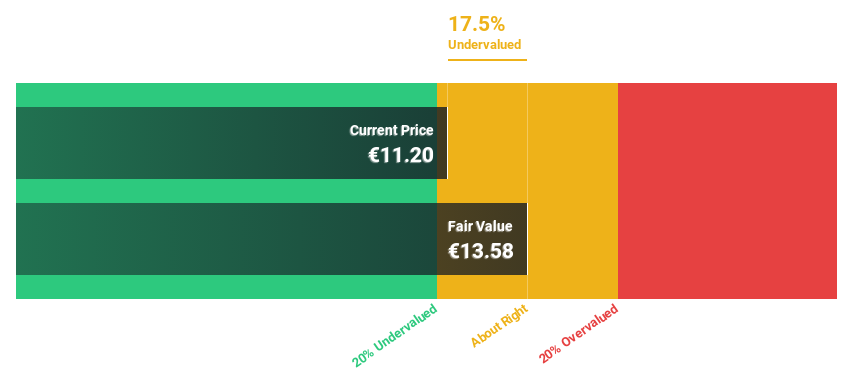

Estimated Discount To Fair Value: 16.7%

Purmo Group Oyj is trading at €11.3, below its estimated fair value of €13.57, indicating potential undervaluation based on cash flows. Despite recent earnings challenges, with a net loss of €5.2 million in Q3 2024, the company is forecasted to become profitable within three years and grow earnings by 93.33% annually. However, the dividend yield of 3.19% is not well covered by current earnings or free cash flows, presenting a risk factor for investors focusing on dividends.

- Our earnings growth report unveils the potential for significant increases in Purmo Group Oyj's future results.

- Navigate through the intricacies of Purmo Group Oyj with our comprehensive financial health report here.

WemadeLtd (KOSDAQ:A112040)

Overview: Wemade Co., Ltd. develops and publishes games both in South Korea and internationally, with a market cap of ₩1.28 trillion.

Operations: The company's revenue primarily comes from its Gaming Business, which generated ₩663.53 billion.

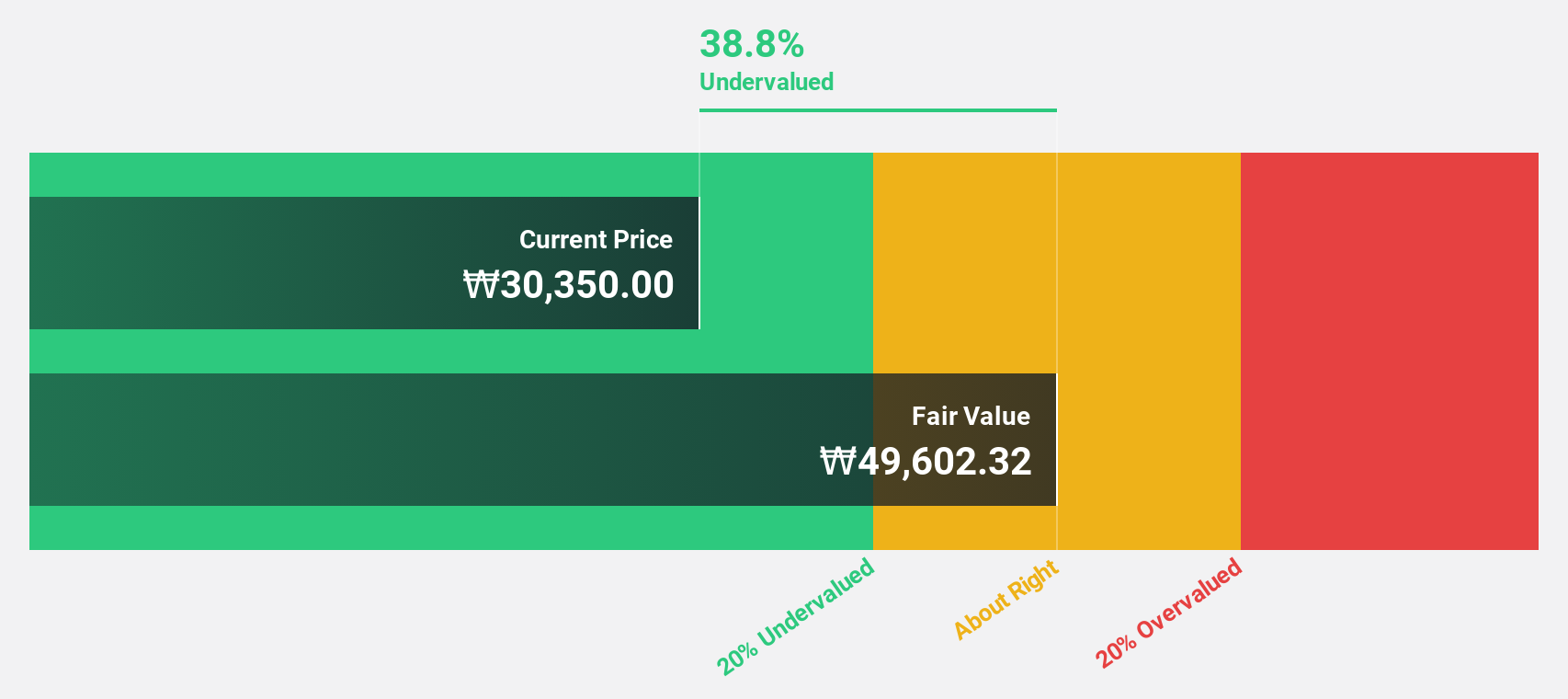

Estimated Discount To Fair Value: 25.7%

Wemade Ltd. is trading at ₩41,900, significantly below its estimated fair value of ₩56,415.23, suggesting it may be undervalued based on cash flows. The company is expected to achieve high revenue growth of 12% annually and earnings growth of over 100% per year. Despite recent share price volatility, Wemade's forecasted return on equity remains robust at 31.4%, with profitability anticipated within three years—outpacing average market growth expectations.

- Our expertly prepared growth report on WemadeLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on WemadeLtd's balance sheet by reading our health report here.

Henglin Home FurnishingsLtd (SHSE:603661)

Overview: Henglin Home Furnishings Co., Ltd specializes in the R&D, production, and sale of office chairs, sofas, massage chairs, panel furniture, and system office products in China with a market cap of CN¥4.61 billion.

Operations: The company's revenue is derived from the sale of office chairs, sofas, massage chairs, panel furniture, and system office products in China.

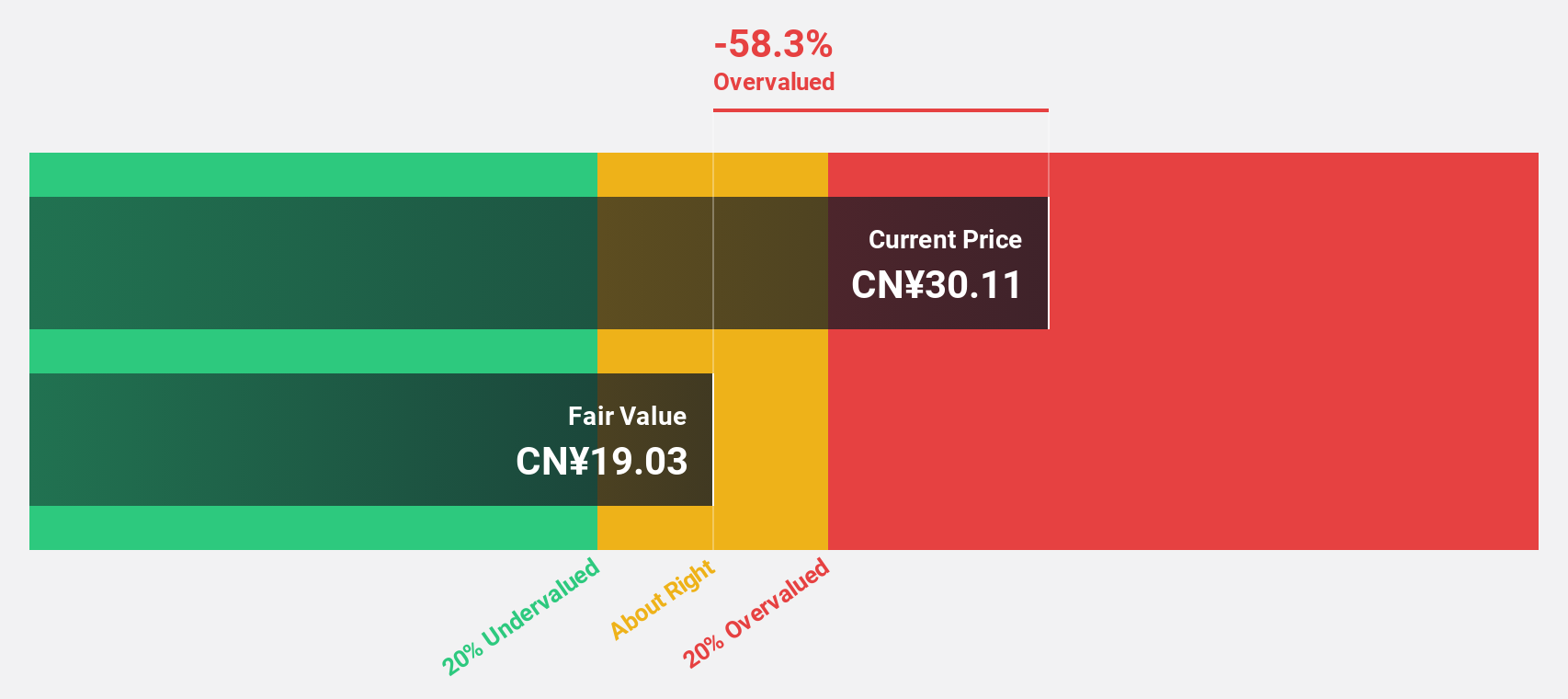

Estimated Discount To Fair Value: 29.9%

Henglin Home Furnishings Ltd. is trading at CN¥33.94, well below its estimated fair value of CN¥48.4, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 5.6% to 1.6%, the company forecasts significant earnings growth of over 43% annually, surpassing the market average of 26.4%. However, revenue growth is expected to be slower than desired but still above the market rate at 18.6% per year.

- According our earnings growth report, there's an indication that Henglin Home FurnishingsLtd might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Henglin Home FurnishingsLtd.

Where To Now?

- Embark on your investment journey to our 896 Undervalued Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henglin Home FurnishingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603661

Henglin Home FurnishingsLtd

Engages in the research and development, production, and sale of office chairs, sofas, massage chairs, panel furniture, and system office products in China.

Undervalued with excellent balance sheet.