- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

High Growth Tech Stocks in South Korea to Watch This September 2024

Reviewed by Simply Wall St

South Korea posted a current account surplus of $9.13 billion in July, the Bank of Korea said on Friday - down from $12.26 billion in June. With exports increasing annually by 16.7 percent, this economic backdrop sets an interesting stage for identifying high-growth tech stocks that can capitalize on favorable market conditions and robust export performance.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally, with a market cap of ₩1.15 billion.

Operations: Wemade Co., Ltd. generates revenue primarily through game development and publishing activities in South Korea and international markets. The company focuses on creating engaging gaming experiences for a diverse audience, leveraging its expertise to capture market share in the global gaming industry.

Wemade Ltd. has reported a 9.5% annual revenue growth, which is slower than the South Korean market's 10.3%, yet its earnings are projected to surge by an impressive 106.57% annually. The company recently announced a net income of ₩4,114 million for the first half of 2024, reversing from last year's ₩29,075 million net loss. Investing heavily in innovation with their WEMIX blockchain ecosystem and WEMIX PLAY platform revamp, they spent ₩171 billion on R&D to bolster future prospects in blockchain gaming and decentralized applications (dApps).

- Take a closer look at WemadeLtd's potential here in our health report.

Assess WemadeLtd's past performance with our detailed historical performance reports.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company primarily in South Korea and has a market cap of ₩1.93 billion.

Operations: PharmaResearch Co., Ltd. generates revenue primarily through its pharmaceuticals segment, which reported ₩296.59 billion in sales. The company focuses on biopharmaceutical products and operates mainly within South Korea.

PharmaResearch is making notable strides with a forecasted annual revenue growth of 22.1%, outpacing the broader South Korean market's 10.3%. The company's earnings have surged by an impressive 63.2% over the past year, significantly outperforming the Biotechs industry average of 6.1%. Investing heavily in R&D, PharmaResearch allocated ₩171 billion to innovation, which is crucial for sustaining its competitive edge in biopharmaceutical advancements and regenerative medicine technologies.

- Click here and access our complete health analysis report to understand the dynamics of PharmaResearch.

Gain insights into PharmaResearch's past trends and performance with our Past report.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

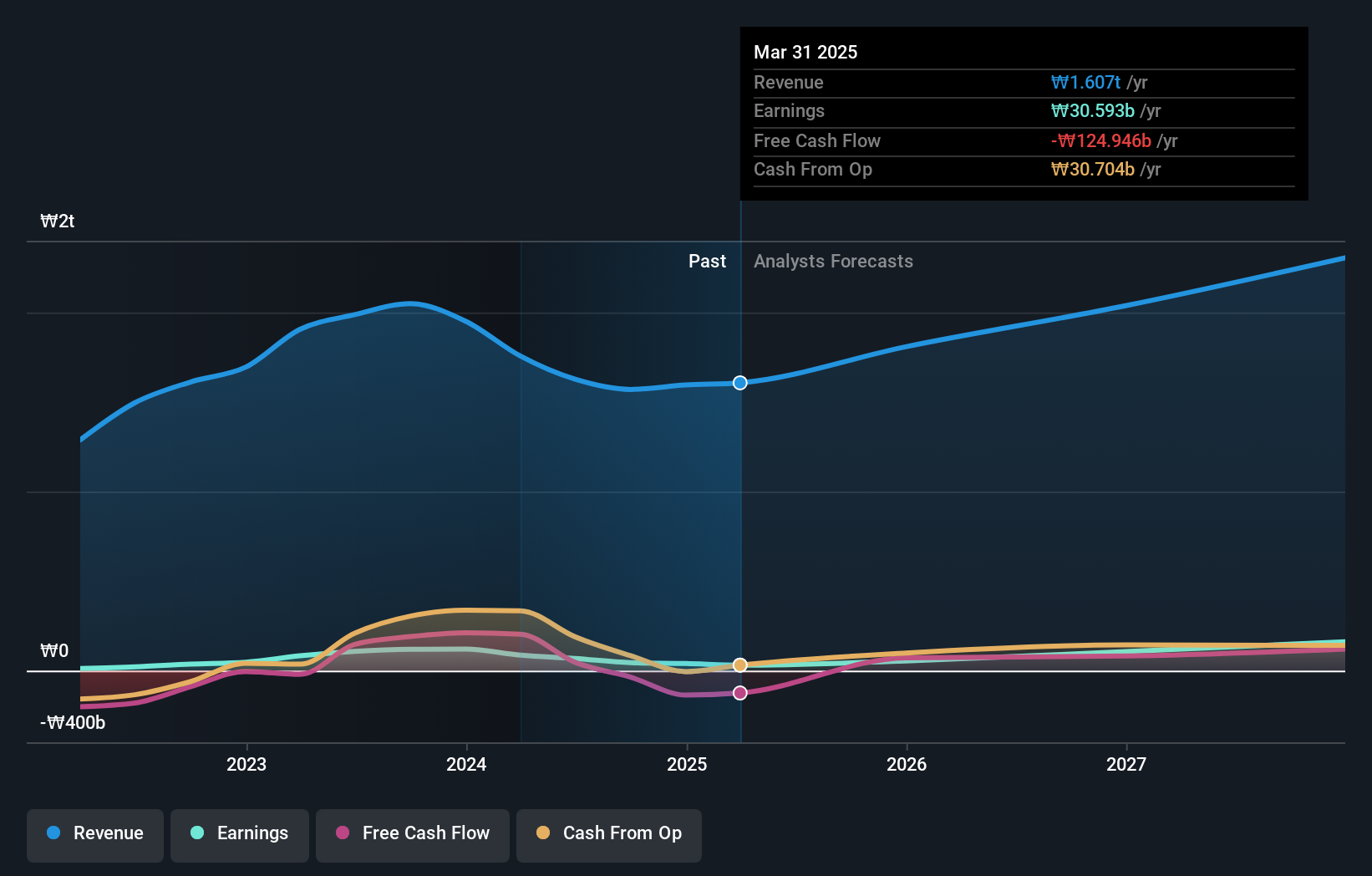

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩988.95 billion.

Operations: Solum Co., Ltd. generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing ₩1.16 trillion. The company's market cap stands at ₩988.95 billion.

Solum's earnings are projected to grow at 37.2% annually, outpacing the broader South Korean market's 28.6%. Despite a challenging past year with a 37.1% decline in earnings, the company is investing heavily in innovation, allocating ₩171 billion to R&D efforts. The recent announcement of a share repurchase program worth KRW 20 billion aims to enhance shareholder value and stabilize stock prices through August 2025.

- Delve into the full analysis health report here for a deeper understanding of Solum.

Review our historical performance report to gain insights into Solum's's past performance.

Key Takeaways

- Click this link to deep-dive into the 49 companies within our KRX High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives