- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

High Growth Tech In South Korea Featuring 3 Promising Stocks

Reviewed by Simply Wall St

The South Korea stock market has finished lower in two straight sessions, plunging more than 100 points or 3.9 percent along the way. The KOSPI now rests just above the 2,580-point plateau although it may see mild support on Thursday. In light of this volatility, identifying high-growth tech stocks with strong fundamentals and innovative potential becomes crucial for investors seeking to navigate these uncertain times effectively.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.65% | 66.96% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| Devsisters | 25.46% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally, with a market cap of ₩1.09 trillion.

Operations: Wemade Co., Ltd. generates revenue primarily through the development and publishing of games in South Korea and international markets. The company focuses on leveraging its gaming portfolio to drive growth and expand its market presence globally.

WemadeLtd. is making significant strides with its WEMIX blockchain ecosystem, focusing on dApps, GameFi, DAOs, DeFi, and NFTs. Despite a net loss of ₩51.60 billion in Q2 2024, the company's revenue grew to ₩332.70 billion for the same period. R&D expenses have been substantial but strategic; investing heavily in innovation has positioned Wemade to capitalize on future growth opportunities within the blockchain gaming sector. Revenue is forecasted to grow at 11.1% annually while earnings are expected to increase by 107.94% per year over the next three years.

- Delve into the full analysis health report here for a deeper understanding of WemadeLtd.

Review our historical performance report to gain insights into WemadeLtd's's past performance.

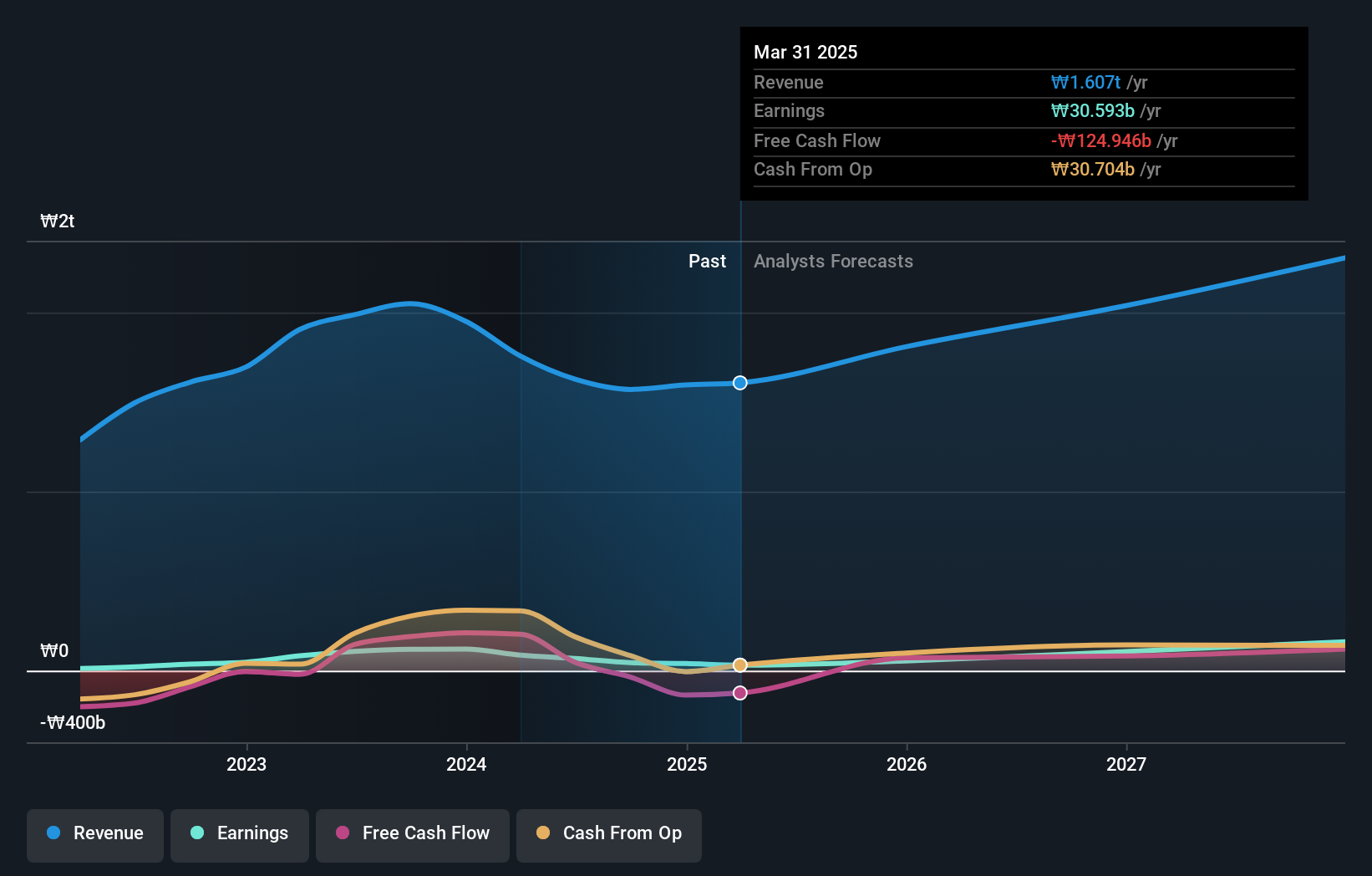

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation produces and sells elecfoils in Korea and internationally, with a market cap of ₩1.83 trillion.

Operations: The company generates revenue primarily from its manufacturing sector, which contributes ₩768.85 billion, and its service sector, adding ₩218.48 billion.

Lotte Energy Materials is making notable advancements in the tech sector, particularly with its focus on energy storage solutions. The company's earnings are forecasted to grow by 53.7% annually, significantly outpacing the broader market's expected growth of 29.1%. Revenue is also expected to rise at a robust rate of 16.3% per year, surpassing South Korea's market average of 10.7%. Strategic R&D investments have been substantial; for instance, ₩36.7 billion was allocated in the last fiscal year alone to drive innovation and maintain competitive edge in this high-growth industry segment.

- Dive into the specifics of Lotte Energy Materials here with our thorough health report.

Gain insights into Lotte Energy Materials' past trends and performance with our Past report.

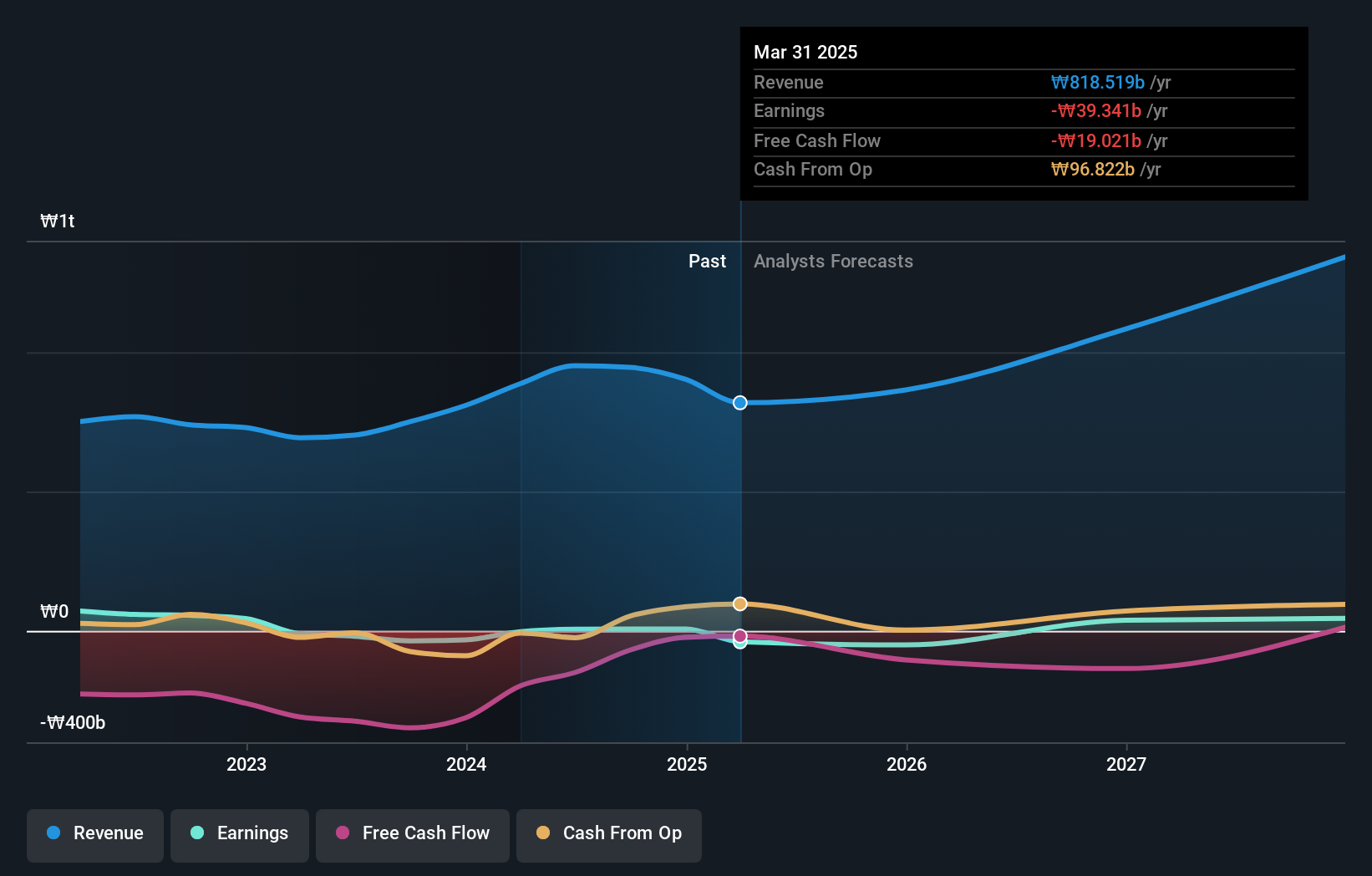

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩971.86 billion.

Operations: Solum Co., Ltd. generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing ₩1.16 billion. The company's market cap stands at ₩971.86 billion.

Solum's earnings are projected to grow at 36.8% annually, outpacing the South Korean market's 29.1%. Revenue growth is expected at 13.9% per year, faster than the market average of 10.7%. The company has committed ₩36.7 billion to R&D in the last fiscal year, emphasizing innovation in its tech solutions segment. Recently, Solum announced a share repurchase program worth ₩20 billion to enhance shareholder value and stabilize stock prices through August 2025.

- Click here and access our complete health analysis report to understand the dynamics of Solum.

Understand Solum's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 48 KRX High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.

Reasonable growth potential with adequate balance sheet.