- South Korea

- /

- Personal Products

- /

- KOSE:A278470

3 Growth Companies With High Insider Ownership On KRX Featuring 62% Revenue Growth

Reviewed by Simply Wall St

The South Korea stock market has finished lower in two straight sessions, plunging more than 100 points or 3.9 percent along the way. The KOSPI now rests just above the 2,580-point plateau although it may see mild support on Thursday. In such a volatile environment, companies with high insider ownership and strong revenue growth can offer a measure of stability and potential for long-term gains. Here are three growth companies listed on the KRX that feature high insider ownership and have demonstrated impressive revenue growth of 62%.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.6% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Underneath we present a selection of stocks filtered out by our screen.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with operations in South Korea and internationally, and it has a market cap of approximately ₩659.45 billion.

Operations: Bioneer Corporation generates revenue through its biotechnology operations across South Korea, the Americas, Europe, Asia, Africa, and other international markets.

Insider Ownership: 17.5%

Revenue Growth Forecast: 23.5% p.a.

Bioneer, a growth company with high insider ownership in South Korea, is forecast to grow earnings by 97.58% per year and become profitable within three years. Despite trading at 66.7% below its estimated fair value and expected revenue growth of 23.5% annually, recent financials show a net loss of KRW 3.03 billion for Q2 2024 compared to net income last year, indicating volatility and potential risk factors for investors.

- Click here to discover the nuances of Bioneer with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Bioneer is priced lower than what may be justified by its financials.

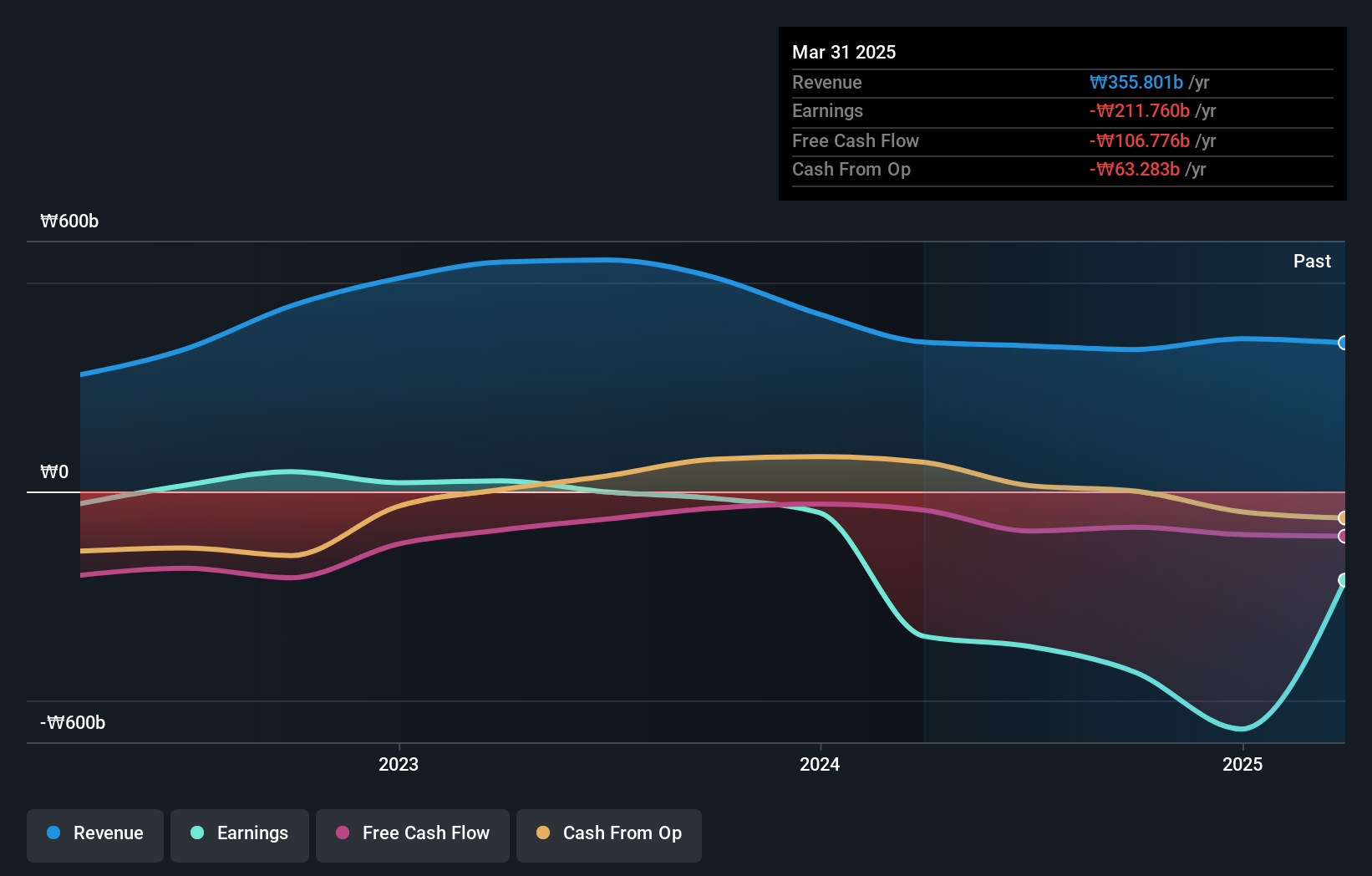

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.03 trillion.

Operations: The company's revenue segment includes electronic components and parts, generating ₩348.75 billion.

Insider Ownership: 19.4%

Revenue Growth Forecast: 63% p.a.

Enchem, a South Korean growth company with high insider ownership, is forecast to grow revenue by 63% annually, significantly outpacing the market's 10.7% growth rate. Earnings are expected to increase by 155.2% per year and the company is projected to become profitable within three years. However, shareholders have faced dilution in the past year and the stock has exhibited high volatility over the last three months, indicating potential risks despite its strong growth outlook.

- Dive into the specifics of Enchem here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Enchem is priced higher than what may be justified by its financials.

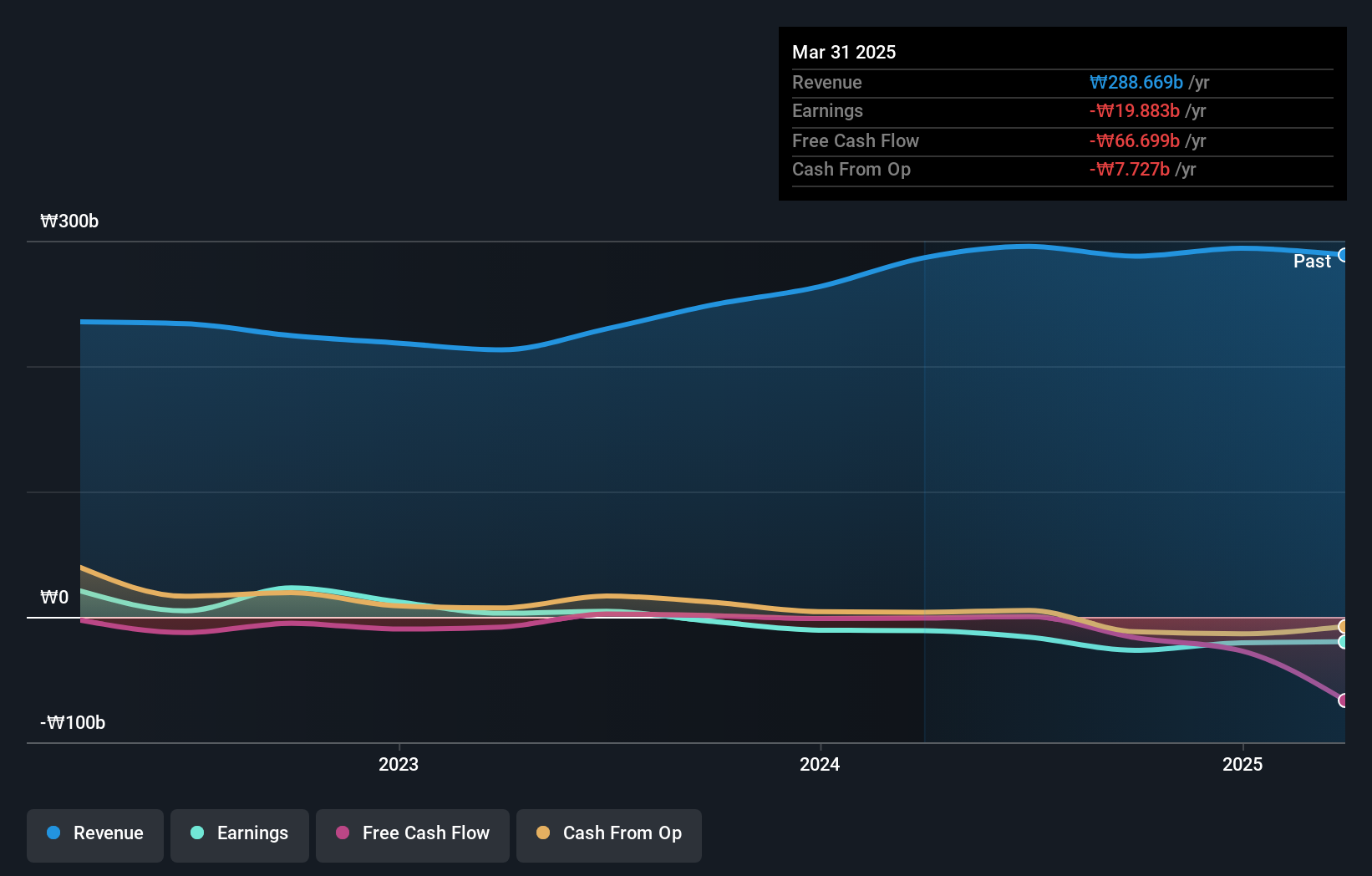

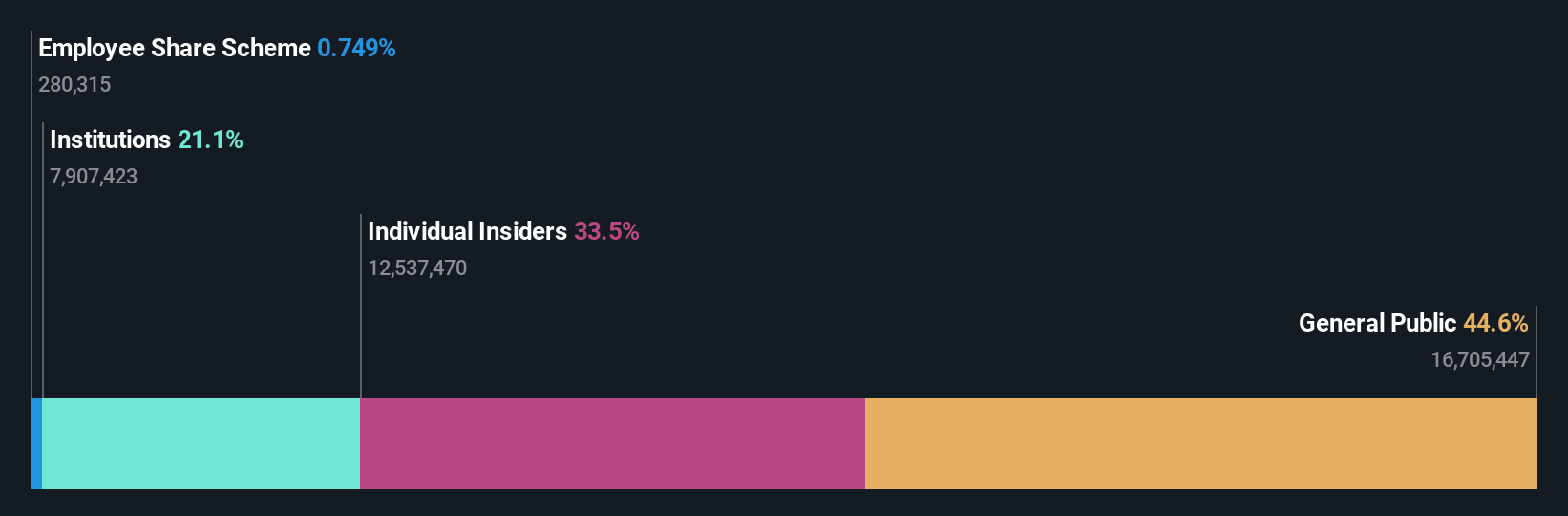

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd manufactures and sells cosmetic products for men and women, with a market cap of ₩2.12 trillion.

Operations: The company's revenue segments include ₩614.77 billion from cosmetics and ₩64.46 billion from apparel fashion.

Insider Ownership: 34.4%

Revenue Growth Forecast: 22.2% p.a.

APR Co., Ltd. is set to repurchase up to ₩60 billion worth of shares by December 2024, aiming to stabilize its volatile stock price and enhance shareholder value. The company trades at a significant discount (45.8%) below its estimated fair value, with earnings forecasted to grow 25.6% annually over the next three years, though slower than the broader South Korean market's growth rate. Revenue growth is expected at 22.2% per year, outpacing market averages.

- Unlock comprehensive insights into our analysis of APR stock in this growth report.

- According our valuation report, there's an indication that APR's share price might be on the cheaper side.

Turning Ideas Into Actions

- Reveal the 86 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet with high growth potential.