- South Korea

- /

- Biotech

- /

- KOSE:A068270

High Growth Tech Stocks To Watch In South Korea September 2024

Reviewed by Simply Wall St

The South Korean market has climbed 2.2% in the last 7 days, although it has been flat overall in the past year, with earnings expected to grow by 29% per annum over the next few years. In this context, identifying high-growth tech stocks that can capitalize on these favorable earnings projections becomes crucial for investors looking to optimize their portfolios.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Park Systems | 23.64% | 35.66% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Daejoo Electronic Materials | 42.24% | 48.74% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

Click here to see the full list of 43 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Com2uS (KOSDAQ:A078340)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Com2uS Corporation develops and publishes mobile games in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and internationally with a market cap of ₩439.16 billion.

Operations: Com2uS generates revenue primarily from mobile games, contributing ₩585.72 billion, with additional income from VFX and new media (₩6.74 billion), exhibition events (₩20.05 billion), and broadcast content production (₩54.43 billion). The company's diverse revenue streams highlight its engagement in both gaming and multimedia sectors.

Com2uS, a South Korean tech firm, is navigating a challenging landscape with its revenue forecasted to grow at 10.3% annually, slightly above the KR market's 10.1%. Despite an 86.34% projected annual earnings growth rate, recent financials show mixed results: Q2 sales were ₩173 billion and net income was ₩3.67 billion. Notably, their R&D expenditure reflects significant investment in innovation; this strategic focus could bolster future competitive positioning within the rapidly evolving tech sector.

- Dive into the specifics of Com2uS here with our thorough health report.

Assess Com2uS' past performance with our detailed historical performance reports.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of approximately ₩16.97 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, totaling ₩90.79 million. The company focuses on developing innovative biopharmaceutical products, including long-acting biobetters and antibody-drug conjugates.

ALTEOGEN, a South Korean biotech firm, is making strides with its recent MFDS approval for Tergase®, a recombinant hyaluronidase boasting over 99% purity and lower immunogenicity. The company's revenue is projected to grow at an impressive 64.2% annually, significantly outpacing the KR market's 10.1%. Despite being unprofitable currently, earnings are forecasted to surge by 99.46% per year. Their commitment to innovation is evident with substantial R&D investments aimed at expanding product applications beyond traditional uses of animal-origin hyaluronidases.

- Get an in-depth perspective on ALTEOGEN's performance by reading our health report here.

Explore historical data to track ALTEOGEN's performance over time in our Past section.

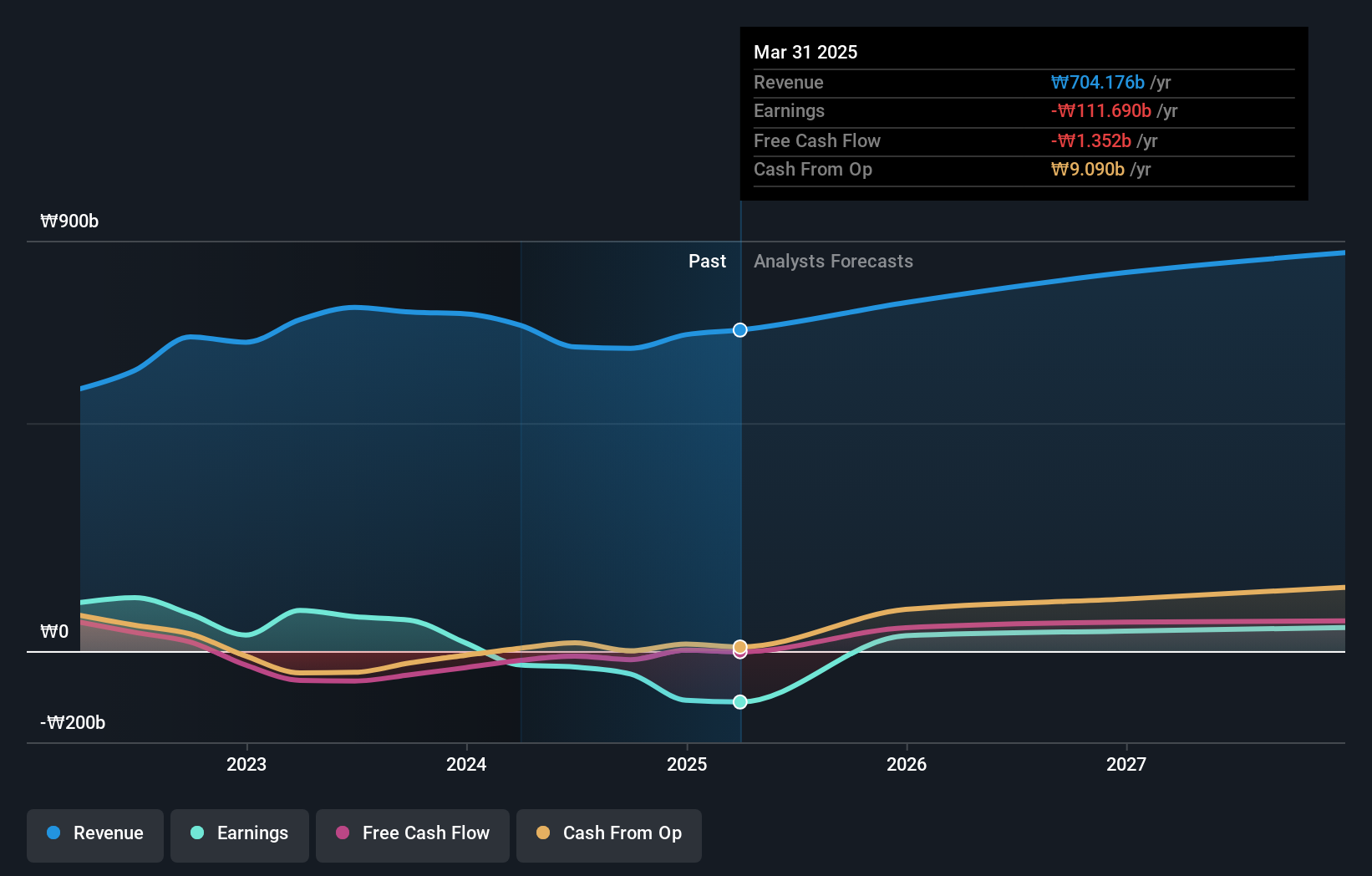

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and producing protein-based drugs for oncology treatment in South Korea and has a market cap of ₩40.28 trillion.

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment (₩3.54 trillion) and Chemical Drugs segment (₩507.02 billion). The company specializes in developing protein-based oncology treatments within South Korea.

Celltrion's earnings are projected to grow 59.6% annually, significantly outpacing the South Korean market's 28.8%. Revenue growth is also robust at 25.5% per year, driven by strategic agreements like the one with Cigna Healthcare and Express Scripts for ZYMFENTRA®, which serves 16.1 million insured lives. The company has invested heavily in R&D, spending ₩75 billion recently to bolster its biosimilar portfolio including SteQeyma®. Despite a net profit margin drop from 23.8% to 12.1%, Celltrion repurchased shares worth ₩75 billion in recent months, reflecting confidence in its future prospects amidst a competitive biotech landscape.

- Take a closer look at Celltrion's potential here in our health report.

Examine Celltrion's past performance report to understand how it has performed in the past.

Where To Now?

- Investigate our full lineup of 43 KRX High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

A biopharmaceutical company, engages in the development, production, and sale of various therapeutic proteins for the treatment of oncology diseases.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.