- South Korea

- /

- Media

- /

- KOSDAQ:A036000

Here's Why We're Not Too Worried About YeaRimDang Publishing's (KOSDAQ:036000) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for YeaRimDang Publishing (KOSDAQ:036000) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for YeaRimDang Publishing

When Might YeaRimDang Publishing Run Out Of Money?

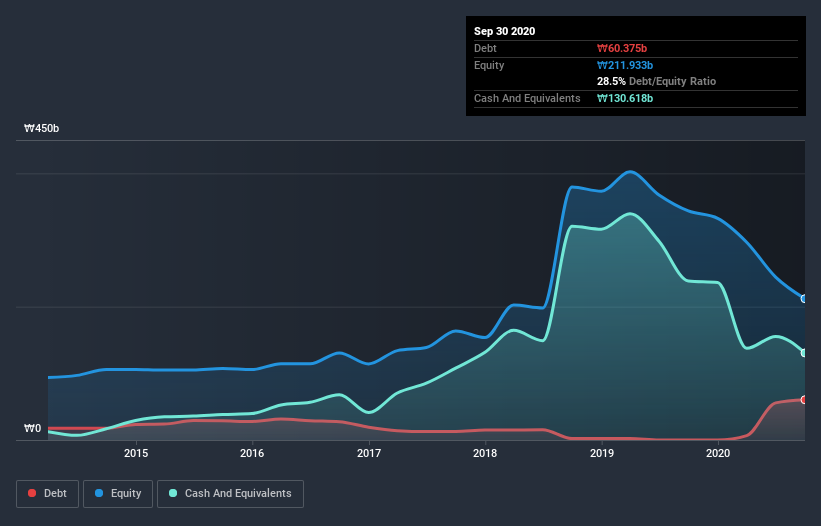

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at September 2020, YeaRimDang Publishing had cash of ₩131b and such minimal debt that we can ignore it for the purposes of this analysis. In the last year, its cash burn was ₩8.1b. So it had a very long cash runway of many years from September 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

Is YeaRimDang Publishing's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because YeaRimDang Publishing actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Unfortunately, the last year has been a disappointment, with operating revenue dropping 48% during the period. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how YeaRimDang Publishing is building its business over time.

How Easily Can YeaRimDang Publishing Raise Cash?

Since its revenue growth is moving in the wrong direction, YeaRimDang Publishing shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

YeaRimDang Publishing has a market capitalisation of ₩68b and burnt through ₩8.1b last year, which is 12% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is YeaRimDang Publishing's Cash Burn Situation?

As you can probably tell by now, we're not too worried about YeaRimDang Publishing's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While we must concede that its falling revenue is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, YeaRimDang Publishing has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course YeaRimDang Publishing may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade YeaRimDang Publishing, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A036000

YeaRimDang Publishing

YeaRimDang Publishing Co., Ltd. publishes books for children in South Korea.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives