- South Korea

- /

- Chemicals

- /

- KOSE:A298050

Pinning Down Hs Hyosung Advanced Materials' (KRX:298050) P/S Is Difficult Right Now

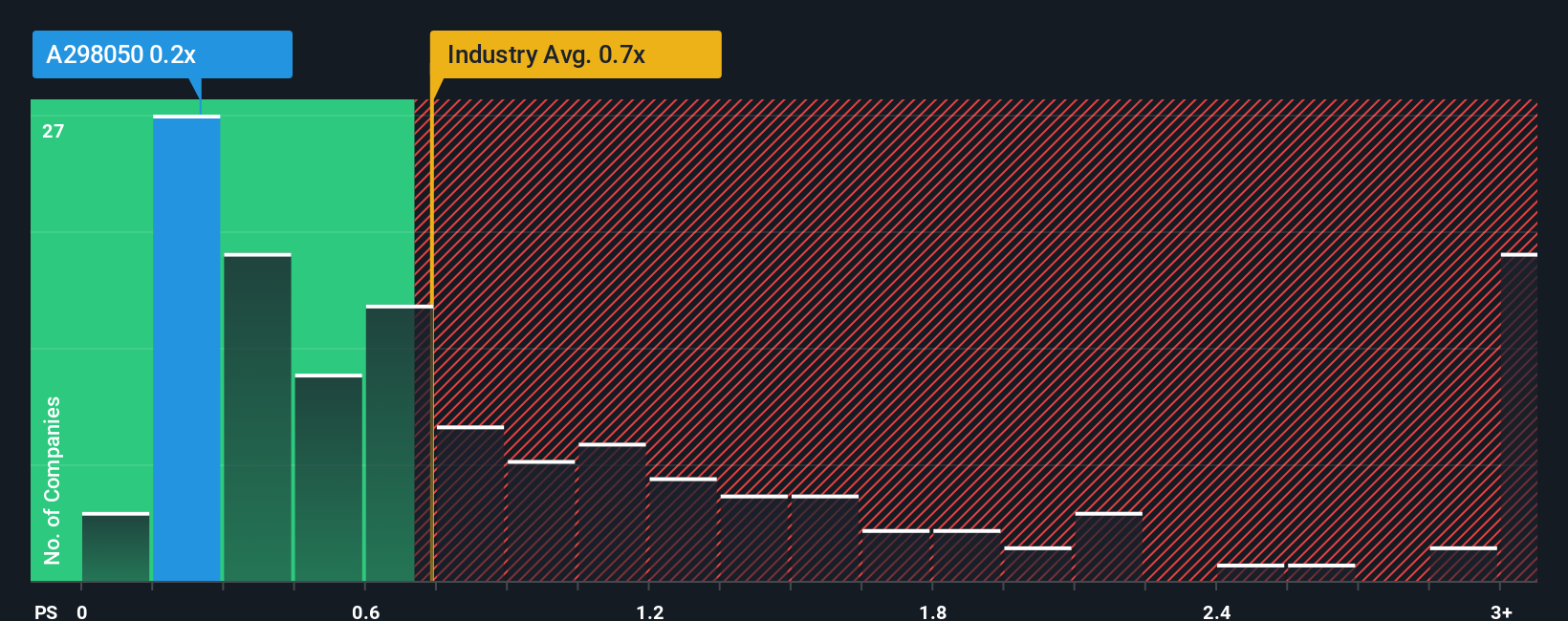

There wouldn't be many who think Hs Hyosung Advanced Materials' (KRX:298050) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Chemicals industry in Korea is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hs Hyosung Advanced Materials

What Does Hs Hyosung Advanced Materials' Recent Performance Look Like?

There hasn't been much to differentiate Hs Hyosung Advanced Materials' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think Hs Hyosung Advanced Materials' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hs Hyosung Advanced Materials would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.2% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 16% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 3.2% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is noticeably more attractive.

With this information, we find it interesting that Hs Hyosung Advanced Materials is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Hs Hyosung Advanced Materials' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Hs Hyosung Advanced Materials' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Hs Hyosung Advanced Materials has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on Hs Hyosung Advanced Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hs Hyosung Advanced Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A298050

Hs Hyosung Advanced Materials

Manufactures and sells industrial, polyester, nylon, and carpet yarns in South Korea and internationally.

Very undervalued with slight risk.

Market Insights

Community Narratives