- South Korea

- /

- Chemicals

- /

- KOSE:A298000

Here's Why Hyosung Chemical (KRX:298000) Is Weighed Down By Its Debt Load

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Hyosung Chemical Corporation (KRX:298000) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Hyosung Chemical

How Much Debt Does Hyosung Chemical Carry?

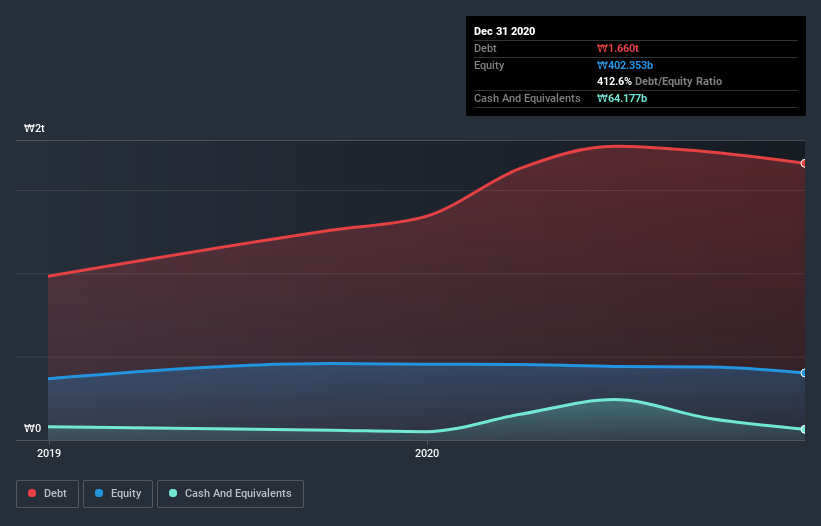

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Hyosung Chemical had ₩1.66t of debt, an increase on ₩1.34t, over one year. However, because it has a cash reserve of ₩64.2b, its net debt is less, at about ₩1.60t.

How Strong Is Hyosung Chemical's Balance Sheet?

We can see from the most recent balance sheet that Hyosung Chemical had liabilities of ₩627.5b falling due within a year, and liabilities of ₩1.39t due beyond that. Offsetting these obligations, it had cash of ₩64.2b as well as receivables valued at ₩220.2b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩1.73t.

The deficiency here weighs heavily on the ₩942.2b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Hyosung Chemical would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hyosung Chemical shareholders face the double whammy of a high net debt to EBITDA ratio (6.7), and fairly weak interest coverage, since EBIT is just 1.4 times the interest expense. This means we'd consider it to have a heavy debt load. Worse, Hyosung Chemical's EBIT was down 60% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Hyosung Chemical can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Hyosung Chemical burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Hyosung Chemical's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its net debt to EBITDA also fails to instill confidence. It looks to us like Hyosung Chemical carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Hyosung Chemical you should be aware of, and 1 of them is potentially serious.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Hyosung Chemical, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyosung Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A298000

Hyosung Chemical

Produces and sells a range of chemical products in South Korea and internationally.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives