- South Korea

- /

- Chemicals

- /

- KOSE:A120110

Kolon Industries, Inc.'s (KRX:120110) Business And Shares Still Trailing The Industry

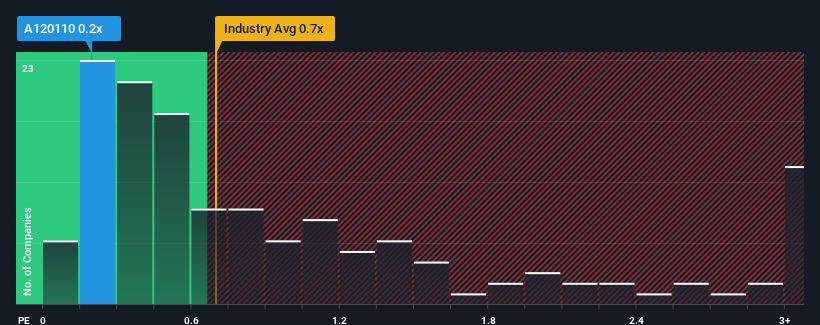

Kolon Industries, Inc.'s (KRX:120110) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Chemicals industry in Korea have P/S ratios greater than 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Kolon Industries

What Does Kolon Industries' P/S Mean For Shareholders?

Recent times have been more advantageous for Kolon Industries as its revenue hasn't fallen as much as the rest of the industry. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Kolon Industries will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Kolon Industries?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Kolon Industries' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 0.6% during the coming year according to the five analysts following the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this information, we can see why Kolon Industries is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Kolon Industries' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Kolon Industries' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Kolon Industries (1 shouldn't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kolon Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A120110

Kolon Industries

Engages in industrial materials, chemicals, films/electronic materials, and fashion businesses in South Korea and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives