- South Korea

- /

- Metals and Mining

- /

- KOSE:A103140

What You Can Learn From Poongsan Corporation's (KRX:103140) P/E After Its 26% Share Price Crash

The Poongsan Corporation (KRX:103140) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 38%, which is great even in a bull market.

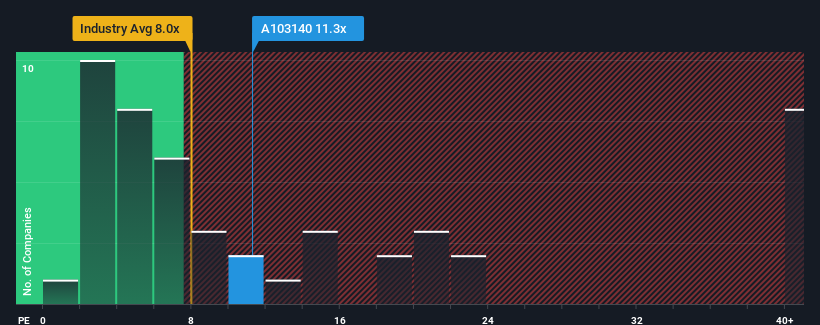

Although its price has dipped substantially, there still wouldn't be many who think Poongsan's price-to-earnings (or "P/E") ratio of 11.3x is worth a mention when the median P/E in Korea is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Poongsan as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Poongsan

How Is Poongsan's Growth Trending?

In order to justify its P/E ratio, Poongsan would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 18% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 18% each year over the next three years. That's shaping up to be similar to the 20% each year growth forecast for the broader market.

With this information, we can see why Poongsan is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Poongsan's P/E

Following Poongsan's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Poongsan maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Poongsan you should be aware of.

If these risks are making you reconsider your opinion on Poongsan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A103140

Poongsan

Develops, manufactures, markets, exports, and sells fabricated non-ferrous metal, commercial ammunition, and defense products in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives