- South Korea

- /

- Metals and Mining

- /

- KOSE:A058430

Lacklustre Performance Is Driving POSCO STEELEON Co., Ltd.'s (KRX:058430) 31% Price Drop

POSCO STEELEON Co., Ltd. (KRX:058430) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

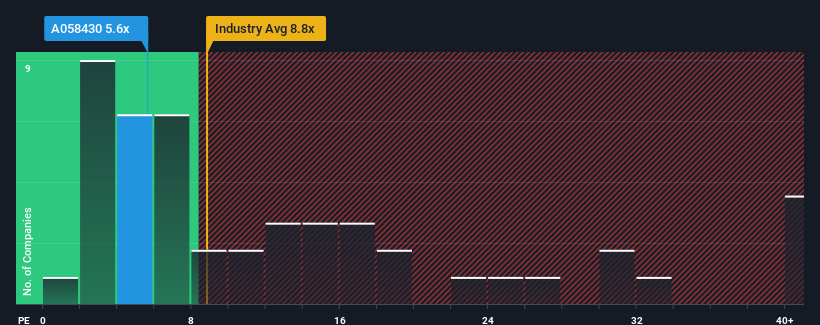

In spite of the heavy fall in price, POSCO STEELEON's price-to-earnings (or "P/E") ratio of 5.6x might still make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 11x and even P/E's above 22x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

POSCO STEELEON certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for POSCO STEELEON

How Is POSCO STEELEON's Growth Trending?

POSCO STEELEON's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 303%. Still, incredibly EPS has fallen 69% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 33% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that POSCO STEELEON's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On POSCO STEELEON's P/E

POSCO STEELEON's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of POSCO STEELEON revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for POSCO STEELEON that you should be aware of.

If you're unsure about the strength of POSCO STEELEON's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A058430

POSCO STEELEON

Manufactures, processes, and sells steel products in South Korea and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives