- South Korea

- /

- Chemicals

- /

- KOSE:A017960

There's A Lot To Like About Hankuk Carbon's (KRX:017960) Upcoming ₩120 Dividend

It looks like Hankuk Carbon Co., Ltd. (KRX:017960) is about to go ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 10th of April.

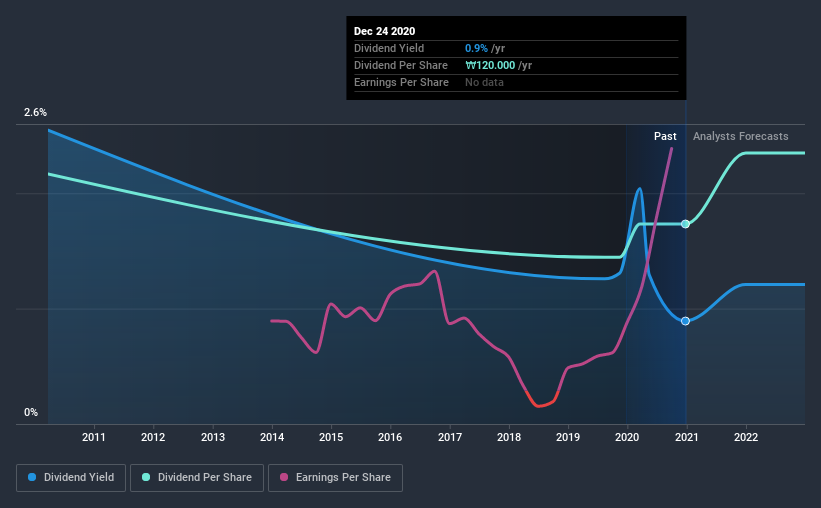

Hankuk Carbon's next dividend payment will be ₩120 per share, and in the last 12 months, the company paid a total of ₩120 per share. Last year's total dividend payments show that Hankuk Carbon has a trailing yield of 0.9% on the current share price of ₩13450. If you buy this business for its dividend, you should have an idea of whether Hankuk Carbon's dividend is reliable and sustainable. So we need to investigate whether Hankuk Carbon can afford its dividend, and if the dividend could grow.

View our latest analysis for Hankuk Carbon

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Hankuk Carbon paid out just 8.3% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether Hankuk Carbon generated enough free cash flow to afford its dividend. The good news is it paid out just 7.2% of its free cash flow in the last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see Hankuk Carbon's earnings have been skyrocketing, up 23% per annum for the past five years. Hankuk Carbon earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Hankuk Carbon's dividend payments per share have declined at 2.2% per year on average over the past 10 years, which is uninspiring. Hankuk Carbon is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

To Sum It Up

Is Hankuk Carbon worth buying for its dividend? We love that Hankuk Carbon is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. It's a promising combination that should mark this company worthy of closer attention.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. For instance, we've identified 3 warning signs for Hankuk Carbon (1 is potentially serious) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Hankuk Carbon, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hankuk Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A017960

Hankuk Carbon

Produces and sells carbon fiber, synthetic resin, and glass paper related products in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success