- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A016590

Benign Growth For Shindaeyang Paper Co., Ltd. (KRX:016590) Underpins Its Share Price

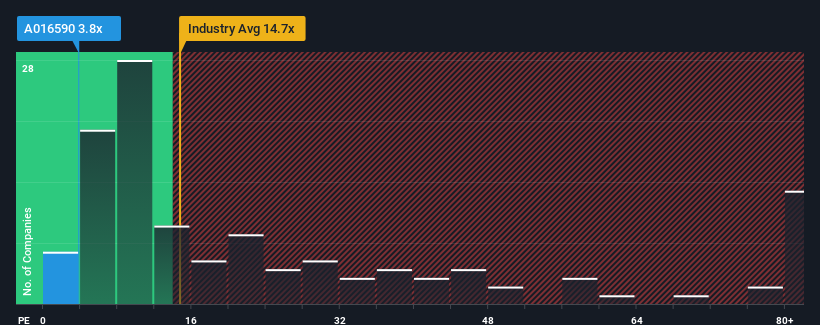

With a price-to-earnings (or "P/E") ratio of 3.8x Shindaeyang Paper Co., Ltd. (KRX:016590) may be sending very bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 12x and even P/E's higher than 24x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

As an illustration, earnings have deteriorated at Shindaeyang Paper over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Shindaeyang Paper

What Are Growth Metrics Telling Us About The Low P/E?

Shindaeyang Paper's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Shindaeyang Paper's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Shindaeyang Paper's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shindaeyang Paper revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shindaeyang Paper (1 is a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Shindaeyang Paper, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A016590

Shindaeyang Paper

Engages in the production and sale of corrugated cardboard base paper.

Flawless balance sheet with low risk.

Market Insights

Community Narratives