- South Korea

- /

- Chemicals

- /

- KOSE:A014530

Shareholders Of Kukdong Oil & ChemicalsLtd (KRX:014530) Must Be Happy With Their 39% Return

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But Kukdong Oil & Chemicals Co.,Ltd (KRX:014530) has fallen short of that second goal, with a share price rise of 13% over five years, which is below the market return. Meanwhile, the last twelve months saw the share price rise 1.3%.

Check out our latest analysis for Kukdong Oil & ChemicalsLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

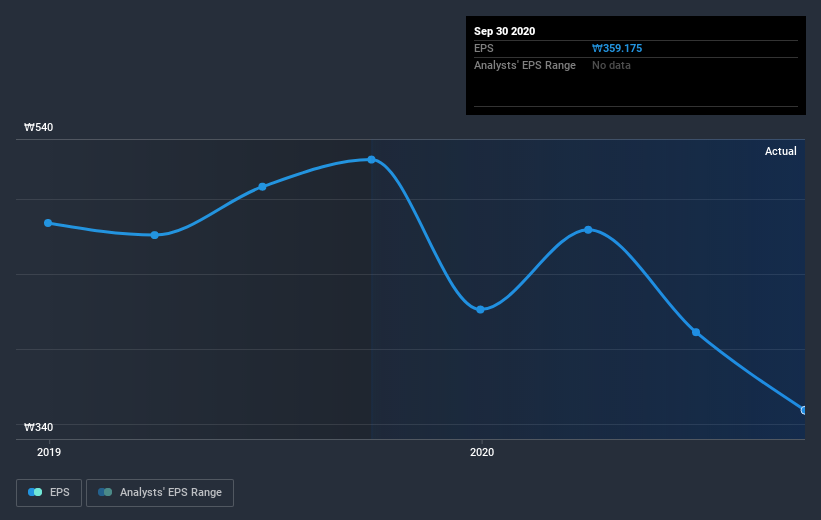

During five years of share price growth, Kukdong Oil & ChemicalsLtd actually saw its EPS drop 2.0% per year.

With EPS falling, but a modestly increasing share price, it seems that the market was probably too pessimistic about the stock in the past. In the long term, though, it will be hard for the share price rises to continue without improving EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Kukdong Oil & ChemicalsLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Kukdong Oil & ChemicalsLtd, it has a TSR of 39% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Kukdong Oil & ChemicalsLtd shareholders are up 6.0% for the year (even including dividends). But that return falls short of the market. On the bright side, the longer term returns (running at about 7% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Kukdong Oil & ChemicalsLtd you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Kukdong Oil & ChemicalsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kukdong Oil & ChemicalsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A014530

Kukdong Oil & ChemicalsLtd

Develops, manufactures, and supplies various lubricant products primarily in South Korea.

Medium-low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives