- South Korea

- /

- Chemicals

- /

- KOSE:A011780

Kumho Petro Chemical Co.,Ltd (KRX:011780) Stock Rockets 30% But Many Are Still Ignoring The Company

Kumho Petro Chemical Co.,Ltd (KRX:011780) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

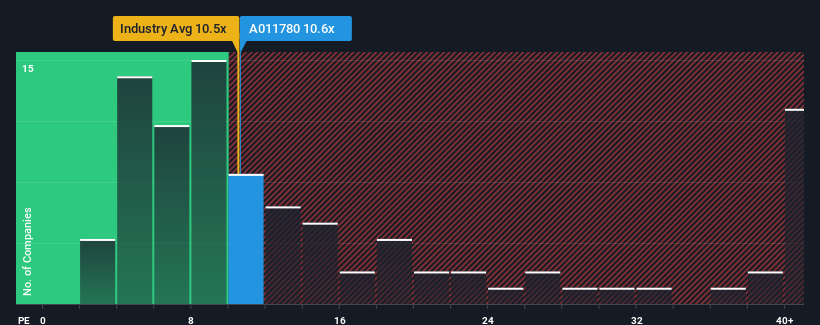

Although its price has surged higher, it's still not a stretch to say that Kumho Petro ChemicalLtd's price-to-earnings (or "P/E") ratio of 10.6x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Kumho Petro ChemicalLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Kumho Petro ChemicalLtd

What Are Growth Metrics Telling Us About The P/E?

Kumho Petro ChemicalLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 40%. As a result, earnings from three years ago have also fallen 83% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 26% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 17% per year, which is noticeably less attractive.

With this information, we find it interesting that Kumho Petro ChemicalLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Kumho Petro ChemicalLtd's P/E?

Kumho Petro ChemicalLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Kumho Petro ChemicalLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Kumho Petro ChemicalLtd you should be aware of.

You might be able to find a better investment than Kumho Petro ChemicalLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kumho Petro ChemicalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011780

Kumho Petro ChemicalLtd

Manufactures and sells synthetic rubber and resins, specialty chemicals, nanocarbon, energy, and building materials in South Korea and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives