- South Korea

- /

- Metals and Mining

- /

- KOSE:A008970

The Market Lifts Dong Yang Steel Pipe Co., Ltd. (KRX:008970) Shares 32% But It Can Do More

Dong Yang Steel Pipe Co., Ltd. (KRX:008970) shares have continued their recent momentum with a 32% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

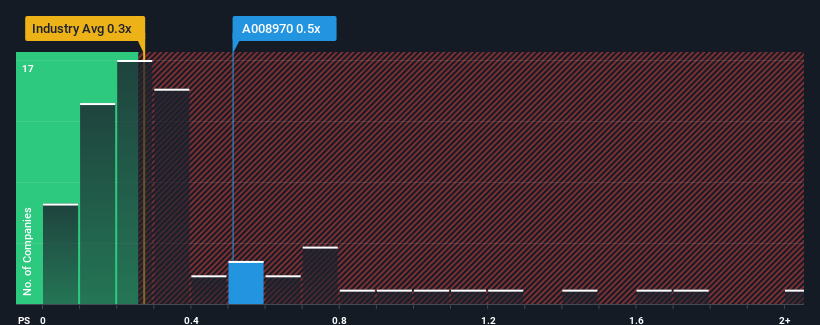

Although its price has surged higher, you could still be forgiven for feeling indifferent about Dong Yang Steel Pipe's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Korea is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Dong Yang Steel Pipe

What Does Dong Yang Steel Pipe's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Dong Yang Steel Pipe, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dong Yang Steel Pipe's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Dong Yang Steel Pipe's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 3.7%. This was backed up an excellent period prior to see revenue up by 71% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Dong Yang Steel Pipe is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Dong Yang Steel Pipe's P/S Mean For Investors?

Dong Yang Steel Pipe appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, Dong Yang Steel Pipe revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Dong Yang Steel Pipe (2 shouldn't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kbi Dong Yang Steel PipeLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008970

Kbi Dong Yang Steel PipeLtd

Manufactures and sells steel pipes in South Korea, the United States, rest of Asia, Europe, the Middle East, and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives