- South Korea

- /

- Basic Materials

- /

- KOSE:A003300

Income Investors Should Know That Hanil Holdings Co., Ltd. (KRX:003300) Goes Ex-Dividend Soon

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Hanil Holdings Co., Ltd. (KRX:003300) is about to go ex-dividend in just four days. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 3rd of April.

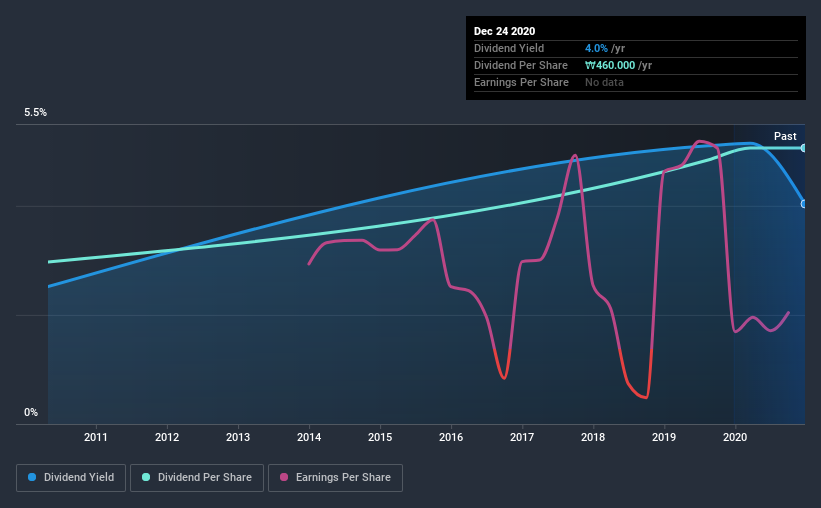

The upcoming dividend for Hanil Holdings is ₩510 per share, increased from last year's total dividends per share of ₩460. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Hanil Holdings

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Hanil Holdings paid out a comfortable 47% of its profit last year. A useful secondary check can be to evaluate whether Hanil Holdings generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 13% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Hanil Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Hanil Holdings's 18% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Hanil Holdings has delivered 5.5% dividend growth per year on average over the past 10 years.

The Bottom Line

From a dividend perspective, should investors buy or avoid Hanil Holdings? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. Overall, it's hard to get excited about Hanil Holdings from a dividend perspective.

In light of that, while Hanil Holdings has an appealing dividend, it's worth knowing the risks involved with this stock. For example, we've found 2 warning signs for Hanil Holdings that we recommend you consider before investing in the business.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Hanil Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanil Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A003300

Hanil Holdings

Manufactures and sells construction materials in South Korea.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success