- South Korea

- /

- Paper and Forestry Products

- /

- KOSE:A002310

ORION Holdings And 2 Other KRX Dividend Stocks To Consider

Reviewed by Simply Wall St

The South Korean stock market has shown resilience, with the KOSPI index recently experiencing modest gains amid fluctuating global markets. This stability, coupled with a cautious optimism reflected in mixed international economic signals, sets an intriguing backdrop for investors considering dividend stocks like ORION Holdings within this market environment. In such conditions, a good dividend stock typically offers not just yield but also stability and potential for growth, aligning well with the current cautious yet hopeful investment climate.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.57% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.71% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.35% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.43% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.39% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.24% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.87% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.95% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.03% | ★★★★☆☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.29% | ★★★★☆☆ |

Click here to see the full list of 69 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ORION Holdings Corp., with a market cap of approximately ₩902.95 billion, is engaged in the manufacturing and selling of confectioneries across South Korea, China, and other international markets.

Operations: ORION Holdings Corp. generates its revenue through the production and sales of confectionery products across various global markets.

Dividend Yield: 4.9%

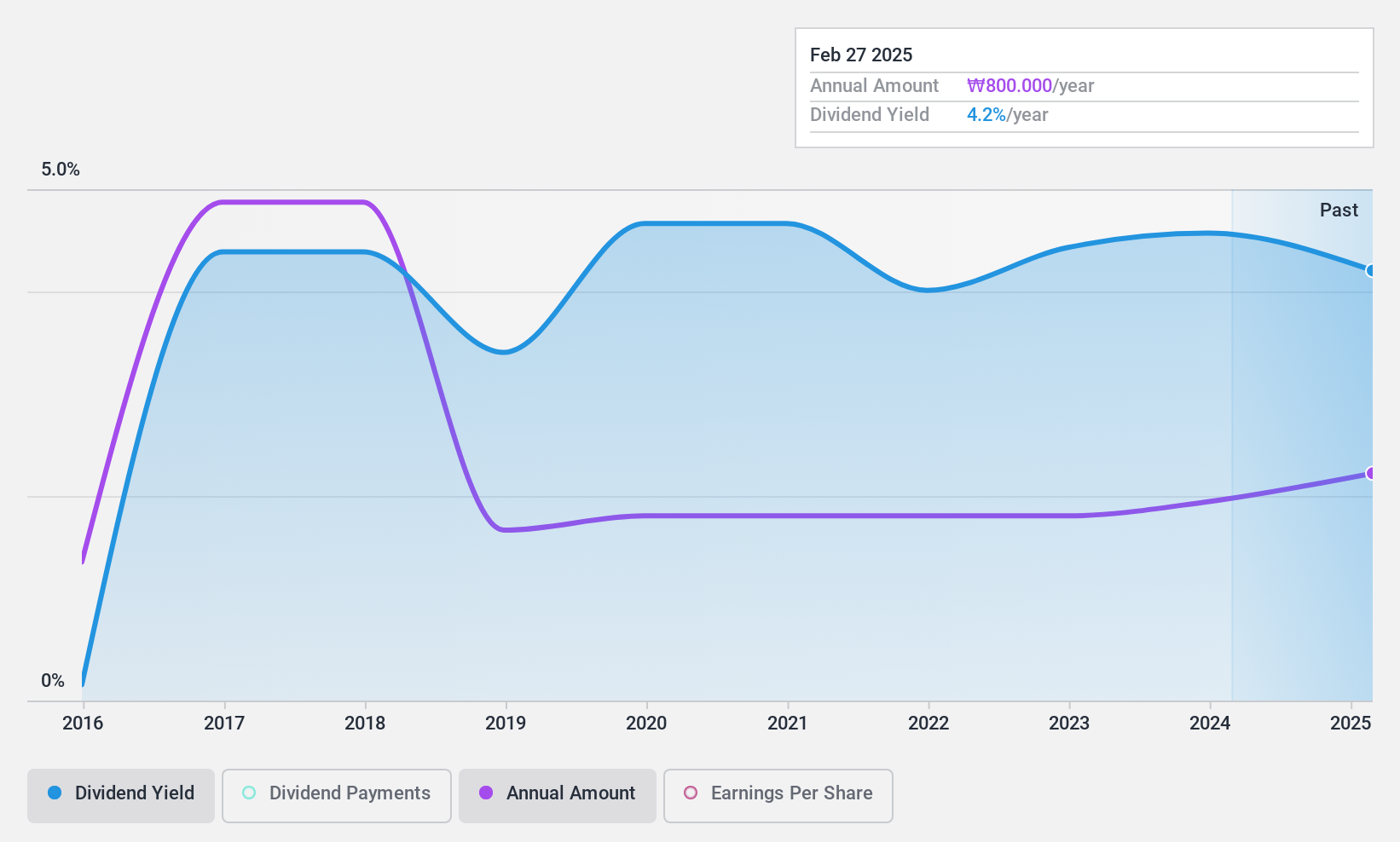

ORION Holdings, while trading 13.9% below estimated fair value, shows a mixed dividend profile with a yield of 4.94%, ranking in the top 25% in the South Korean market. Despite its attractive yield, the company has only been paying dividends for nine years with some volatility in payments. However, dividends are well-supported by both earnings and cash flows, with payout ratios of 42.4% and 11%, respectively. Recent financials reveal a decline in net income from KRW 102.97 billion to KRW 85.62 billion year-over-year, potentially impacting future dividend stability.

- Navigate through the intricacies of ORION Holdings with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of ORION Holdings shares in the market.

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd specializes in the production and sale of specialized industrial paper in South Korea, with a market capitalization of approximately ₩346 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates its revenue primarily from the production and sales of specialized industrial paper in South Korea.

Dividend Yield: 5.7%

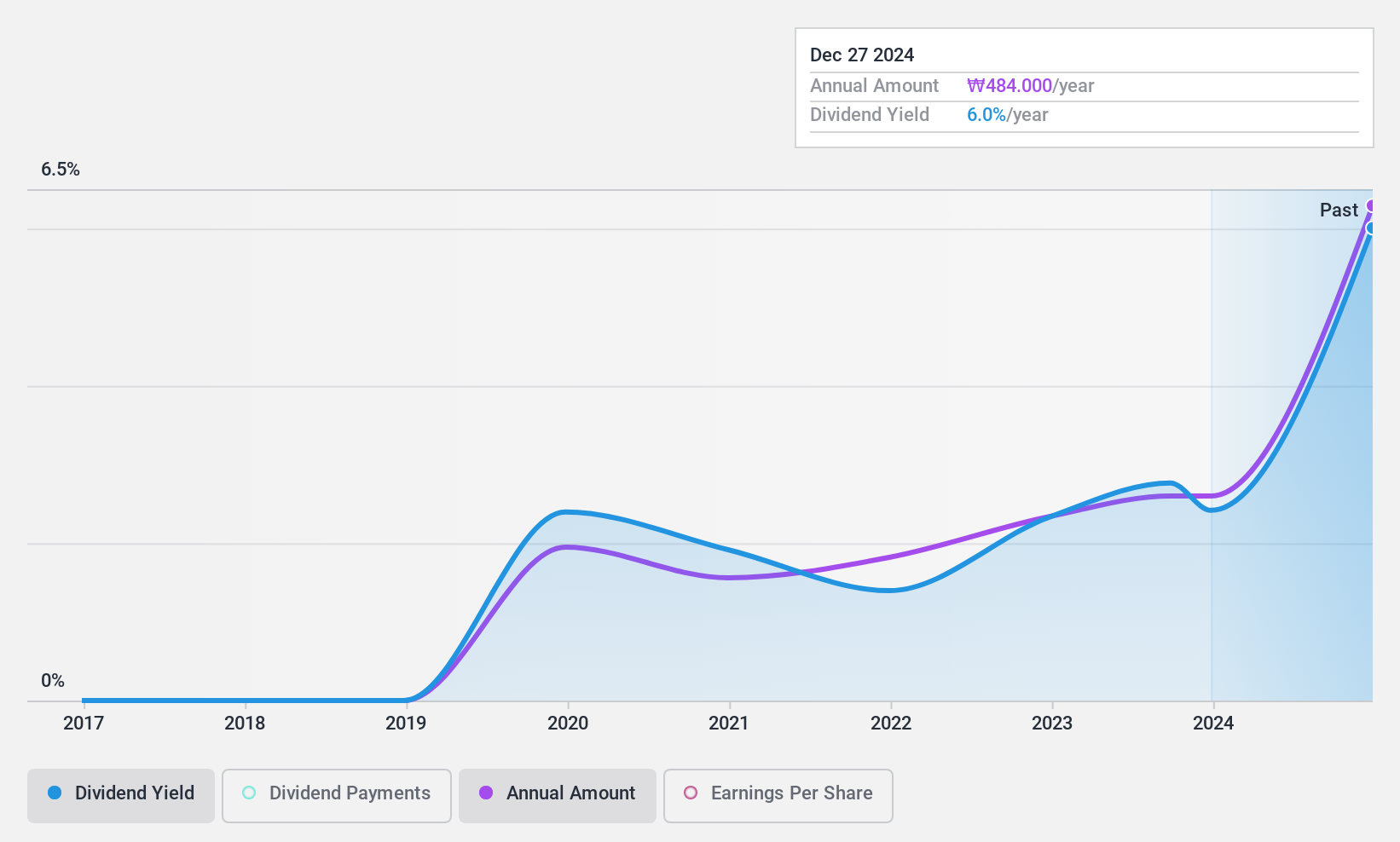

Asia Paper Manufacturing offers a dividend yield of 5.71%, placing it in the top 25% of South Korean dividend payers. Despite its attractive position, the company's dividend history is marked by instability, having paid dividends for only five years with significant fluctuations. The dividends are supported by earnings and cash flows, with payout ratios of 27.4% and 58.5% respectively, indicating reasonable coverage. Recent activities include a share buyback completion for KRW 2.74 billion and reported annual net income decline to KRW 81.05 billion from KRW 94.40 billion previously, which could influence future payouts.

- Click to explore a detailed breakdown of our findings in Asia Paper Manufacturing's dividend report.

- Our valuation report here indicates Asia Paper Manufacturing may be undervalued.

Shinhan Financial Group (KOSE:A055550)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinhan Financial Group Co., Ltd. operates as a provider of a diverse range of financial products and services both domestically in South Korea and internationally, with a market capitalization of approximately ₩23.53 trillion.

Operations: Shinhan Financial Group Co., Ltd. generates its revenue primarily from banking (₩8.67 billion), credit card services (₩2.02 billion), and securities (₩0.76 billion).

Dividend Yield: 4.4%

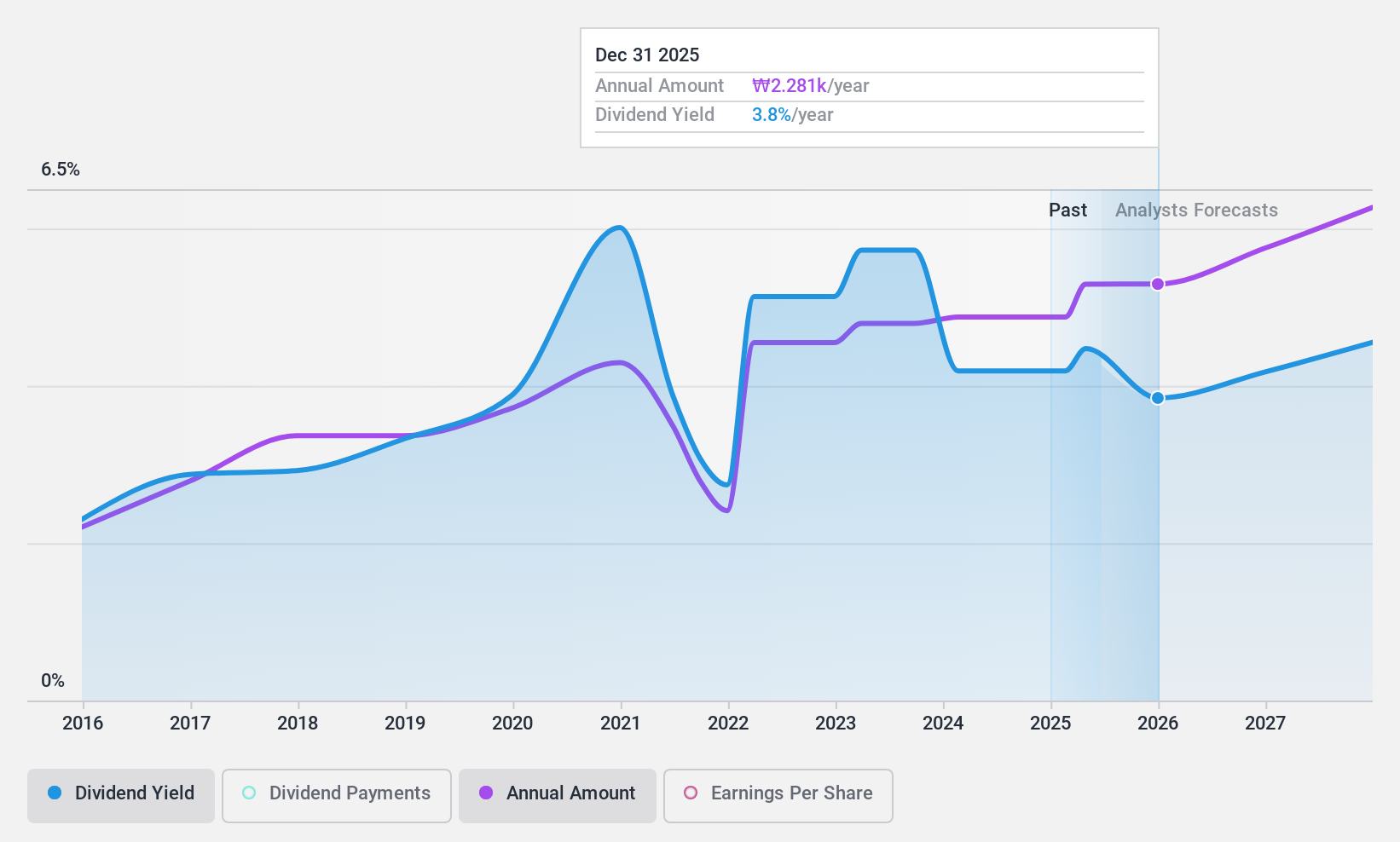

Shinhan Financial Group has recently increased its quarterly dividend to KRW 540, reflecting a commitment to enhancing shareholder returns, supported by a stable payout ratio of 33%. However, despite a decade of dividend growth, the reliability of these payments has been questioned due to historical volatility. The company's recent share repurchase program for up to KRW 300 billion aims to further bolster shareholder value. With earnings forecasted to grow by 7.4% annually, future dividends appear sustainable with an expected payout ratio of 23.4% in three years.

- Unlock comprehensive insights into our analysis of Shinhan Financial Group stock in this dividend report.

- Our expertly prepared valuation report Shinhan Financial Group implies its share price may be lower than expected.

Seize The Opportunity

- Delve into our full catalog of 69 Top KRX Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A002310

Asia Paper Manufacturing

Engages in the production and sale of specialized industrial paper in South Korea.

Flawless balance sheet average dividend payer.