- South Korea

- /

- Chemicals

- /

- KOSDAQ:A348370

Enchem Co., Ltd. (KOSDAQ:348370) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Enchem Co., Ltd. (KOSDAQ:348370) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 161%.

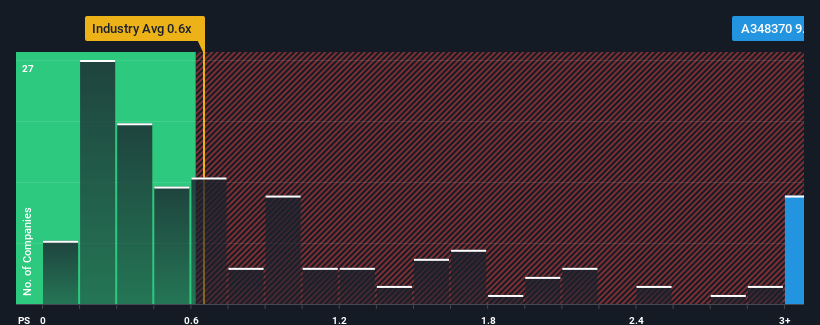

In spite of the heavy fall in price, when almost half of the companies in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider Enchem as a stock not worth researching with its 9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Enchem

What Does Enchem's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Enchem has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Enchem's future stacks up against the industry? In that case, our free report is a great place to start.How Is Enchem's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Enchem's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 116% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 217% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we can see why Enchem is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Enchem's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Enchem maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 2 warning signs for Enchem that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enchem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A348370

Enchem

Manufactures and sells electrolytes and additives for secondary batteries and EDLC.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives