- South Korea

- /

- Chemicals

- /

- KOSDAQ:A170920

Slowing Rates Of Return At LTCLtd (KOSDAQ:170920) Leave Little Room For Excitement

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at LTCLtd (KOSDAQ:170920) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for LTCLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.05 = ₩6.9b ÷ (₩327b - ₩190b) (Based on the trailing twelve months to September 2024).

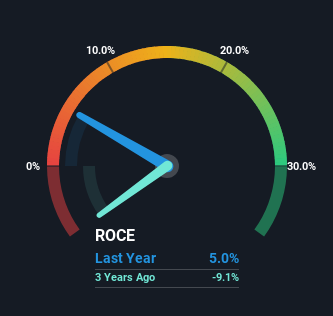

Therefore, LTCLtd has an ROCE of 5.0%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 7.5%.

Check out our latest analysis for LTCLtd

Historical performance is a great place to start when researching a stock so above you can see the gauge for LTCLtd's ROCE against it's prior returns. If you'd like to look at how LTCLtd has performed in the past in other metrics, you can view this free graph of LTCLtd's past earnings, revenue and cash flow.

How Are Returns Trending?

Things have been pretty stable at LTCLtd, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So unless we see a substantial change at LTCLtd in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 58% of total assets, this reported ROCE would probably be less than5.0% because total capital employed would be higher.The 5.0% ROCE could be even lower if current liabilities weren't 58% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

Our Take On LTCLtd's ROCE

We can conclude that in regards to LTCLtd's returns on capital employed and the trends, there isn't much change to report on. Since the stock has declined 28% over the last five years, investors may not be too optimistic on this trend improving either. Therefore based on the analysis done in this article, we don't think LTCLtd has the makings of a multi-bagger.

On a final note, we found 3 warning signs for LTCLtd (1 shouldn't be ignored) you should be aware of.

While LTCLtd may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A170920

LTCLtd

Provides FPD and semiconductor chemical solutions in Korea and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives