- South Korea

- /

- Metals and Mining

- /

- KOSDAQ:A151860

0.02% earnings growth over 3 years has not materialized into gains for KG Eco SolutionLtd (KOSDAQ:151860) shareholders over that period

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of KG Eco Solution Co.,Ltd. (KOSDAQ:151860); the share price is down a whopping 73% in the last three years. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 61% in a year. The falls have accelerated recently, with the share price down 27% in the last three months.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for KG Eco SolutionLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, KG Eco SolutionLtd actually saw its earnings per share (EPS) improve by 0.07% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

We note that, in three years, revenue has actually grown at a 39% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching KG Eco SolutionLtd more closely, as sometimes stocks fall unfairly. This could present an opportunity.

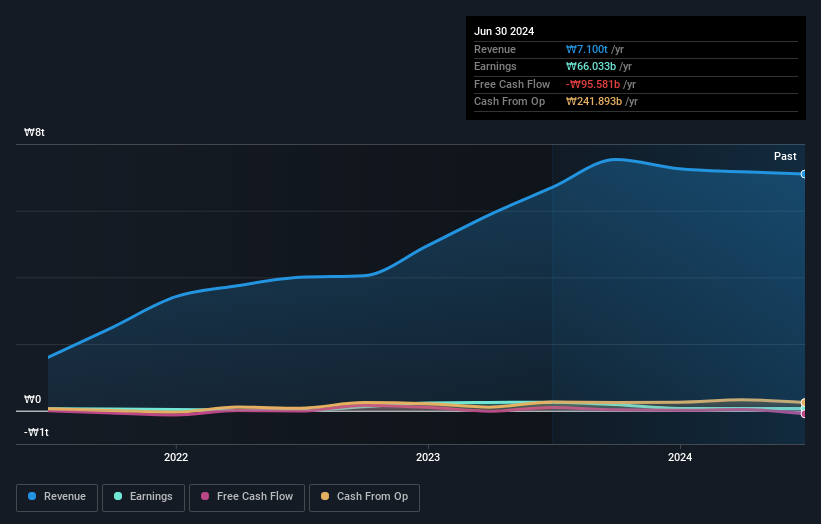

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on KG Eco SolutionLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that KG Eco SolutionLtd shareholders are down 60% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 3.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that KG Eco SolutionLtd is showing 3 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KG Eco SolutionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A151860

Adequate balance sheet low.