- South Korea

- /

- Chemicals

- /

- KOSDAQ:A102710

Revenues Not Telling The Story For ENF Technology Co., Ltd. (KOSDAQ:102710) After Shares Rise 34%

ENF Technology Co., Ltd. (KOSDAQ:102710) shares have continued their recent momentum with a 34% gain in the last month alone. The last month tops off a massive increase of 133% in the last year.

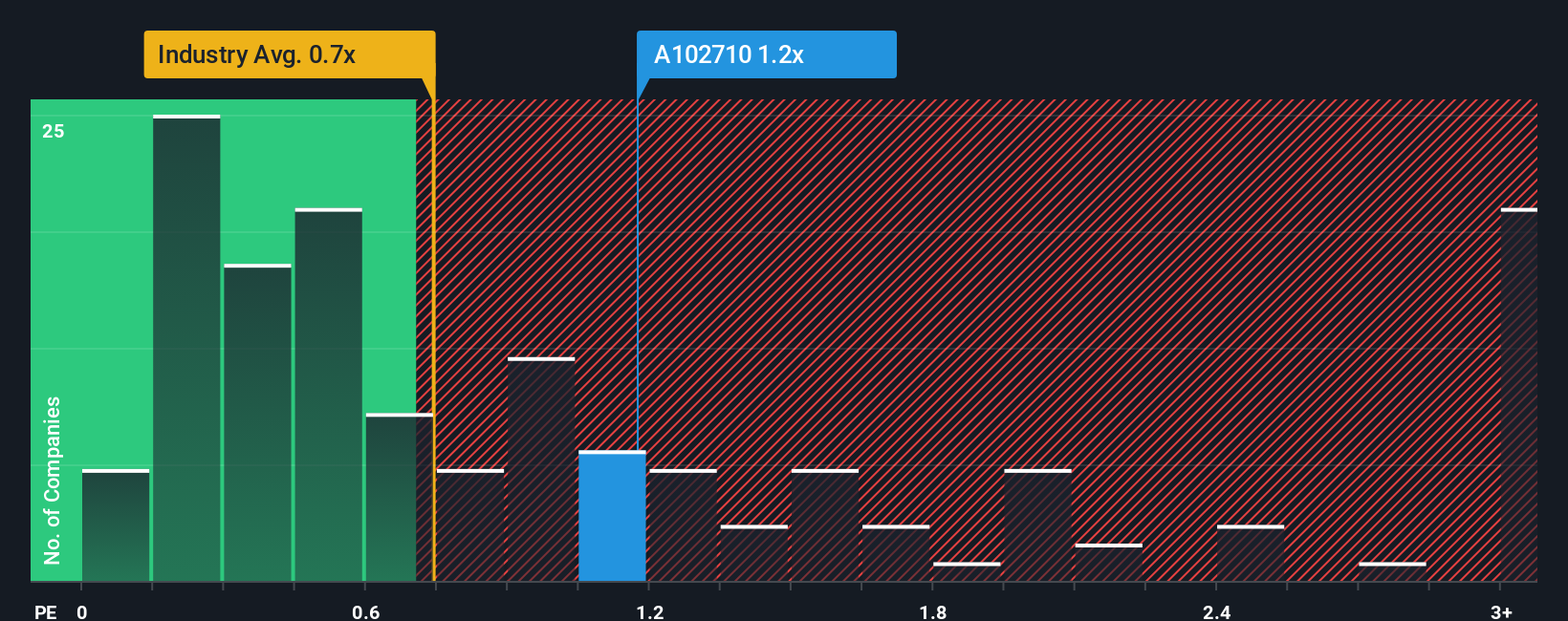

Although its price has surged higher, there still wouldn't be many who think ENF Technology's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Korea's Chemicals industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for ENF Technology

What Does ENF Technology's Recent Performance Look Like?

Revenue has risen firmly for ENF Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for ENF Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is ENF Technology's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like ENF Technology's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that ENF Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

ENF Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of ENF Technology revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Plus, you should also learn about these 2 warning signs we've spotted with ENF Technology (including 1 which shouldn't be ignored).

If these risks are making you reconsider your opinion on ENF Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if ENF Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A102710

ENF Technology

Produces and sells process chemicals, fine chemicals, and color pastes for use in semiconductor and display manufacturing processes in South Korea and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives