- South Korea

- /

- Basic Materials

- /

- KOSDAQ:A060560

Home Center Holdings Co.,Ltd (KOSDAQ:060560) Stock Rockets 31% As Investors Are Less Pessimistic Than Expected

The Home Center Holdings Co.,Ltd (KOSDAQ:060560) share price has done very well over the last month, posting an excellent gain of 31%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.9% in the last twelve months.

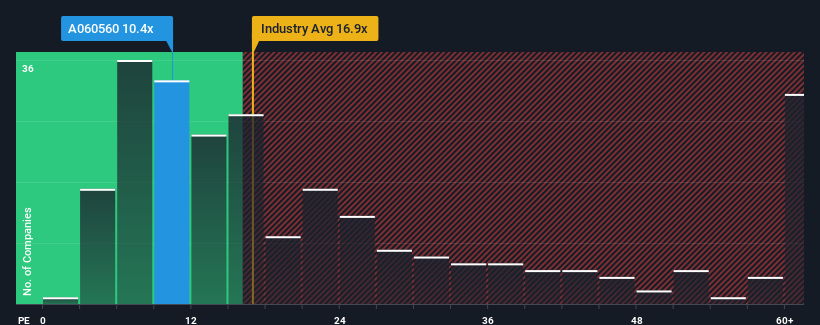

Even after such a large jump in price, it's still not a stretch to say that Home Center HoldingsLtd's price-to-earnings (or "P/E") ratio of 10.4x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

As an illustration, earnings have deteriorated at Home Center HoldingsLtd over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Home Center HoldingsLtd

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Home Center HoldingsLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. Even so, admirably EPS has lifted 38% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Home Center HoldingsLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Home Center HoldingsLtd's P/E?

Home Center HoldingsLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Home Center HoldingsLtd revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 5 warning signs for Home Center HoldingsLtd (1 is significant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Home Center HoldingsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Home Center HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A060560

Home Center HoldingsLtd

Engages in the manufacture and sale of ready-mix concrete in South Korea.

Moderate risk with imperfect balance sheet.

Market Insights

Community Narratives