- South Korea

- /

- Paper and Forestry Products

- /

- KOSDAQ:A025900

Some Dongwha Enterprise Co.,Ltd (KOSDAQ:025900) Shareholders Look For Exit As Shares Take 25% Pounding

To the annoyance of some shareholders, Dongwha Enterprise Co.,Ltd (KOSDAQ:025900) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

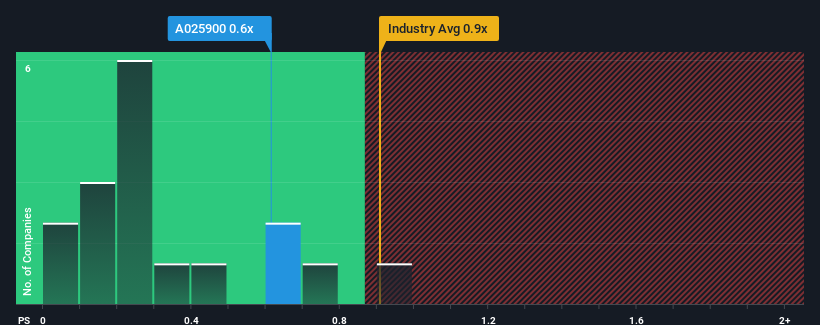

Although its price has dipped substantially, there still wouldn't be many who think Dongwha EnterpriseLtd's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Korea's Forestry industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Dongwha EnterpriseLtd

What Does Dongwha EnterpriseLtd's P/S Mean For Shareholders?

There hasn't been much to differentiate Dongwha EnterpriseLtd's and the industry's retreating revenue lately. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Dongwha EnterpriseLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Dongwha EnterpriseLtd's Revenue Growth Trending?

Dongwha EnterpriseLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 7.0% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.3% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 13% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Dongwha EnterpriseLtd's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Dongwha EnterpriseLtd's P/S?

Following Dongwha EnterpriseLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Dongwha EnterpriseLtd's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for Dongwha EnterpriseLtd that you should be aware of.

If you're unsure about the strength of Dongwha EnterpriseLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A025900

Dongwha EnterpriseLtd

Manufactures and sells wood materials in South Korea.

Slightly overvalued with minimal risk.

Market Insights

Community Narratives