- South Korea

- /

- Insurance

- /

- KOSE:A244920

A Piece Of The Puzzle Missing From Aplus Asset Advisor Co. Ltd's (KRX:244920) 25% Share Price Climb

Aplus Asset Advisor Co. Ltd (KRX:244920) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 76%.

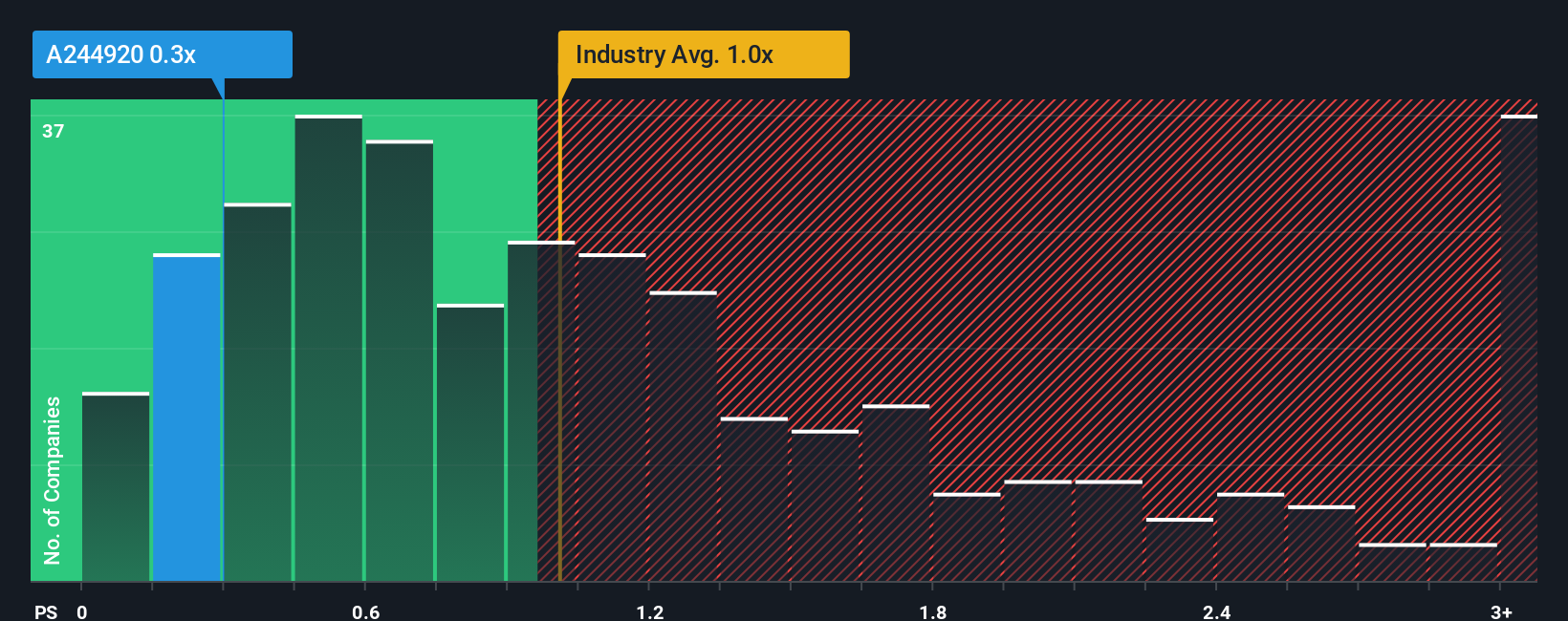

In spite of the firm bounce in price, it's still not a stretch to say that Aplus Asset Advisor's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Insurance industry in Korea, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Aplus Asset Advisor

How Has Aplus Asset Advisor Performed Recently?

With revenue growth that's superior to most other companies of late, Aplus Asset Advisor has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Aplus Asset Advisor's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Aplus Asset Advisor?

In order to justify its P/S ratio, Aplus Asset Advisor would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The strong recent performance means it was also able to grow revenue by 134% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 12% as estimated by the sole analyst watching the company. This is still shaping up to be materially better than the broader industry which is also set to decline 64%.

With this information, it's perhaps curious but not a major surprise that Aplus Asset Advisor is trading at a fairly similar P/S in comparison. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There's still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Aplus Asset Advisor's P/S Mean For Investors?

Aplus Asset Advisor appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite Aplus Asset Advisor's analyst forecasts being a less shaky outlook than the rest of the industry, its P/S is a bit lower than we expected. Even though it's revenue prospects are better than the wider industry, we assume there are several risk factors might be placing downward pressure on the P/S, bringing it in line with the industry average. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 2 warning signs for Aplus Asset Advisor that you need to take into consideration.

If you're unsure about the strength of Aplus Asset Advisor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A244920

Flawless balance sheet and fair value.

Market Insights

Community Narratives