- South Korea

- /

- Telecom Services and Carriers

- /

- KOSE:A030200

Top Dividend Stocks On KRX To Consider

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat, with notable gains of 5.6% in the Financials sector. Over the past year, the market is up 4.1%, and earnings are forecast to grow by 29% annually. In this context, selecting strong dividend stocks can be a prudent strategy for investors seeking stable income and potential growth in a dynamic market environment like South Korea's.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.38% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 5.78% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.95% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.05% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 6.87% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.31% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 4.76% | ★★★★☆☆ |

| Snt DynamicsLtd (KOSE:A003570) | 4.65% | ★★★★☆☆ |

| Cheil Worldwide (KOSE:A030000) | 6.16% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.05% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc., with a market cap of ₩1.82 trillion, offers a range of marketing solutions globally.

Operations: Cheil Worldwide Inc. generates revenue from multiple segments including ₩1.25 trillion from advertising, ₩0.75 trillion from digital marketing, and ₩0.50 trillion from public relations services.

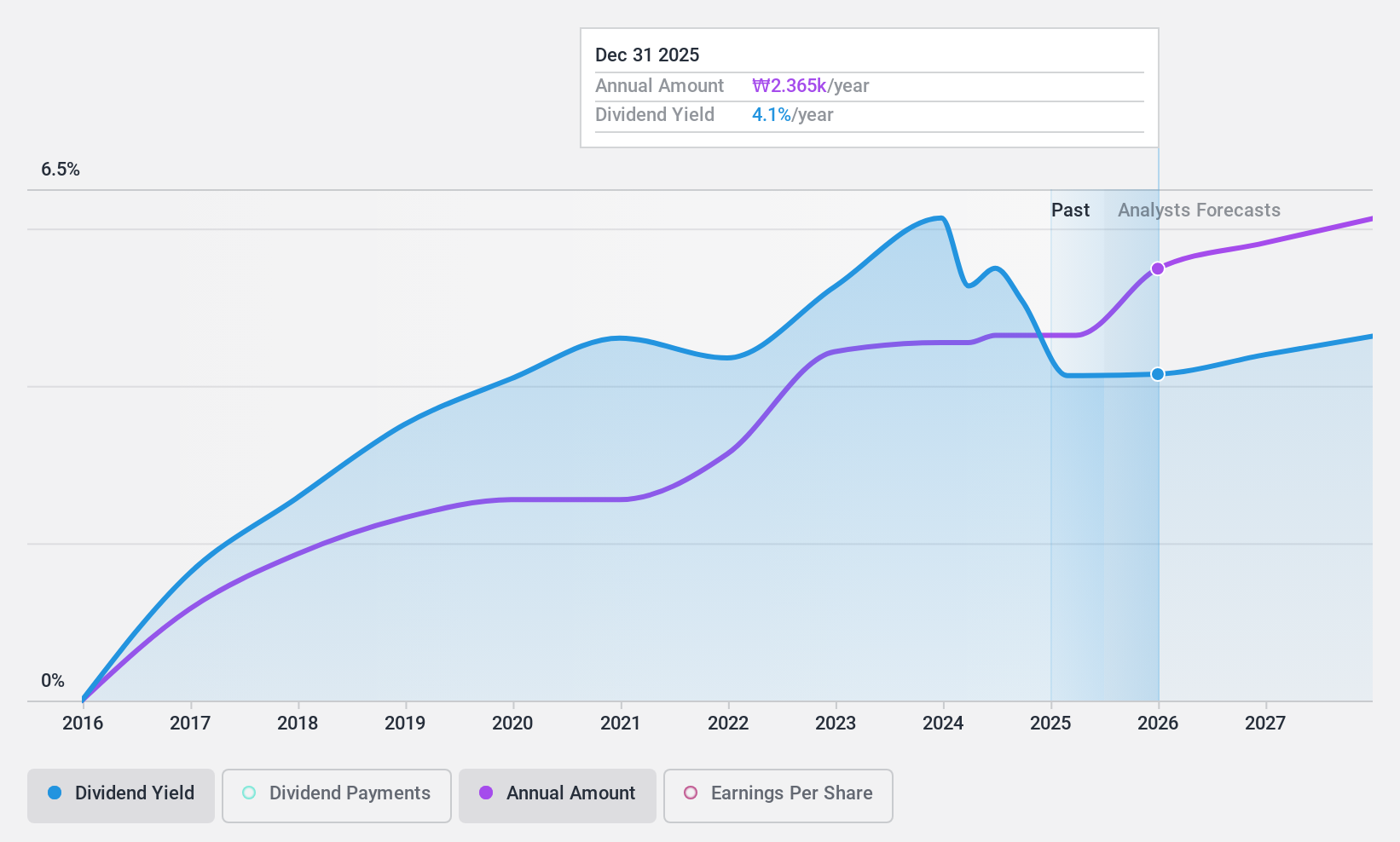

Dividend Yield: 6.2%

Cheil Worldwide's dividend payments have been stable and growing, although the company has only paid dividends for five years. The dividends are well-covered by both earnings (payout ratio 59%) and cash flows (cash payout ratio 40.5%). With a dividend yield of 6.16%, it ranks in the top 25% of dividend payers in South Korea. Additionally, Cheil Worldwide is trading at a good value compared to peers and industry benchmarks, with analysts predicting a potential price increase of 36.3%.

- Click here to discover the nuances of Cheil Worldwide with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Cheil Worldwide is priced lower than what may be justified by its financials.

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation offers integrated telecommunications and platform services both in Korea and internationally, with a market cap of ₩9.73 trillion.

Operations: KT Corporation's revenue segments include ₩18.84 billion from ICT, ₩3.66 billion from Finance, ₩0.71 billion from Satellite Broadcasting, and ₩0.53 billion from Real Estate.

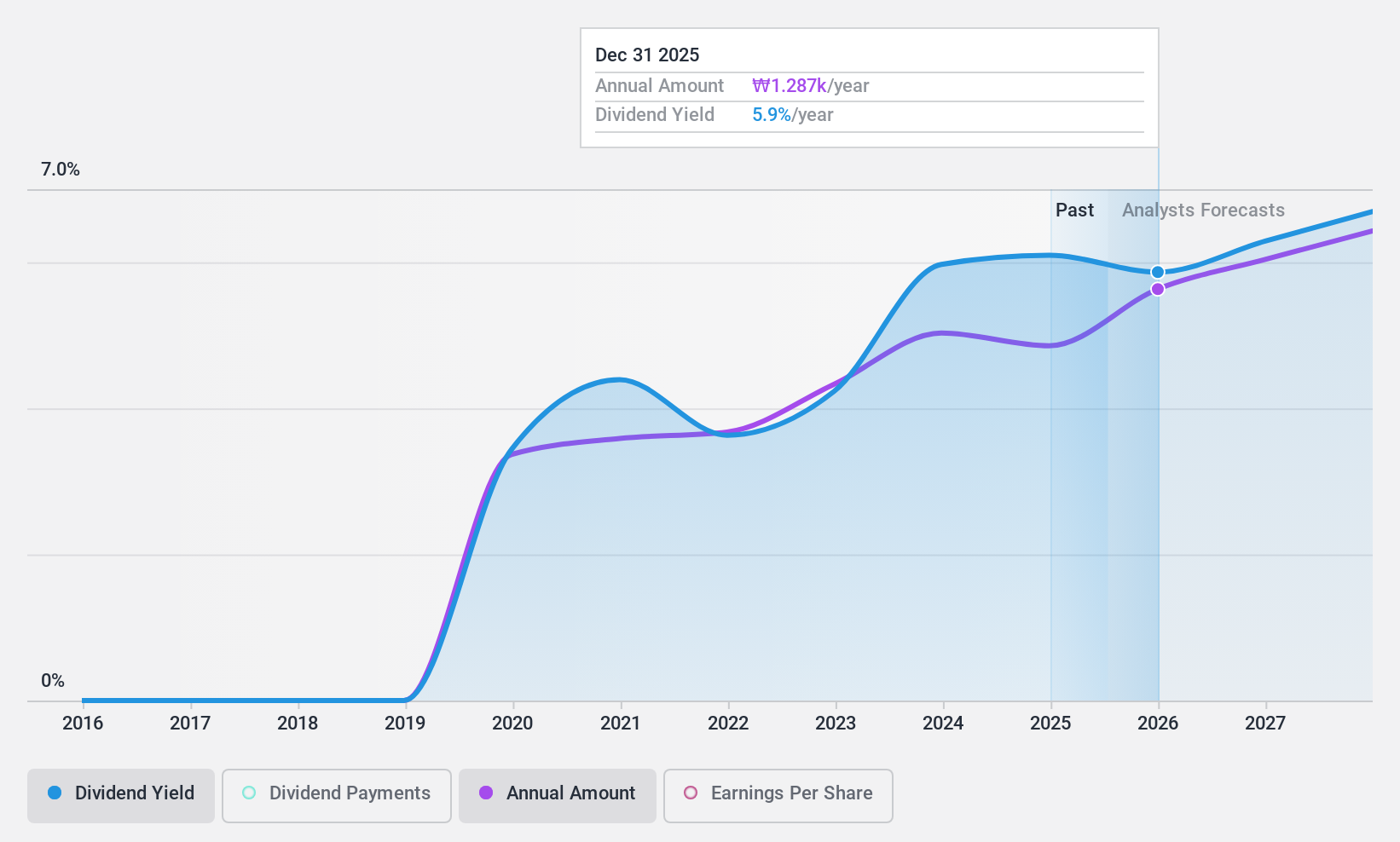

Dividend Yield: 5.1%

KT Corporation's dividend yield of 5.05% places it in the top 25% of South Korean dividend payers. Despite a volatile track record over the past decade, recent dividends are well-covered by earnings (payout ratio 68.1%) and cash flows (cash payout ratio 19.6%). The company trades at a significant discount to its estimated fair value, enhancing its appeal for value investors. Recent Q2 earnings showed stable revenue and net income year-over-year, with KRW 500 per share declared as a quarterly dividend.

- Navigate through the intricacies of KT with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that KT is trading behind its estimated value.

Tong Yang Life Insurance (KOSE:A082640)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates in the life insurance sector in South Korea and has a market cap of ₩1.31 trillion.

Operations: Tong Yang Life Insurance Co., Ltd. generates revenue primarily from its life and health insurance segments, totaling ₩2.90 billion.

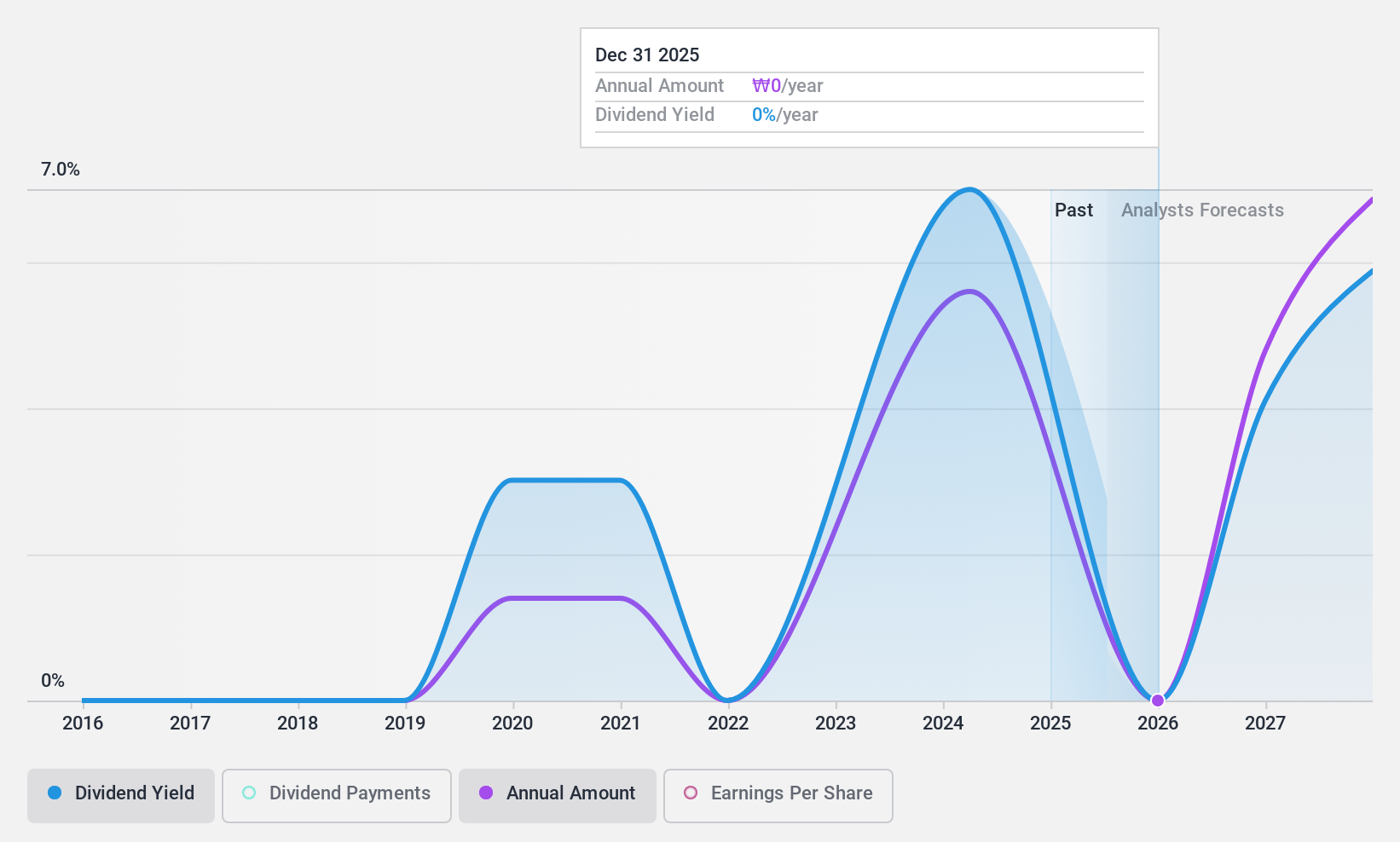

Dividend Yield: 4.8%

Tong Yang Life Insurance's dividend yield of 4.76% ranks it in the top 25% of South Korean dividend payers. Despite only five years of dividend history, payments have increased and are well-covered by earnings (payout ratio: 30.6%) and cash flows (cash payout ratio: 3.8%). Earnings grew by 177.6% over the past year, though large one-off items impacted results. The stock trades at a significant discount to its estimated fair value, making it attractive for value investors.

- Get an in-depth perspective on Tong Yang Life Insurance's performance by reading our dividend report here.

- Our valuation report unveils the possibility Tong Yang Life Insurance's shares may be trading at a discount.

Seize The Opportunity

- Reveal the 72 hidden gems among our Top KRX Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030200

KT

Provides integrated telecommunications and platform services in Korea and internationally.

Undervalued with excellent balance sheet and pays a dividend.