- Taiwan

- /

- Medical Equipment

- /

- TPEX:4138

3 Dividend Stocks To Consider With Yields Up To 6.6%

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly seeking stability in their portfolios. In this environment, dividend stocks offer a compelling option for those looking to generate income while potentially benefiting from long-term capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.09% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.02% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

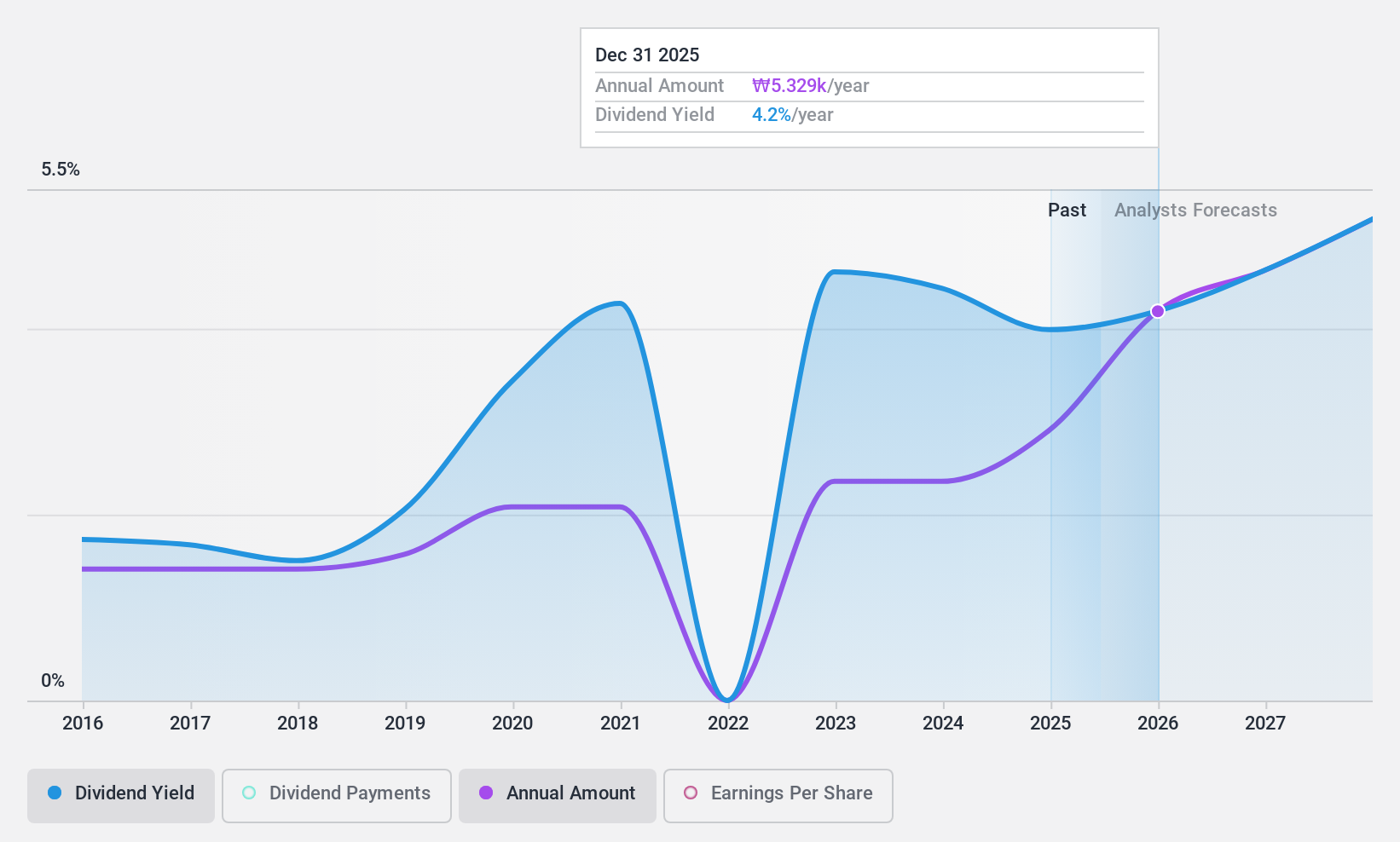

Samsung Life Insurance (KOSE:A032830)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Life Insurance Co., Ltd. operates in the life insurance sector both in Korea and internationally, with a market cap of ₩17.10 trillion.

Operations: Samsung Life Insurance Co., Ltd. generates revenue from several segments, including Domestic - Insurance at ₩26.51 trillion, Domestic - Card and Installment Lease at ₩4.02 trillion, and Overseas operations at ₩145.04 billion.

Dividend Yield: 3.9%

Samsung Life Insurance offers a stable dividend history with payments growing consistently over the past decade. The dividend yield of 3.89% is slightly below the top 25% in the KR market, yet remains reliable and well-covered by both earnings (payout ratio: 26.7%) and cash flows (cash payout ratio: 9.5%). Recent earnings results show significant growth, with net income rising to ₩2 trillion for nine months ending September 2024, supporting its sustainable dividend payouts.

- Click to explore a detailed breakdown of our findings in Samsung Life Insurance's dividend report.

- The valuation report we've compiled suggests that Samsung Life Insurance's current price could be quite moderate.

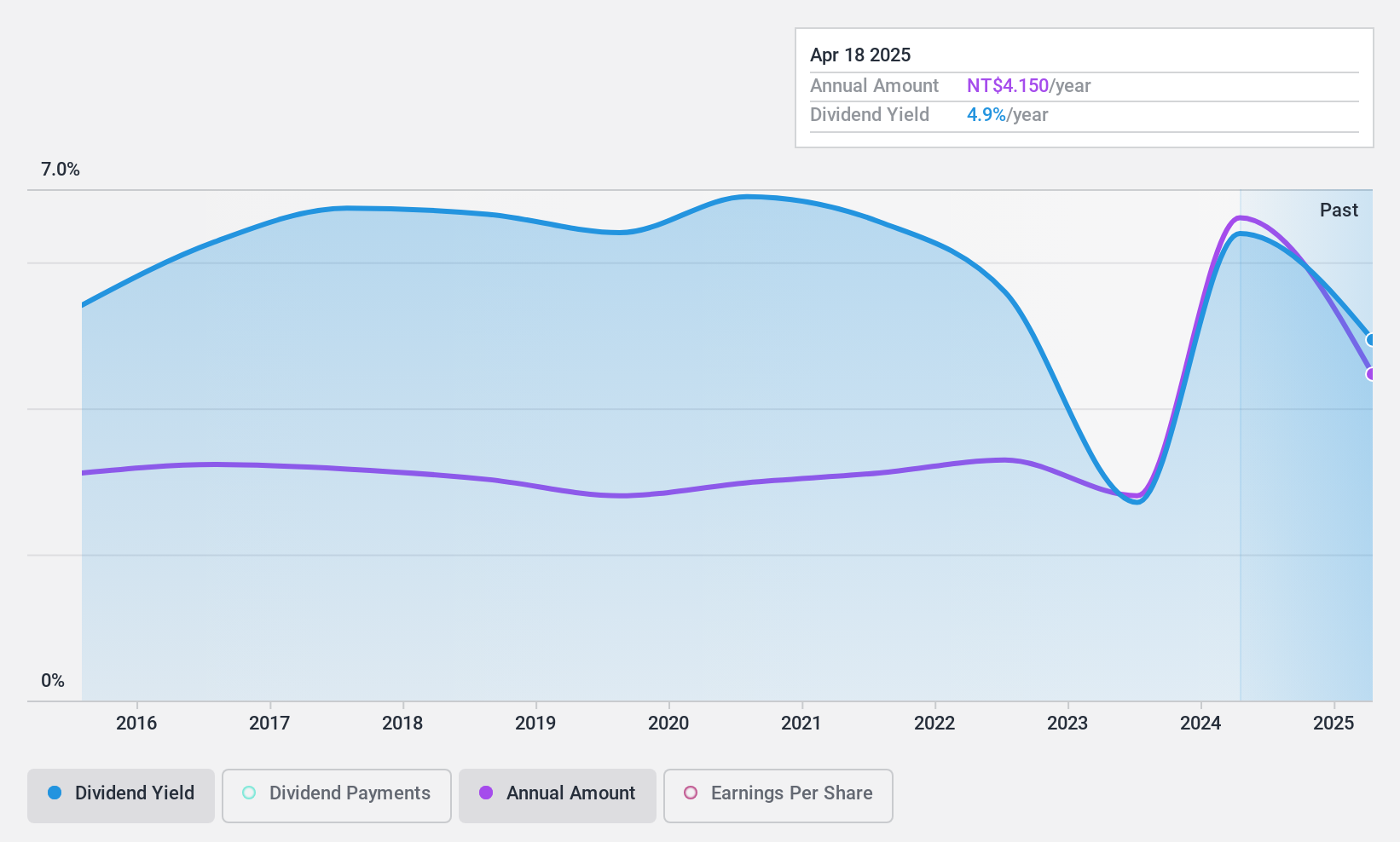

Dynamic Medical Technologies (TPEX:4138)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dynamic Medical Technologies Inc. operates in Taiwan and Hong Kong, focusing on the maintenance and marketing of aesthetic lasers and light-based equipment, with a market cap of NT$3.37 billion.

Operations: Dynamic Medical Technologies Inc. generates revenue from its Beauty Channel Division, amounting to NT$231.91 million.

Dividend Yield: 6.6%

Dynamic Medical Technologies has a strong dividend yield of 6.62%, ranking in the top 25% of the TW market, with stable and growing dividends over the past decade. However, its high payout ratio (113.3%) and cash payout ratio (236%) indicate dividends are not well covered by earnings or cash flows. Recent earnings show slight declines in sales and net income for both Q3 and nine months ending September 2024, potentially impacting future dividend sustainability.

- Navigate through the intricacies of Dynamic Medical Technologies with our comprehensive dividend report here.

- Our valuation report unveils the possibility Dynamic Medical Technologies' shares may be trading at a premium.

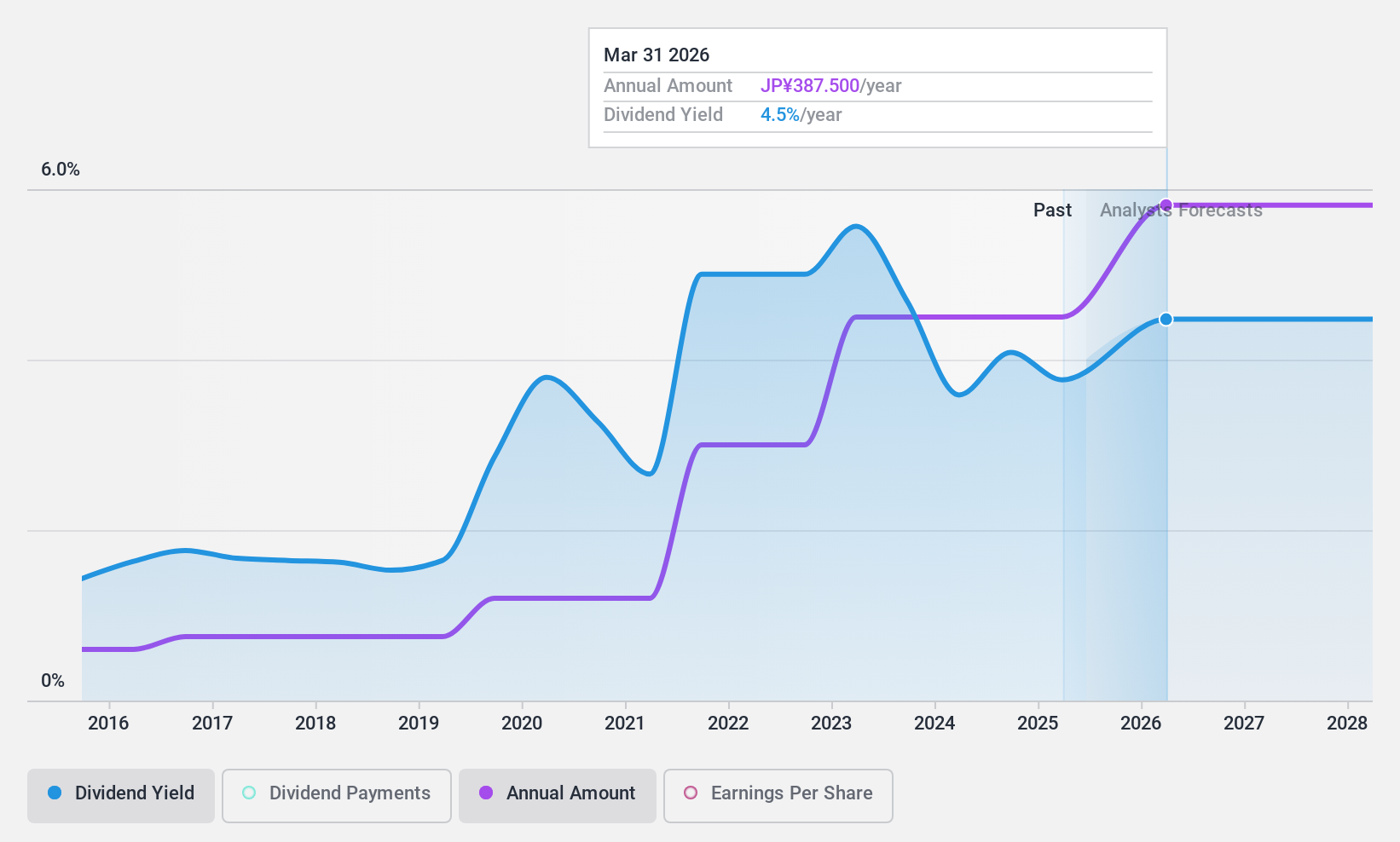

Yamato Kogyo (TSE:5444)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yamato Kogyo Co., Ltd., with a market cap of ¥475.42 billion, operates through its subsidiaries to manufacture and sell steel products both in Japan and internationally.

Operations: Yamato Kogyo Co., Ltd.'s revenue segments include the Steel Business in Japan generating ¥64.32 billion, the Track Equipment Business contributing ¥8 billion, and the Steel Business in Thailand with ¥77.18 billion.

Dividend Yield: 4%

Yamato Kogyo offers a reliable dividend yield of 4.02%, placing it in the top quartile of JP market dividend payers, with stable and growing payouts over the past decade. The dividends are well-supported by both earnings, with a payout ratio of 30.7%, and cash flows at 28.1%. Trading at a discount to estimated fair value, Yamato Kogyo's recent share buyback program could enhance shareholder returns while maintaining dividend sustainability amidst forecasted revenue growth.

- Unlock comprehensive insights into our analysis of Yamato Kogyo stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Yamato Kogyo is priced lower than what may be justified by its financials.

Where To Now?

- Discover the full array of 1994 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4138

Dynamic Medical Technologies

Dynamic Medical Technologies Inc., together with its subsidiaries, maintains and markets aesthetic lasers and light-based equipment in Taiwan and Hong Kong.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives