- South Korea

- /

- Personal Products

- /

- KOSDAQ:A270870

Can NewtreeLtd (KOSDAQ:270870) Keep Up These Impressive Returns?

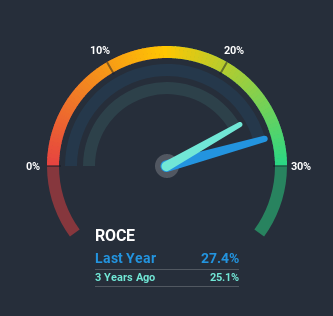

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of NewtreeLtd (KOSDAQ:270870) looks attractive right now, so lets see what the trend of returns can tell us.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for NewtreeLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = ₩22b ÷ (₩102b - ₩21b) (Based on the trailing twelve months to September 2020).

Therefore, NewtreeLtd has an ROCE of 27%. That's a fantastic return and not only that, it outpaces the average of 6.8% earned by companies in a similar industry.

View our latest analysis for NewtreeLtd

In the above chart we have measured NewtreeLtd's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For NewtreeLtd Tell Us?

In terms of NewtreeLtd's history of ROCE, it's quite impressive. Over the past three years, ROCE has remained relatively flat at around 27% and the business has deployed 437% more capital into its operations. Now considering ROCE is an attractive 27%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. If NewtreeLtd can keep this up, we'd be very optimistic about its future.

The Bottom Line

NewtreeLtd has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. And the stock has followed suit returning a meaningful 84% to shareholders over the last year. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

If you'd like to know about the risks facing NewtreeLtd, we've discovered 1 warning sign that you should be aware of.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

When trading NewtreeLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Newtree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A270870

Newtree

Provides health and beauty products in South Korea, China, and the United States.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives